Understanding Advanced Charitable Giving Strategies

[et_pb_section fb_built="1" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_row use_custom_gutter="on" gutter_width="1" admin_label="Intro" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_column type="4_4" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_image src="https://5280associates.com/wp-content/uploads/2024/07/advanced-charitable-giving-strategies-couple.jpg" alt="Young couple setting up advanced charitable giving strategies" _builder_version="4.27.4" _module_preset="default" global_colors_info="{}"][/et_pb_image][et_pb_divider show_divider="off" _builder_version="4.27.4" _module_preset="default" global_colors_info="{}"][/et_pb_divider][et_pb_heading title="Tax-Advantaged Donations for a Greater Impact" admin_label="h2: intro" _builder_version="4.27.4" _module_preset="default" title_level="h2" title_text_color="#5b6770" title_font_size="32px" global_colors_info="{}"][/et_pb_heading][et_pb_text admin_label="Intro paragraph" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"]Giving back is one of the most fulfilling ways to positively impact your community and leave a lasting legacy. The joy of seeing the difference your contribution makes is unmatched. Plus, as an added benefit, there are substantial tax advantages to charitable giving. While writing a check to your favorite charity is always appreciated, there are more efficient ways to support the causes you believe in. Advanced charitable giving strategies, such as a Donor-Advised Fund or Charitable Remainder Trust, can help you build your legacy, maximize your charitable impact, and benefit from tax efficiencies.

[/et_pb_text][et_pb_divider show_divider="off" _builder_version="4.27.4" _module_preset="default" global_colors_info="{}"][/et_pb_divider][et_pb_heading title="Popular Advanced Charitable Giving Strategies " admin_label="h2: Popular Advanced Charitable Giving Strateies" _builder_version="4.25.0" _module_preset="default" title_level="h2" global_colors_info="{}"][/et_pb_heading][et_pb_text admin_label="Popular Advanced Charitable Giving Strategies Text" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"]Advanced charitable giving strategies go beyond basic donations by utilizing tax-efficient charitable planning techniques. These strategies offer a wide array of opportunities to support your favorite causes while reaping tax benefits. In this guide, we will explore some of the most popular advanced charitable giving strategies, including Donor-Advised Funds (DAFs), Qualified Charitable Distributions (QCDs), Charitable Lead Trusts (CLTs), Charitable Remainder Trusts (CRTs), bunching donations, and donating appreciated assets. Although many options are available, we will focus on these widely used strategies to give you a comprehensive overview.

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row column_structure="1_2,1_4,1_4" admin_label="Donor-Advised Funds" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_column type="1_2" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_heading title="Donor-Advised Funds " admin_label="h3: Donor-Advised Funds" _builder_version="4.25.0" _module_preset="default" title_level="h3" global_colors_info="{}"][/et_pb_heading][et_pb_text admin_label="Donor-Advised Fund Text" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"]A Donor-Advised Fund (DAF) is a charitable investment account that allows donors to make a charitable contribution, receive an immediate tax deduction, and recommend grants from the fund over time. These funds have become increasingly popular due to their flexibility and tax benefits.

[/et_pb_text][/et_pb_column][et_pb_column type="1_4" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_toggle title="Pros" icon_color="#c8102e" open_icon_color="#cbc4bd" admin_label="DAF Pros" _builder_version="4.25.0" _module_preset="default" title_font_size="16px" custom_margin="50px||||false|false" custom_padding="||||false|false" global_colors_info="{}"]● Immediate tax deduction

● Flexibility in timing of grants

● Ability to grow contributions tax-free

● Anonymity in giving

[/et_pb_toggle][/et_pb_column][et_pb_column type="1_4" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_toggle title="Cons" icon_color="#c8102e" open_icon_color="#cbc4bd" admin_label="DAF Cons" _builder_version="4.25.0" _module_preset="default" custom_margin="50px||||false|false" custom_padding="||||false|false" global_colors_info="{}"]● Fees and administrative costs

● Limited investment options

● Irrevocable contributions

[/et_pb_toggle][/et_pb_column][/et_pb_row][et_pb_row column_structure="1_2,1_4,1_4" admin_label="Qualified Charitable Distribution" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_column type="1_2" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_text admin_label="h3: Qualified Charitable Distributions" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"]Qualified Charitable Distributions

[/et_pb_text][et_pb_text admin_label="QCD Text" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"]A Qualified Charitable Distribution (QCD) allows individuals over 70½ to make tax-free transfers from their IRAs directly to a qualified charity. This can count towards their required minimum distributions (RMDs) and provides a tax-efficient way to give.

[/et_pb_text][/et_pb_column][et_pb_column type="1_4" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_toggle title="Pros" icon_color="#c8102e" open_icon_color="#cbc4bd" open_toggle_icon_tablet="" open_toggle_icon_phone="" open_toggle_icon_last_edited="on|desktop" admin_label="QCD Pros" _builder_version="4.25.0" _module_preset="default" title_font_size="16px" body_text_align="left" custom_margin="50px||||false|false" custom_padding="||||false|false" global_colors_info="{}"]● Satisfies RMD requirements

● Reduces taxable income

● Direct transfer to charity

● No impact on itemized deductions

[/et_pb_toggle][/et_pb_column][et_pb_column type="1_4" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_toggle title="Cons" icon_color="#c8102e" open_icon_color="#cbc4bd" admin_label="QCD Cons" _builder_version="4.25.0" _module_preset="default" body_text_align="left" custom_margin="50px||||false|false" custom_padding="||||false|false" global_colors_info="{}"]● Limited to IRAs

● Maximum annual limit ($100,000)

● Only available to those over 70½

[/et_pb_toggle][/et_pb_column][/et_pb_row][et_pb_row column_structure="1_2,1_4,1_4" admin_label="Charitable Lead Trust" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_column type="1_2" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_heading title="Charitable Lead Trusts" admin_label="h3: Charitable Lead Trusts" _builder_version="4.25.0" _module_preset="default" title_level="h3" title_text_align="left" global_colors_info="{}"][/et_pb_heading][et_pb_text admin_label="CLT Text" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"]A Charitable Lead Trust (CLT) provides income to a charity for a specified period, after which the remaining assets return to the donor or other beneficiaries. This can help reduce estate taxes and provide a steady income to a charity.

[/et_pb_text][/et_pb_column][et_pb_column type="1_4" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_toggle title="Pros" icon_color="#c8102e" open_icon_color="#cbc4bd" admin_label="CLT Pros" _builder_version="4.25.0" _module_preset="default" title_font_size="16px" body_text_align="left" custom_margin="50px||||false|false" custom_padding="||||false|false" global_colors_info="{}"]● Reduces estate taxes

● Provides steady income to charity

● Potentially lower gift taxes

[/et_pb_toggle][/et_pb_column][et_pb_column type="1_4" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_toggle title="Cons" icon_color="#c8102e" open_icon_color="#cbc4bd" admin_label="CLT Cons" _builder_version="4.25.0" _module_preset="default" body_text_align="left" custom_margin="50px||||false|false" custom_padding="||||false|false" global_colors_info="{}"]● Complex to set up

● Irrevocable

● Administration and legal costs

[/et_pb_toggle][/et_pb_column][/et_pb_row][et_pb_row column_structure="1_2,1_4,1_4" admin_label="Charitable Remainder Trust" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_column type="1_2" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_heading title="Charitable Remainder Trusts" admin_label="h3: Charitable Remainder Trusts" _builder_version="4.25.0" _module_preset="default" title_level="h3" title_text_align="left" global_colors_info="{}"][/et_pb_heading][et_pb_text admin_label="CRT Text" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"]A Charitable Remainder Trust (CRT) is the reverse of a CLT. It provides income to the donor or other beneficiaries for a specified period, after which the remaining assets go to the designated charity. This strategy offers tax benefits and a potential income stream. It is important to note that the charitable donation must be at least 10% of the original fair market value of all assets transferred to the trust.

