ELEVATE WEBINAR

Here you will find video recordings regarding our investment management process, market commentary, and more. Videos are sorted with the most recent appearing at the top. Not seeing what you are looking for? Try using our search bar or pagination at the bottom.

Elevate Webinar 7: Market Overview

Ted recaps the first quarter of 2024, and looks ahead to the rest of the year!

Elevate Webinar 6: Market Overview

Ted recaps 2023, and the first quarter of 2024. He also gives some exciting updates on our Helios models, and looks ahead to the rest of 2024.Download PDF

Elevate Webinar 5: Market Overview

Join Ted as he recaps Quarter 1 of 2023, and looks ahead to Quarter 2 and beyond.Download PDF

Elevate Webinar 4: Market Overview

In this webinar, Ted focuses on a recap of 2022 and provides us a look ahead at expectations for 2023. Download PDF

Elevate Webinar 3: Market Overview

In this webinar, Ted discusses market performance in the equity and fixed income markets for the year, Federal Reserve policy, and how expectations regarding the Fed Funds rate and inflation have shifted. Additionally, and as always, our four level elements. ...

August 2022 Market Commentary

In this month's market recap, Ted covers discussions around the possibility of a recession, yield changes in Treasuries and Corporates, Expectations for Fed Policy and Inflation, and as always, our 4 elements. Download PDF

Elevate 2: Market Commentary with Ted Kouba

"Elevate" your knowledge of the markets with our Senior Officer of Investment Operations and Financial Planning, Ted Kouba. These webinars occur quarterly, and go for 30 minutes during a Thursday noon lunch break. In this second webinar of 2022, Ted recaps the July...

3 Layers of Risk Management

In this short video, Scott Huelskamp describes our “3 Layers of Risk Management” that we use to protect our clients’ portfolios from risk in the markets. Layer 1 refers to our diversification of holdings in each portfolio. We aim to identify valuable holdings in a...

May 2022 Market Commentary

In this month's market recap, Ted visits the drawdown, bond trends, the yield curve, Fed and inflation expectations, and our four elements. May Market Recap — Jun 17, 8:43 am Download PDF

April 2022 Market Commentary

In this brief video, Ted covers April's market overview, bond performance, fixed income drawdowns, credit risk, trends across asset classes, Fed Policy and inflation expectations, and our ecosystem of elements. April 2022 Market Commentary Download PDF

Elevate Webinar 1: Market Commentary with Ted Kouba

"Elevate" your knowledge of the markets and economy with our first 30-minute zoom webinar featuring our Director of Investment Management, Ted Kouba! This is the first webinar of a quarterly series. In Q1's call, Ted touches on January's volatility, market overview,...

Elevate Webinar Series: Market Commentary with Ted Kouba

5280 Associates invites you to join us next week for our first quarterly market updates webinar with our Director of Investment Management, Ted Kouba. This series will be called “Elevate” as we hope you use these calls to elevate your knowledge of the markets and your...

March 2022 Market Commentary

In this month's market recap, Ted discusses the recent inversion of the yield curve, Fed expectations, mortgage rates, inflation expectations, and the four model elements. Keep an eye out for registration for our first quarterly webinar with Ted on April 21st. A...

Research Supplement: The Fed and Interest Rate Expectations

Summary On March 15th, in a highly telegraphed move, the Fed took its first step in attempting to combat inflation. Recently, expectations of the Fed’s meeting have shifted around quite a bit, which can drive short-term equity volatility. With inflation and the Fed...

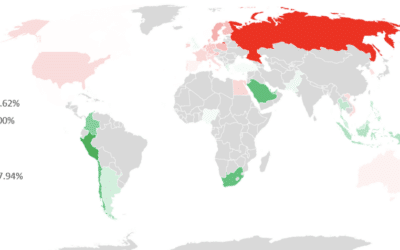

February 2022 Market Commentary

Welcome to our first monthly market commentary video featuring our Director of Investment Management, Ted Kouba. This month, Ted covers a brief market overview, the Russia/Ukraine conflict, energy costs, Fed expectations, inflation expectations, and the four elements...