[/et_pb_text][/et_pb_column][et_pb_column type="1_4" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_toggle title="Pros" icon_color="#c8102e" open_icon_color="#cbc4bd" admin_label="CRT Pros" _builder_version="4.25.0" _module_preset="default" title_font_size="16px" body_text_align="left" custom_margin="50px||||false|false" custom_padding="||||false|false" global_colors_info="{}"]● Immediate tax benefit

● Potential income stream

● Avoids capital gains tax

[/et_pb_toggle][/et_pb_column][et_pb_column type="1_4" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_toggle title="Cons" icon_color="#c8102e" open_icon_color="#cbc4bd" admin_label="CRT Cons" _builder_version="4.25.0" _module_preset="default" body_text_align="left" custom_margin="50px||||false|false" custom_padding="||||false|false" global_colors_info="{}"]● Irrevocable

● Complex setup and administration

● Fees and costs

[/et_pb_toggle][/et_pb_column][/et_pb_row][et_pb_row column_structure="1_2,1_4,1_4" admin_label="Bunching Charitable Contributions" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_column type="1_2" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_heading title="Bunching Charitable Contributions" admin_label="h3: Bunching Charitable Contributions" _builder_version="4.25.0" _module_preset="default" title_level="h3" title_text_align="left" global_colors_info="{}"][/et_pb_heading][et_pb_text admin_label="Bunching Text" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"]Bunching charitable contributions involves grouping several years' worth of donations into a single year to exceed the standard deduction threshold, allowing for itemization and more significant tax savings in that year.

[/et_pb_text][/et_pb_column][et_pb_column type="1_4" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_toggle title="Pros" icon_color="#c8102e" open_icon_color="#cbc4bd" admin_label="Bunching Pros" _builder_version="4.25.0" _module_preset="default" title_font_size="16px" body_text_align="left" custom_margin="50px||||false|false" custom_padding="||||false|false" global_colors_info="{}"]● Maximizes deductions

● Flexibility in timing of donations

● Simple to implement

[/et_pb_toggle][/et_pb_column][et_pb_column type="1_4" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_toggle title="Cons" icon_color="#c8102e" open_icon_color="#cbc4bd" admin_label="Bunching Cons" _builder_version="4.25.0" _module_preset="default" body_text_align="left" custom_margin="50px||||false|false" custom_padding="||||false|false" global_colors_info="{}"]● Requires careful planning

● May not suit all donors

● Variable charitable support year-to-year

[/et_pb_toggle][/et_pb_column][/et_pb_row][et_pb_row column_structure="1_2,1_4,1_4" admin_label="Donating Appreciated Assets" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_column type="1_2" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_heading title="Donating Appreciated Assets" admin_label="h3: Donating Appreciated Assets" _builder_version="4.25.0" _module_preset="default" title_level="h3" title_text_align="left" global_colors_info="{}"][/et_pb_heading][et_pb_text admin_label="Assets Text" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"]Donating appreciated assets like stocks, real estate, or alternative assets like jewelry or fine art can provide significant tax benefits. Donors can avoid capital gains taxes and receive a tax deduction for the asset's fair market value. Regardless of asset type, donors will only receive tax benefits when donating to an eligible organization.

[/et_pb_text][/et_pb_column][et_pb_column type="1_4" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_toggle title="Pros" icon_color="#c8102e" open_icon_color="#cbc4bd" admin_label="Assets Pros" _builder_version="4.25.0" _module_preset="default" title_font_size="16px" body_text_align="left" custom_margin="50px||||false|false" custom_padding="||||false|false" global_colors_info="{}"]● Avoids capital gains tax

● Tax deduction for fair market value

● Diversifies charitable contributions

[/et_pb_toggle][/et_pb_column][et_pb_column type="1_4" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_toggle title="Cons" icon_color="#c8102e" open_icon_color="#cbc4bd" admin_label="Assets Cons" _builder_version="4.25.0" _module_preset="default" body_text_align="left" custom_margin="50px||||false|false" custom_padding="||||false|false" global_colors_info="{}"]● Requires valuation of assets

● Potential legal and administrative costs

● Complexity in transferring non-liquid assets

[/et_pb_toggle][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section fb_built="1" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_row admin_label="Conclusion" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_column type="4_4" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_heading title="Take Advantage of Advanced Charitable Giving Strategies " admin_label="h2: Take Advantage of Advanced Charitable Giving Strategies" _builder_version="4.25.0" _module_preset="default" title_level="h2" global_colors_info="{}"][/et_pb_heading][et_pb_text admin_label="Conclusion Text" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"]By utilizing these advanced charitable giving strategies, you can achieve significant tax benefits, enhance your philanthropic impact, and build a lasting legacy. Given the complexity of these strategies, it's essential to partner with an experienced financial firm, like 5280 Associates, to maximize the benefits. Keep in mind the AGI limitations for tax deductions and consult with a financial planner to explore all the available options. To learn more about these strategies or to take advantage of them, reach out to an expert financial planner at 5280 Associates and unlock your financial potential.

[/et_pb_text][et_pb_button button_url="https://5280associates.com/tax-efficient-charitable-planning/" button_text="Learn More" button_alignment="center" admin_label="Learn More CTA /tax-efficient-charitable-giving/" _builder_version="4.27.4" _module_preset="default" global_colors_info="{}"][/et_pb_button][/et_pb_column][/et_pb_row][/et_pb_section]

Tax Benefits of Donor-Advised Funds

[et_pb_section fb_built="1" admin_label="Section" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_row _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_column type="4_4" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_image _builder_version="4.27.4" _module_preset="default" hover_enabled="0" sticky_enabled="0" alt="hiker standing on rock overlooking vista" src="https://5280associates.com/wp-content/uploads/2024/07/tax-benefits-donor-advised-fund.jpg"][/et_pb_image][et_pb_divider show_divider="off" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][/et_pb_divider][et_pb_text admin_label="p: intro " _builder_version="4.25.0" _module_preset="default" hover_enabled="0" global_colors_info="{}" sticky_enabled="0"]High-net-worth individuals (HNWIs) are in a unique position to better their communities by making donations through charitable planning. Donor-advised funds (DAFs) provide a flexible and efficient way for these individuals to manage their philanthropic efforts. By using DAFs, HNWIs can contribute assets, receive immediate tax benefits, and recommend grants to their favorite charities over time. This approach not only maximizes the impact of their donations but also simplifies the administrative burden of charitable giving. [/et_pb_text][et_pb_divider show_divider="off" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][/et_pb_divider][et_pb_heading title="What is a Donor-Advised Fund?" admin_label="h2: What is a Donor-Advised Fund? " _builder_version="4.27.4" _module_preset="default" title_level="h2" hover_enabled="0" global_colors_info="{}" title_font_size="26px" sticky_enabled="0"][/et_pb_heading][et_pb_text admin_label="p: what is a donor-advised fund? " _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"]A donor-advised fund (DAF) is essentially a charitable investment account. It allows you to deposit assets into an account where they will be donated to charity over time. The account is managed by a section 501(c)(3) organization, which is referred to as the sponsoring organization. Although you relinquish legal control of the assets when they are deposited into a DAF, you retain advisory privileges over how the funds are distributed. It is important to note that contributions to a DAF are irrevocable. Once a donation is made, the funds and any appreciation must be distributed to a non-exempt organization. [/et_pb_text][et_pb_heading title="DAF Tax Deduction Limits" admin_label="H2: DAF Tax Deduction Limits " _builder_version="4.27.4" _module_preset="default" title_level="h2" global_colors_info="{}"][/et_pb_heading][et_pb_text admin_label="p: daf tax deduction limits " _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"]Although DAFs offer immediate tax benefits, they do not serve as a vehicle to completely offset your tax bill. The IRS maintains deduction limits, which depend on the type of recipient organization to which the DAF contributes. Generally, a taxpayer can deduct up to 60% of their adjusted gross income (AGI) for cash donations and up to 30% of their AGI for non-cash donations that are held for more than one year. If the deduction amount exceeds the tax-payer's AGI limit, the remainder can be carried forward for up to five additional tax years. [/et_pb_text][et_pb_heading title="Tax Benefits of Donor-Advised Funds" admin_label="h2: Tax Benefits of Donor-Advised Funds" _builder_version="4.25.0" _module_preset="default" title_level="h2" global_colors_info="{}"][/et_pb_heading][et_pb_text admin_label="p: daf tax benefits " _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"]Contributions to a DAF offer several tax benefits, including tax-free growth, controlling capital gains on appreciated assets, and lowering estate tax liabilities. These benefits make DAFs an attractive option for donors looking to optimize their charitable giving while receiving favorable tax treatment. Understanding these benefits can help donors maximize their impact and plan their philanthropic strategies effectively. [/et_pb_text][et_pb_divider show_divider="off" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][/et_pb_divider][/et_pb_column][/et_pb_row][et_pb_row column_structure="1_3,1_3,1_3" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_column type="1_3" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_icon font_icon="||fa||900" icon_color="#b0c5cc" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][/et_pb_icon][et_pb_heading title="Tax-Free Growth" admin_label="Tax-Free Growth " _builder_version="4.25.0" _module_preset="default" title_level="h3" title_text_align="center" global_colors_info="{}"][/et_pb_heading][et_pb_text admin_label="tax free growth " _builder_version="4.25.0" _module_preset="default" text_orientation="justified" global_colors_info="{}"]Assets contributed to a DAF can grow tax-free, meaning that any investment income or capital gains generated within the DAF are not subject to taxes. This allows the funds to potentially grow more quickly than if they were held in a taxable account, increasing the amount available for charitable grants. [/et_pb_text][/et_pb_column][et_pb_column type="1_3" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_icon font_icon="||fa||900" icon_color="#5b6770" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][/et_pb_icon][et_pb_heading title="Mitigate Capital Gains Taxes" admin_label="Mitigate Capital Gains Taxes " _builder_version="4.25.0" _module_preset="default" title_level="h3" title_text_align="center" custom_margin="||27px|||" global_colors_info="{}"][/et_pb_heading][et_pb_text admin_label="controlling capital gains taxes " _builder_version="4.25.0" _module_preset="default" text_orientation="justified" global_colors_info="{}"]Donating appreciated assets, such as stocks, to a DAF allows donors to avoid paying capital gains tax on the increase in value. This means that the full fair market value of the assets can be donated, providing a more significant charitable gift and a potentially larger tax deduction. [/et_pb_text][/et_pb_column][et_pb_column type="1_3" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_icon font_icon="||fa||900" icon_color="#cbc4bd" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][/et_pb_icon][et_pb_heading title="Reduce Estate Tax Liabilities" admin_label="Reduce Estate Tax Liabilities " _builder_version="4.25.0" _module_preset="default" title_level="h3" title_text_align="center" global_colors_info="{}"][/et_pb_heading][et_pb_text admin_label="lowering estate tax liabilities " _builder_version="4.25.0" _module_preset="default" text_orientation="justified" global_colors_info="{}"]Contributing to a DAF can also help reduce estate tax liabilities. By transferring assets to a DAF, donors remove those assets from their taxable estate, significantly reducing the value of the estate and, consequently, the estate tax liability. Additionally, donating to a DAF allows donors to support their charitable interests and create a lasting legacy while benefiting from the associated tax advantages. [/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_column type="4_4" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_heading title="Unlock Your Charitable Potential with 5280 Associates" admin_label="h2: Unlock Your Charitable Potential with 5280 Associates " _builder_version="4.25.0" _module_preset="default" title_level="h2" global_colors_info="{}"][/et_pb_heading][et_pb_text admin_label="p: unlock your charitable potential " _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"]Donor-advised funds (DAFs) offer numerous tax benefits that make them an attractive option for high-net-worth individuals looking to maximize their charitable impact. From tax-free growth and controlling capital gains to reducing estate tax liabilities, DAFs provide a flexible and efficient way to manage your philanthropic efforts. By contributing to a DAF, you can enjoy immediate tax deductions, avoid capital gains taxes on appreciated assets, and ensure your charitable contributions grow tax-free over time.

At 5280 Associates, our expertise in managing donor-advised funds ensures that your charitable giving is both impactful and compliant with all relevant laws. We take the guesswork out of philanthropy, providing personalized guidance and support every step of the way. By partnering with us, you can take full advantage of these benefits while supporting the causes you care about most. Together, we can unlock your charitable potential and create a lasting legacy for future generations.

[/et_pb_text][et_pb_button button_url="https://5280associates.com/contact-us/" button_text="Establish a Donor-Advised Fund" button_alignment="center" admin_label="Button - Establish a DAF " _builder_version="4.27.4" _module_preset="default" custom_button="on" button_text_color="#ffffff" button_bg_color="#c8102e" button_border_width="20px" button_border_radius="20px" custom_margin="50px||||false|false" custom_padding="15px||15px||false|false" hover_enabled="0" global_colors_info="{}" button_bg_enable_color="on" button_use_icon="off" sticky_enabled="0"][/et_pb_button][/et_pb_column][/et_pb_row][/et_pb_section]

Charitable Lead Trust Vs. Charitable Remainder Trust

[et_pb_section fb_built="1" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_row _builder_version="4.27.3" _module_preset="default" global_colors_info="{}"][et_pb_column type="4_4" _builder_version="4.27.3" _module_preset="default" global_colors_info="{}"][et_pb_text _builder_version="4.27.3" _module_preset="default" custom_margin="-25px||||false|false" custom_padding="0px||||false|false" hover_enabled="0" global_colors_info="{}" sticky_enabled="0"]Charitable planning is a cornerstone for high-net-worth individuals (HNWIs) wishing to leave a lasting legacy while optimizing tax efficiency. Among the advanced charitable giving strategies available, Charitable Remainder Trusts (CRTs) and Charitable Lead Trusts (CLTs) stand out as two popular options that offer both philanthropic fulfillment and financial benefits. In this guide, we'll explore the nuances of CRTs and CLTs, examining their mechanics and showcasing their potential to support your charitable giving plans.

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row _builder_version="4.27.3" _module_preset="default" global_colors_info="{}"][et_pb_column type="4_4" _builder_version="4.27.3" _module_preset="default" global_colors_info="{}"][et_pb_heading title="Key Takeaways" admin_label="H2: Key Takeaways" _builder_version="4.27.4" _module_preset="default" title_level="h2" title_text_align="center" title_font_size="26px" hover_enabled="0" global_colors_info="{}" sticky_enabled="0" title_font="--et_global_heading_font|||||on|||"][/et_pb_heading][/et_pb_column][/et_pb_row][et_pb_row column_structure="1_3,1_3,1_3" _builder_version="4.27.3" _module_preset="default" global_colors_info="{}"][et_pb_column type="1_3" _builder_version="4.27.3" _module_preset="default" global_colors_info="{}"][et_pb_blurb title="Charitable Lead Trusts (CLTs)" use_icon="on" font_icon="||fa||900" icon_color="#ffffff" image_icon_width="65px" admin_label="CLTs" _builder_version="4.27.4" _module_preset="default" header_level="h3" header_font="|600|||||||" header_text_align="center" header_text_color="#c8102e" header_font_size="20px" body_font="|300|||||||" body_text_align="left" body_text_color="#5b6770" background_color="#cbc4bd" border_width_all="30px" border_color_all="#cbc4bd" border_width_bottom="6px" border_radii_image="off||||" global_colors_info="{}"]Beneficiary order: Charities receive income for a set time period, and then it is transferred to heirs.

Tax benefit: Front loading donations may lead to significant tax savings.

Strategic Philanthropy: CLTs are a powerful tool for integrating charitable giving into your overall financial plan.

[/et_pb_blurb][/et_pb_column][et_pb_column type="1_3" _builder_version="4.27.3" _module_preset="default" global_colors_info="{}"][et_pb_blurb title="Charitable Remainder Trusts (CRTs)" use_icon="on" font_icon="||fa||900" icon_color="#ffffff" image_icon_width="65px" admin_label="CRTs" _builder_version="4.27.4" _module_preset="default" header_level="h3" header_font="|600|||||||" header_text_color="#c8102e" header_font_size="20px" body_text_align="left" body_text_color="#5b6770" background_color="#cbc4bd" text_orientation="center" border_width_all="30px" border_color_all="#cbc4bd" border_width_bottom="6px" global_colors_info="{}"]Beneficiary order: Generates income for heirs until the trust period ends. Charities receive the remainder.

Tax benefits:Potentially eliminate capital gains on transferred assets.

Income Flexibility: CRTs offer unitrusts (variable) or annuity trusts (fixed) for beneficiary payments.

[/et_pb_blurb][/et_pb_column][et_pb_column type="1_3" _builder_version="4.27.3" _module_preset="default" global_colors_info="{}"][et_pb_blurb title="Which Option is Right For You?" use_icon="on" font_icon="||fa||900" icon_color="#ffffff" image_icon_width="65px" admin_label="Which is right for you?" _builder_version="4.27.4" _module_preset="default" header_level="h3" header_font="|600|||||||" header_text_align="center" header_text_color="#c8102e" header_font_size="20px" body_text_align="left" body_text_color="#ffffff" background_color="#cbc4bd" border_width_all="30px" border_color_all="#cbc4bd" border_width_bottom="6px" global_colors_info="{}"]Giving Timeline: Charitable impact now or long-term legacy planning?

Financial Goals: Income generation for beneficiaries or estate tax reduction for heirs?

Expert Guidance: Consult with a financial advisor for personalized recommendations.

[/et_pb_blurb][/et_pb_column][/et_pb_row][et_pb_row _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_column type="4_4" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][et_pb_heading title="Charitable Lead Trusts Explained" admin_label="H2" _builder_version="4.27.3" _module_preset="default" title_level="h2" title_text_color="#cb353c" title_font_size="35px" custom_padding="||2px|||" global_colors_info="{}"][/et_pb_heading][et_pb_text _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"]A charitable lead trust (CLT) is a powerful tool for individuals seeking to support charitable causes while preserving wealth for future generations. A CLT is an irrevocable trust that allows donors to contribute to charitable organizations for a set period of time. After the charitable period passes, the remainder of the trust becomes designated to benefit the donor's heirs.

[/et_pb_text][et_pb_heading title="What is a CLT?" admin_label="H3" _builder_version="4.27.3" _module_preset="default" title_level="h3" global_colors_info="{}"][/et_pb_heading][et_pb_text _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"]A charitable lead trust strategically plans an estate to support charitable organizations for a specified period before transferring the remaining assets to designated heirs. This arrangement allows donors to impact charitable causes meaningfully while leveraging tax advantages and wealth transfer strategies to benefit their loved ones.

[/et_pb_text][et_pb_heading title="How CLTs Work" admin_label="H3" _builder_version="4.25.0" _module_preset="default" title_level="h3" global_colors_info="{}"][/et_pb_heading][et_pb_text _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"]In a charitable lead trust, the mechanics revolve around allocating income between charitable beneficiaries and designated heirs. Upon funding the trust, income generated by the trust's assets is directed to one or more charitable organizations for a predetermined period, often spanning several years or even decades. After the charitable term, the remaining assets are distributed to the donor's heirs or other designated beneficiaries.

From a tax perspective, charitable lead trusts offer compelling benefits for donors. By front-loading charitable contributions during the lead term, donors may qualify for significant income tax deductions, effectively reducing their taxable income in the year of the trust's creation. Additionally, CLTs can facilitate wealth transfer strategies by potentially reducing the size of the donor's taxable estate, thereby minimizing estate tax liabilities for heirs.

[/et_pb_text][et_pb_heading title="Benefits of CLTs" admin_label="H3" _builder_version="4.27.3" _module_preset="default" title_level="h3" global_colors_info="{}"][/et_pb_heading][et_pb_text _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"]The appeal of charitable lead trusts extends beyond their philanthropic impact, covering a range of advantages for financial and estate planning. One of the main benefits is the ability to support charitable causes while preserving wealth for future generations, allowing donors to leave a meaningful legacy that reflects their values and aspirations.

Charitable lead trusts offer strategic tax planning opportunities, including income tax deductions for charitable contributions and potential estate tax savings by reducing the donor's taxable estate. Donors can optimize their tax position by incorporating CLTs into their overall estate plan while advancing charitable initiatives aligning with their philanthropic vision. This charitable giving vehicle represents a dynamic strategy for individuals seeking to make a lasting impact on charitable causes while also providing for their heirs.

[/et_pb_text][et_pb_heading title="Charitable Remainder Trusts Explained " admin_label="H2" _builder_version="4.27.3" _module_preset="default" title_level="h2" title_text_color="#cb353c" title_font_size="35px" global_colors_info="{}"][/et_pb_heading][et_pb_text _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"]Charitable Remainder Trusts (CRTs) can be thought of as the inverse of CLTs. Instead of initial contributions going to a charity, the funds are reinvested to generate income for the beneficiaries. Once the trust period ends, the remainder is used to support charitable causes. These trusts serve a dual purpose: preserving assets for beneficiaries while facilitating charitable giving.

CRTs come in two main types: unitrust and annuity trust.

- Unitrusts provide a variable income stream determined by a set percentage of the trust's total worth, recalculated annually, offering flexibility.

- Annuity Trusts offer a fixed income amount determined at the trust's creation, providing predictability but less flexibility.

A key feature of CRTs is their ability to balance philanthropic goals with financial objectives. By establishing a CRT, donors effectively transfer assets—from cash and securities to real estate—into an irrevocable trust. This transfer ensures that the designated charitable organizations will ultimately benefit from the trust's assets, while beneficiaries continue to receive income either for a specified period or throughout their lifetime.

[/et_pb_text][et_pb_heading title="How CRTs work " admin_label="H3" _builder_version="4.25.0" _module_preset="default" title_level="h3" global_colors_info="{}"][/et_pb_heading][et_pb_text _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"]The mechanics of a CRT are relatively straightforward yet offer considerable flexibility and strategic benefits. Upon funding the trust, donors or named beneficiaries begin receiving income payments as stipulated in the trust agreement. These payments can be structured to provide a fixed annuity or a percentage of the trust's assets, allowing donors to tailor income streams to their specific needs and preferences.

From a tax perspective, CRTs present notable advantages for donors. Donors can potentially secure an immediate income tax deduction based on the current value of the charitable remainder interest by transferring appreciated assets into the trust. Furthermore, donors can potentially eliminate capital gains tax on the transferred assets, optimizing their overall tax position while supporting charitable causes.

[/et_pb_text][et_pb_heading title="Benefits of CRTs" admin_label="H3" _builder_version="4.25.0" _module_preset="default" title_level="h3" global_colors_info="{}"][/et_pb_heading][et_pb_text _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"]The appeal of CRTs extends beyond their philanthropic impact, encompassing a range of financial and estate planning benefits. One of the primary advantages is asset preservation, as CRTs allow donors to retain control over the donated assets while simultaneously generating income for beneficiaries. Additionally, the tax advantages associated with CRTs—such as immediate income tax deductions and capital gains tax avoidance—enhance the overall efficiency of charitable giving.

CRTs offer significant flexibility, accommodating various asset types and allowing donors to structure income streams according to their preferences. Whether donors seek to support specific charitable initiatives, diversify their investment portfolio, or optimize their tax position, CRTs offer a versatile solution tailored to their unique financial objectives.

By leveraging the strategic benefits of CRTs in conjunction with our commitment to transparent financial planning and client advocacy, we enable our clients to make well-informed choices that match their charitable vision and long-term financial goals.

[/et_pb_text][et_pb_heading title="CLT vs CRT: Which Option is Right for You? " admin_label="H2" _builder_version="4.27.3" _module_preset="default" title_level="h2" title_text_color="#cb353c" title_font_size="35px" global_colors_info="{}"][/et_pb_heading][et_pb_text _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"]When comparing charitable remainder trusts vs charitable lead trusts, it's essential to weigh the benefits and functionalities of each in the context of your financial and philanthropic objectives. CRTs offer a means to preserve assets while providing income for beneficiaries and offer significant tax advantages. On the other hand, CLTs prioritize immediate charitable impact, supporting charitable causes during the trust's term while potentially reducing estate tax liabilities.

As you navigate charitable planning, determining the right option between CRTs and CLTs requires careful consideration. We also recommend consultation with a trusted wealth advisor. At 5280 Associates, our expert team specializes in charitable giving strategies and can help you determine if a charitable lead trust, charitable remainder trust, or even a combination of the two is the right option for you. If you want to learn more about how charitable remainder trusts and charitable lead trusts fit into your wealth management plan, we are more than happy to help.

[/et_pb_text][et_pb_button button_url="https://5280associates.com/contact-us/" button_text="Build Your Charitable Giving Strategy" button_alignment="center" _builder_version="4.25.0" _module_preset="default" global_colors_info="{}"][/et_pb_button][/et_pb_column][/et_pb_row][/et_pb_section]

Cybersecurity 101

As the reliance on the internet continues to grow, so does the need for cybersecurity. According to the cybersecurity company Norton, there are around 2,200 cyberattacks per day. In the ever-changing world that we live in, it is imperative to protect your private information from such attacks. Fortunately, there are many steps that you can take to be the first line of defense against scams and malware.

Steps to Account Security

Here are a few things to consider to ensure your accounts stay protected:- Security Alerts: Set up security alerts via email or text so you are the first to know if your account has been compromised.

- Voice Identification: If you have accounts with us at Schwab, you can enroll in Schwab’s voice ID service by calling 800-435-4000.

- Protect Your Passwords: NEVER share your login information.

- Update Your Devices/Apps Regularly: Device/App updates typically come with security updates. If you aren’t updating your devices/apps regularly, you are leaving yourself exposed to security holes in previous versions.

- Protect Your Network: Fortify your own home’s network and router with strong passwords. Anything else in your home that utilizes the internet should also contain a password such as security systems, smart devices, cameras, etc.

- Avoid Public Wi-Fi: Using public Wi-Fi in places like coffee shops and airports is fine to check the score of your favorite sports team or look up a definition for your game of scrabble, but be wary of using free Wi-Fi when logging into sensitive accounts. If you must do so, try using your own personal hotspot on your phone to maintain security. You can also use a personal VPN.

- Assign a Trusted Contact: If you have not done so already, you may consider establishing a trusted contact person for your financial accounts. While a trusted contact person has no authority to make changes to your accounts, financial institutions may contact that person to discuss possible financial exploitation.

- Make It a Conversation: Keep your entire family up to date on cybersecurity. Teach your kids from a young age the importance of internet safety and help your older relatives avoid possible scams.

- Follow Your Gut: If you receive an email or a call that doesn’t feel quite right, there is nothing wrong with saying no to giving up sensitive information.

- Be Aware of Phishing: See below for information on how to detect emails from scammers.

Passwords Are Key

Simply put, the number one rule of passwords is, you guessed it, never share your passwords. Be sure all of your passwords are strong and difficult to guess. Do not use information such as birthdays, names, etc. It is a good idea to create a password that uses a full combination of uppercase and lowercase letters, numbers, and symbols and are at least 8 characters long. Do not use the same password for multiple logins. Passwords should be hard to find! Do not store them in a notebook, or somewhere other people can easily access. Nowadays, it is a great idea to maintain passwords on your devices as well. Make sure your laptop, smartphone, and tablets utilize a password, code, fingerprint, or facial recognition to access. Password managers are a great option if you have many passwords or want to store them securely without having to remember each one. Most password managers can create, store, and autofill your passwords for an unlimited number of logins. According to Investopedia, the best password managers of 2022 are:- LastPass – Best Overall

- Dashline – Best for Extra Security

- LogMeOnce – Best for Multiple Devices

- Bitwarden – Best Free Option

- RememBear – Best for New Users

- 1Password – Best for Families

- Keeper – Best for Enterprises

Something Seems Phishy

Phishing emails are defined as malicious emails sent by an attacker to scam the receiver into revealing sensitive information, system credentials, or clicking on links that lead to viruses and malware on their device. Scammers may use techniques in these emails such as forgery, lying, misdirection, and more that can lead the recipient of such attacks to release sensitive information. Being able to recognize such emails is a great defense in protecting you from scams. If you receive an unexpected email, take a moment to confirm the legitimacy of the email before clicking any links or replying with sensitive information. Begin by double-checking the email address. Is this the email this person normally uses? Is everything in the address spelled correctly? Does the domain make sense? Next, hover your cursor over any links in the email without clicking on them. If the URL doesn’t match with what the sender is saying, do not click on it. If the sender of the email is claiming to be someone you know, it never hurts to give that person or office a call to doublecheck that they sent the email. When in doubt, do not reply or click any links. Remember, 5280 Associates will never ask you for your passwords. We will only ask for or provide sensitive information via an encrypted email or in a secure folder. If you are unsure about providing information to us via email, don’t hesitate to give us a call.

Be Aware of Malware

According to Business Insider, malware refers to any software that is designed to damage, destroy, or steal data, take control of devices, or aid in other criminal activity. There are a few different kinds of malware to know about: adware, ransomware, scareware, spyware, trojan software, viruses, and worms.Adware

Not all adware is malicious, as it is software that is simply meant to show you advertisements on your device. That being said, some adware can be harmful. You may have adware if you are seeing more ads than normal, the ads do not make sense or are not relatable to you in any way, your browser’s homepage has changed, your browser has new tools that were not installed to your knowledge, or you are being redirected to websites you did not mean to access.Ransomware

Ransomware works by encrypting some or all files on your computer and demanding a “ransom,” or a form of payment, in order to unlock them. It is important when you notice ransomware to not pay the fee, as there is no guarantee that doing so will actually get rid of the software encrypting your files. The best way to protect yourself is to back up your files frequently and be on the lookout for phishing scams.Scareware

Scareware is software designed to tell you that your device has already been infected with malware. This will typically appear in the form of a pop-up with instructions on how to get rid of the virus with a link to antivirus software. This link is actually the malware in disguise and clicking on it will infect your PC. Be wary of such pop-ups and seek guidance from an IT professional when in doubt over a possible virus.Spyware

Spyware is literally meant to spy on your device. This form of malware steals information from your device and delivers it to scammers without you knowing. The best way to protect yourself from malware is be aware of phishing emails and protect your computer with antimalware software.Trojan Software

Trojan software gets its name from the Trojan Horse. It appears harmless and disguises itself as useful software- until it is too late.Viruses

Computer viruses work the same way as viruses in people. Once your device is infected, the malware will replicate itself, making the situation more difficult to cure.Worms

Worms work the exact same way as viruses, but replicate the malware without any need for human prompting. You can protect yourself from malware with firewalls (a network security device that filters traffic based on your network’s security policies), anti-phishing protection in your email account, Virtual Private Networks (VPNs), password managers, encryption, parental controls, software to protect your microphone and webcam, and of course, malware protection software. Here is a list of the Best Malware Protection Software of 2022 according to Safety Detectives:- Norton – Best Overall Protection

- Bitdefender – Full Anti-Malware Software

- McAfee – Total Malware and Virus Removal

- TotalAV – Fast and Easy-to-Use with PC

- Avira – Best Free Option

- Malwarebytes – Simple and Secure

- Intego – Best for Mac

What 5280 Associates is Doing to Protect You

Your private and account information can only be accessed by our team via multi-factor authentication and we only access your data on devices approved by our security company. These devices are used by our team members only. 5280 Associates does not share your financial information unless you are present or have completed a form that authorizes us to disclose your information to select individuals. As mentioned above, our team will never ask you for your passwords. If our team members call you with sensitive information, you can expect us to verify we are speaking with the right person by asking for your date of birth or some other piece of information. If we are emailing, sensitive information will be sent via an encrypted email or in a secure password protected folder. If you have private information to send our team, please ask for a link to a secure email. If you ever feel unsure about something you have received from our team, please give us a call. Remember, you are the first line of defense against theft and damage to your assets. Be aware of possible scams and make sure your devices are up-to-date with anti-malware software. The best security is like an onion- it has layers! Unfortunately, there is not one single thing you can do to protect yourself, but following these steps will make your shield over your assets stronger. Of course, please don’t hesitate to reach out if you have any further questions in regards to how we protect you and your private information here at 5280 Associates.

Remember, you are the first line of defense against theft and damage to your assets. Be aware of possible scams and make sure your devices are up-to-date with anti-malware software. The best security is like an onion- it has layers! Unfortunately, there is not one single thing you can do to protect yourself, but following these steps will make your shield over your assets stronger. Of course, please don’t hesitate to reach out if you have any further questions in regards to how we protect you and your private information here at 5280 Associates.

Considering Charitable Gifting for This Year’s Holiday Season? Here is What You Need to Know.

[et_pb_section fb_built="1" _builder_version="4.16" global_colors_info="{}"][et_pb_row _builder_version="4.16" background_size="initial" background_position="top_left" background_repeat="repeat" global_colors_info="{}"][et_pb_column type="4_4" _builder_version="4.16" custom_padding="|||" global_colors_info="{}" custom_padding__hover="|||"][et_pb_text _builder_version="4.16" background_size="initial" background_position="top_left" background_repeat="repeat" hover_enabled="0" global_colors_info="{}" sticky_enabled="0"]The holiday season is right around the corner! Donating to an organization can be a great way to spread cheer supporting a cause you believe in while also benefiting from a tax perspective. In our guide to charitable gifting, we will cover tax implications and strategies around five types of donations: cash, appreciated stock, charitable trusts, real estate, and assets. Please keep in mind that while these strategies are a good option for most cases, they may not always serve you best. Be sure to keep your tax professional in the loop when making decisions on charitable donations.

Cash Donations

The most common form of donation, cash donations are as simple as sending cash, writing a check, or using a credit or debit card to send money to your preferred organization. They benefit the organization by providing them with liquid cash to spend as needed. They benefit you as you can deduct charitable cash contributions in most cases, and if the donations total under $300, you do not have to itemize. In general, most donations can be deducted up to 50% of your adjusted gross income, or AGI, if made to a qualifying organization. However, donations to private organizations, such as fraternal or veteran foundations are only deductible up to 30% of your AGI. To find out if the organization you are donating to is qualified, use the IRS Tax Exempt Organization Search Tool.

Gifting Appreciated Stock

Publicly traded securities make for a fine donation as they are easily transferrable and will grow over time for the organization. By itemizing deductions on your tax return, you may not only benefit from the deduction, but you could also eliminate the capital gains tax that you would have incurred had you sold the asset. Therefore, if you are planning on gifting a fund to charity, it is better to transfer the fund rather than sell it and give them the money, as the organization could benefit more by the amount of tax that would have been paid! What’s more, is you can claim the current fair market value of the stock or fund as a charitable deduction for that tax year, which can save you money either for yourself or further gifting. It is important to note that gifting appreciated stock can make your tax analysis more complicated. Therefore, a good strategy when gifting money from an appreciated stock is to consider transferring the securities to the organization in lieu of selling. However, if the stock did not appreciate over time and is actually worth less in the present than the time that you bought it, it may be better to sell the stock and gift the proceeds in order to claim the loss on your tax return. Similar to donating cash, donating funds does have limits when it comes to itemizing deductions. Overall deductions are limited to 50% of your AGI, but the limit for appreciated assets held for longer than one year is 30% of AGI.

Charitable Trust

Charitable trusts are tools commonly used in estate planning, as they are spread over a long period of time rather than made as a one-time donation. There are two different types of charitable trusts. The first, called a charitable lead trust, is great for those with substantial wealth who need a place to store assets that are likely to appreciate as time goes on. Generally, these trusts are established over a predetermined period. The charities named in the trust receive interest payments during this period. Once the period expires, the trust is returned to you or a non-charity beneficiary. While trusts are not tax exempt, this strategy could help you avoid gift or estate taxes, however, as you do not have full control over the money, you may not see a great deal of tax savings while alive. The other option is a charitable remainder trust. This type of trust is a good solution for folks with stocks or real estate. It allows the holder of the assets to sell them without facing taxes on capital gain. They allow for the giver to benefit from the tax deduction as well as reduce their estate taxes. There are two types of charitable remainder trusts: charitable remainder annuity trusts (CRATs) and charitable remainder unit trusts (CRUTs). A CRAT provides income to a non-charitable beneficiary, either for a certain number of years, or the rest of their life. Once the set period ends, the trust’s charity will receive the remaining interest from the trust. The charity may choose to withdraw the interest right away, or allow it to continue to grow in the trust. A CRUT is similar to a CRAT, however, it allows the donor to transfer additional funds to the trust at any time. It also requires for the trust to pay out 5% or more of the original investment every year as income to the non-charitable beneficiary during the set period. Charitable trusts are good tools, but they are major investments. Much of the time, they require hundreds of thousands of dollars to truly realize the tax benefits as well as the income benefits. It is also important to note that these trusts cannot be dissolved. If the stock market takes a dip, you cannot pull out the funds. It is good to look at this strategy primarily as a tax benefit, not one for increasing wealth.

Real Estate Donations

If you have a home, rental property, land, or other real estate asset that you have held for over a year, you are able to donate it to a charity if you wish. The benefit to doing this is avoiding the capital gains tax. By donating the property to charity rather than selling the property and donating the proceeds, the charity can see more impact by the amount of tax that otherwise would have been paid. On top of that, you may claim the fair market value of the donation on your tax return as a deduction. It is important to note that gifting non-cash assets complicates the tax planning process. Be sure to consult with your tax professional before making the donation. The simplest way of donating real estate is through direct transfer of the deed or title. This allows you to receive the tax benefits mentioned above. You may also contribute your property to your CRUT (see Charitable Trusts) or sell the property to the charity for under the fair market value, which allows you to incur less capital gains tax as well as claim a deduction on the difference.

Other Assets

Lastly, you may also donate your items to charity and qualify for deductions. Items like clothing, books, supplies, and even vehicles can be donated to charity. When you donate an item, you must use the fair market value to determine the deduction on your cash return. Many donation centers such as Salvation Army or Goodwill provide a Value Guide for items they accept. For items over $5000, you will need an appraisal. The items must be in good condition when donated. The fall and winter seasons seem to spring philanthropic thoughts, and we hope that our guide to charitable gifting has answered some of your questions. Donating assets to charity creates a great win-win situation in most cases, in which the organization gets to benefit from the funding or items, and you get to reap the tax benefits. Remember that while each of the strategies in this article are good in most cases, it is always a good idea to consult with a tax professional before taking the leap on any large donations.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]

The fall and winter seasons seem to spring philanthropic thoughts, and we hope that our guide to charitable gifting has answered some of your questions. Donating assets to charity creates a great win-win situation in most cases, in which the organization gets to benefit from the funding or items, and you get to reap the tax benefits. Remember that while each of the strategies in this article are good in most cases, it is always a good idea to consult with a tax professional before taking the leap on any large donations.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]

Our Take on Inflation: Where It’s Been, Where It’s Going, and How You Can Hedge Your Portfolio Against It

The COVID-19 pandemic was a completely unprecedented event that left our economy at a near-standstill in 2020, causing downward pressure on pricing in many different industries. Now, the economy is beginning to heat back up creating new demands for goods and services that haven’t seen much attention for over a year. Such demand leads to one question: What does the turn of our economy mean for inflation? In this article, we will cover the potential causes for inflation, what this year has shown thus far, what we expect for inflation looking forward, and what you can do to hedge your portfolio.

What Causes Inflation?

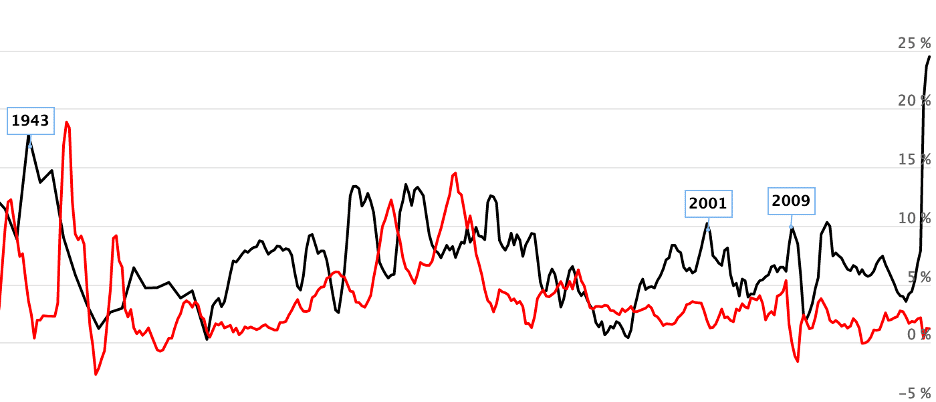

In economics, there are two main schools of thought regarding inflation: Monetarists, followers of Milton Friedman, who believe that inflation is a monetary phenomenon where “too many dollars chase too few goods,” and Keynesians, who believe that inflation occurs when an economy overheats and production can’t keep up with demand, generally because employers can’t find any new employees, and consumers thus bid up prices. This phenomenon is referred to as “demand-pull inflation.” Really, neither of these schools of thought adequately account for inflation all on their own. We have had periods where high deficits and loose money accompany low inflation, and we have had strong economic growth and low unemployment also accompany low inflation. Inflation then, can be a product of a number of different economic factors. The economic recession at the start of the pandemic last year certainly set the stage for 2021. Things like travel, entertainment, and transportation quickly lost demand in the wake of COVID-19, but those things are coming back. According to Helios Quantitative Research, May of last year was the last month that overall pricing was in decline. Since then, prices for goods have continued to elevate. In fact, they are coming back at a such a high rate that companies cannot handle the demand. Let’s take a look at rental car companies. In order to stay afloat during 2020 as demand decreased, many rental car companies sold off much of their fleets as they were uncertain when demand would pick back up. As you likely know now, the landscape has changed and the need for rental cars has come back faster than those companies anticipated. Have you tried renting a car recently? If not, count yourself lucky as it is a difficult and expensive process to go through. However, with 2020 in the rearview mirror, and the pandemic hopefully ending soon, we are likely to see improvements in this area soon. In addition to increased prices for goods, Americans used to spend around 69% of their overall spending on services pre-pandemic. That number has declined down to 64% as of today, according to a study performed by Helios Quantitative Research. Services can expand with changes in demand much easier than goods. Consider a bus tour through Denver. If the tour company is doing well, they may consider adding additional tour times before adding a new bus to the fleet. By adding additional tour times, they can use the same bus with the same staff- just for longer. Understandably, the cost of doing this would be paying the employees additional compensation for more hours worked as well as added costs for gas and maintenance of the bus. However, in a perfect world, the additional income from filling seats on a new tour would likely make up for those additional costs. Let’s flip the page and consider a company that makes gym equipment now. If the demand for gym equipment rises and employees are already at full capacity, the company cannot simply add hours for their employees to make new gym equipment. They also must obtain more parts and materials and coordinate with forces up the supply chain to make more equipment. This is possible, but more difficult than the tour company adding on an additional tour- especially if the supply chain for gym equipment is facing bottlenecks. How does such a slight decrease in demand for services over goods affect inflation? Consider how home gym equipment prices spiked dramatically over the last year. Disruptions to the gym equipment supply chain caused by COVID-19 are making it more difficult for companies to get the resources they need in time to make the amount of goods demanded. Low supply mixed with high demand is the recipe for inflated prices. Another factor to consider is the government stimulus program we saw during the pandemic. We have never seen the government move so quickly with fiscal response to economic decline as we did last year. According to Helios Quantitative Research, the Global Financial Crisis of 2008 added $4.8 trillion to the US national debt over the course of 3 years. Since the pandemic, we have seen a rise of $4.9 trillion in just a little over a year. We have not seen this kind of fiscal response since World War II. This means there is more money in circulation than there ever has been before. What does that mean for inflation? It may be surprising, but the relationship between money supply and inflation is not quite as correlated as one might think. Check out the chart below from Longtermtrends.net. The black line represents the amount of money in circulation, while the red line represents inflation. While inflation does follow money supply to a degree, you can see that the correlation is not exact, especially in 1943, 2001, and 2009. Why could this be? The simple answer is that printing money only causes inflation if it is done too quickly and supply is limited. If money is spent on extra goods and services that are readily available, the price of those good and services theoretically should not rise. However, if money is printed with not enough supply of goods to spend it on, prices on those goods will likely rise- causing inflation. Printing money creates inflation when the money printed causes demand for goods and services which do not have the supply to meet a change in demand.

While inflation does follow money supply to a degree, you can see that the correlation is not exact, especially in 1943, 2001, and 2009. Why could this be? The simple answer is that printing money only causes inflation if it is done too quickly and supply is limited. If money is spent on extra goods and services that are readily available, the price of those good and services theoretically should not rise. However, if money is printed with not enough supply of goods to spend it on, prices on those goods will likely rise- causing inflation. Printing money creates inflation when the money printed causes demand for goods and services which do not have the supply to meet a change in demand.

2021 So Far

Following the US Inflation Calculator, inflation was fairly moderate early in the year, with January and February following the same trends as the second half of 2020 with rates at about 1.4-1.7% over the previous year. Rates spiked to 2.6% in March, then really started gaining momentum in April as inflation rates surged over 4%. In both June and July of this year, inflation rates were nearly 5.4% higher over last year. In June, inflation was accelerating at a rapid rate – faster than we have seen in 13 years. Prices went up the most for travel items, such as auto (as mentioned with rental cars above) and airline tickets. Right now in our economy, we are not at full employment and a number of bottlenecks have popped up in our supply chain due to Covid. Along with this, the Federal Reserve has had a fairly loose money supply, along with generous fiscal policy, and the impact has been an increase in our overall inflation rate. While the increase in prices is apparent to everyone, what is not so apparent, is how long the current inflation will last. Some believe that price level increases will moderate as we come out of Covid and production increases, some believe that inflation will take longer to wring out of the economy, due to our monetary and fiscal policy.

When Does the Fed Step In?

How long this inflationary period lasts is largely up to the Federal Reserve. They can tighten the Money Supply, increase interest rates, and reign in prices. This, however, comes at the cost of economic growth. Thus far, while there has been mounting pressure to scale back or reverse stimulus, they have seemed reluctant to do so. How does this work? The Federal Reserve can influence the availability as well as the cost of credit. They can also change the federal funds rate, or the rate that banks pay to borrow money from the federal funds market. By raising this rate, banks in turn raise their own interest rates on borrowed money, raising the interest rates for loans on houses, businesses, and other items. When interest rates go down, it is less costly to borrow money. Therefore, households are more willing buy goods and services and businesses are more willing to expand. When interest rates go up, the opposite takes effect, and the demand for goods and services decreases. On July 28th, Federal Reserve officials did give an update on how they are keeping US inflation in check. Chairman Jerome Powell claimed at that time that the economy is not quite close enough to the “substantial further progress” that they hope to see towards stable prices and employment.

Looking Forward

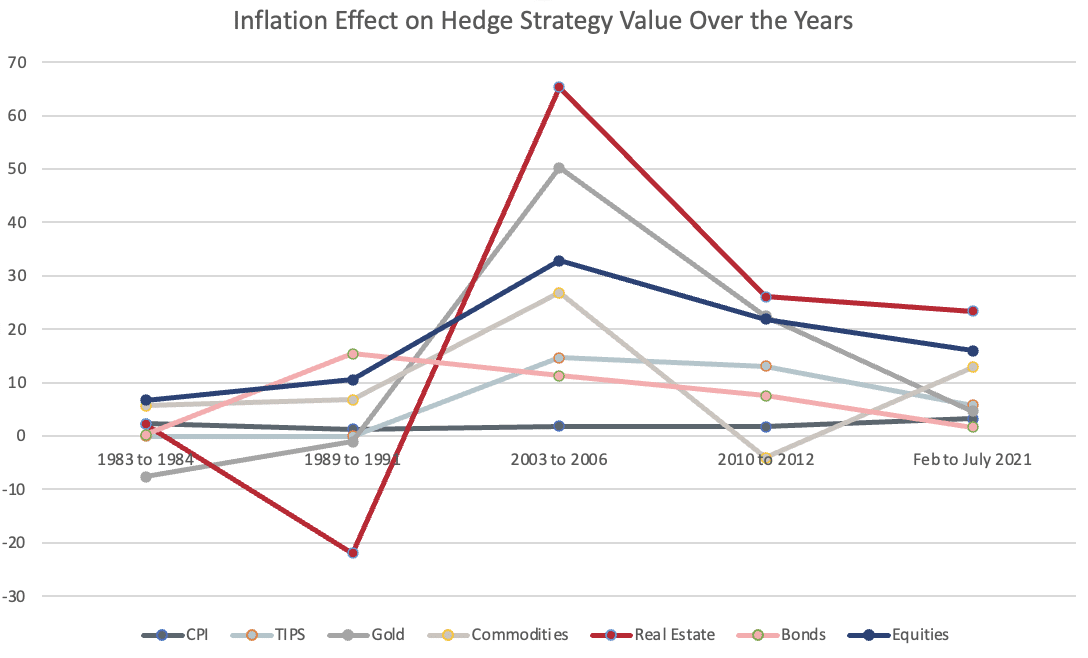

It is uncertain exactly what will happen with inflation as the economy continues its recovery, however we do anticipate higher levels of inflation for the foreseeable future due to bottlenecks in supply chains, pent-up demand for goods and services, and the fed delaying action to step in. Of course, there are plenty of scenarios that could change this. The truth of the matter is that it is very difficult to create an outlook on inflation given the uncertainty in our world. For now, it is safe to say that inflation will continue into 2022.How to Hedge Your Portfolio

Truly hedging a portfolio against inflation in a matter that works and is both consistent and reliable is difficult to do. There are many potential strategies to combat inflation in your portfolio but the reality is they come with a high opportunity cost. You may consider adding investments such as commodities, gold, real estate, and Treasury Inflation Protected Securities into your portfolio, but make sure to keep diversification top of mind as completely redirecting your portfolio to such investments may not be wise. Timing is also important, if you do not time the change perfectly, you may not see the returns you are hoping for. Take a look at the case study below performed by Helios Quantitative Research in regards to adding these types of investments into your portfolio as a hedge against inflation. As you can see, the value of each of these assets does not follow inflation, and there is no real pattern to any of them. In fact, even though inflation was up in each of the years shown, some of the assets even lost their value. This goes to show that predictions around these strategies are difficult! The best way to hedge inflation without worrying about timing is to stay invested and keep your portfolio diversified. At 5280 Associates, we take a measured view of this matter. We have recently updated our investment models in response to growing inflation concerns. Our advisors will continue to monitor the situation and make adjustments to our clients’ portfolios as the situation warrants.

Additional ways to combat inflation include paying off variable debt. As inflation goes up, so do interest rates. As interest rates go up, the more you owe! Now is a wonderful time to consider refinancing any adjustable-rate loans into loans with a fixed-rate. Other considerations are to prepay for an item, buy items in bulk, or seek cheaper alternatives. If you expect your washer to kick the bucket soon, now may be the time to shop around for a replacement. Build inflation into your overall financial plan as well. Prices will most certainly look different once your children begin college or you reach retirement age!

At 5280 Associates, we take a measured view of this matter. We have recently updated our investment models in response to growing inflation concerns. Our advisors will continue to monitor the situation and make adjustments to our clients’ portfolios as the situation warrants.

Additional ways to combat inflation include paying off variable debt. As inflation goes up, so do interest rates. As interest rates go up, the more you owe! Now is a wonderful time to consider refinancing any adjustable-rate loans into loans with a fixed-rate. Other considerations are to prepay for an item, buy items in bulk, or seek cheaper alternatives. If you expect your washer to kick the bucket soon, now may be the time to shop around for a replacement. Build inflation into your overall financial plan as well. Prices will most certainly look different once your children begin college or you reach retirement age!

In conclusion, we are facing high inflation rates in the US currently and it is likely to remain that way into 2022. Bottlenecks in supply chains from COVID-19 and an increase in spending on goods over services is likely to drive prices for goods higher. Take inflation into consideration when reviewing your financial plan and portfolio. Not sure where to start? Our advisors are happy to help!

In conclusion, we are facing high inflation rates in the US currently and it is likely to remain that way into 2022. Bottlenecks in supply chains from COVID-19 and an increase in spending on goods over services is likely to drive prices for goods higher. Take inflation into consideration when reviewing your financial plan and portfolio. Not sure where to start? Our advisors are happy to help!