Employee Equity Compensation and How Best to Use It

[et_pb_section fb_built="1" _builder_version="4.16" custom_padding="0px|||" locked="off" global_colors_info="{}"][et_pb_row column_structure="2_3,1_3" module_class="postPadding" _builder_version="4.16" custom_padding="0px|0px||0px" global_colors_info="{}"][et_pb_column type="2_3" _builder_version="4.16" custom_padding="|0px||0px" global_colors_info="{}" custom_padding__hover="|||"][et_pb_text _builder_version="4.17.4" background_size="initial" background_position="top_left" background_repeat="repeat" global_colors_info="{}"]In today’s day and age, many large, publicly traded companies are offering equity as compensation. This means that the employees have the option to use different stock programs to generate compensation for themselves. This also helps tie employees to the greater cause of growing the stock price of their respective company. These different programs can be confusing. Below is a summary of some of the common examples of equity compensation, including stock options, an employee stock ownership plan, an employee stock purchase plan, and restricted stock units. When involved in these programs, it is important to learn how to best use them as well as what the tax implications of your decisions may be.

Equity Compensation in a Nutshell

Equity compensation is a form of non-cash employee-payment. It may include stock options, ownership plans, performance shares, or restricted stock units representing ownership in the company the employee works for. Equity compensation is offered by many public companies, and even some private companies (especially start-ups). Equity compensation is attractive to the companies offering it because the employees’ financial reward depends on the success of the company. Therefore, it is in the employees’ best interest to contribute to the best of their ability to the growth of the firm. It is a highly attractive option for start-ups as cash is not involved, so they can offer equity to highly skilled individuals in lieu of a higher salary. Equity compensation can also generate tax deductions and build better employee retention. On the employee side of things, equity compensation can be a great financial planning decision if the company is doing well. It also doesn’t hold much risk in some cases and can provide tax benefits (more on that below). However, with this benefit, there is a chance that your stake in the company will never actually pay off. It is beneficial to receive a salary as well which covers your expenses so you have some certainty. This article will cover a few of the forms of equity compensation including stock options, ESOPS, ESPPs, RSUs, and phantom stock (which isn’t technically a form of equity compensation, but holds similar benefits).

Stock Options

Stock options extend the right to employees to buy a certain amount of shares of the company’s stock at a pre-determined price known as the “strike” or “exercise” price. Typically, there is a waiting period before you may exercise the options. It is important to point out that you do not actually own the stock until you exercise the options! Stock options simply provide the right to purchase the stock- ownership is not granted until the options are exercised. There are two major categories of stock options- incentive stock options (ISOs) and non-qualified stock options (NSOs). NSOs are the most common form, and receive relatively straightforward taxation. ISOs, on the other hand, are a bit more complicated. Read on for what makes ISOs and NSOs so different.Incentive Stock Options vs Nonqualified Stock Options

ISOs may have significant tax benefits over NSOs, however it is a challenge to qualify for them and it is possible to not receive them at all. Here are some of the many differences between ISOs and NSOs:- While only employees of the firm can receive ISOs, both employees and independent contractors of the firms can receive NSOs.

- ISOs have more favorable tax status than NSOs. With an ISO, if the stock is held for more than one year past exercise and two years past the grant date, the spread (difference between exercise and strike price) can be taxed as capital gain. Also, the tax is deferred until the sale of the stock. With and NSO, regardless of holding period, the spread is taxed as income at the time of exercise. The “post exercise" gain or loss will be taxed as capital gain or loss in either case.

- If you exercise a large amount of ISOs in a year you may be subject to AMT and should consult a tax advisor prior to exercise.

- ISOs must be exercised within 3 months of termination from the company (although this length of time may be extended in the case of death or disability). NSOs do not have a period limit so long as they are exercised prior to the expiration date of the stock options.

- The maximum term of an ISO is ten years from the date the ISO was granted, or 5 years for ISOs held by shareholders who own more than 10% in the company. NSOs don’t have a maximum term, although they are commonly set at 10 years.

- ISOs have an annual limitation of $100,000 worth of stock. There is no annual limitation on NSOs.

- ISOs have special rules for stock holders owning over 10% of the firm while NSOs have none.

Employee Stock Ownership Plans (ESOPs)

Congress passed a law in 1974 which allowed an owner to sell a portion or all of their business to their employees, who, in turn, pay nothing. ESOPs are often used to align the interests of the employees with that of the company’s shareholders, as the benefit that comes out of ESOPs relies on the growth and success of the firm. The company takes out a loan and then pays the owner the market value for the company. The benefit to doing this for the company is that they do not have to pay taxes on profits for the portion of the business owned by employees. The owner maintains control of the company, but hands some of the stake over to the employees. The employees benefit by gaining a positive financial future in the case the company continues to succeed. ESOPs come in the form of tax-exempt trust funds. The company contributes new shares of its own stock into the fund, or uses cash to purchase existing shares. ESOPs can also borrow money to purchase new and existing shares. Once the employee retires, the company is required to repurchase the employee’s shares.Pros and Cons

There are quite a few pros to holding ESOPs as an employee. First off, on the positive side, ESOPs can serve as a long-term benefit and can build you significant wealth if the shares appreciate over time. They are also known to boost employee morale as everyone in the company shares the same common goal of helping the company to grow and succeed. Because ESOPs come in the form of tax-exempt trusts, profits earned by the company stay with you- the employee! They also take less time to implement than a regular third-party sale, and allow for both instant and gradual ownership on the company. That being said, ESOPs also face some downsides. ESOPs only pay fair market value for the shares held, while owners outside of the company may receive top dollar for their shares. ESOP companies require strong management in order to succeed. The fall of the company means the fall of share value. Also, because the company must repurchase the shares when an employee leaves or is terminated- they may face significant expenses if a handful of employees were to leave at once, which may create financial strain within the company.Tax Implications

ESOPs receive a myriad of tax benefits- mostly benefitting the company. There are two employee benefits: One, you pay no tax on contributions. Two, it is also possible to roll the ESOP funds into an IRA and pay only capital gains tax on the gain portion if done correctly under Net Unrealized Appreciation rules. Be sure to consult a CPA to determine your eligibility.

Employee Stock Purchase Plans (ESPPs)

ESPPs are stock plans within a company which offer shares to employees at a discount to fair market value. This discount can reach up to 15% in some cases! A percentage of the employee’s paycheck (an amount which they elect themselves, typically 1-20%) is automatically deposited into their plan each pay period. Sometimes, the employer matches their contribution. At the end of the period, the company uses the money in their plan to purchase the stock at the determined discounted price. The value of the stock can increase or decrease normally, so it is possible to see both gains and losses. Like you should with any kind of investment management, it is important to keep your overall portfolio diverse.Pros and Cons

ESPPs offer quite a few benefits. First off, if your company is successful during the ESPP period, you can realize large gains. For example, say at the start of the period- the company determines that you can buy the stock at 10% off market value- which is currently $50. You will buy the future stock for $45. But during the time you and your employer are contributing money to your plan, the stock price rises to $100. If you have $180 in your plan- you can buy 4 shares for less than the cost of 2! Sell them immediately, and you could see $220 in gains. ESPPs also align your interests with that of your company. Focusing on the long-term rather than only being concerned about this week’s paycheck is said to boost employee morale, as everyone is working together for the benefit of the business. ESPPs also have their risks. There is no guarantee that you will come out ahead by owning stock in your company. Let’s use the same example as before. At the start of the period, the company determines you can buy stock at 10% off the current market value, which is $50. You will buy the future shares for $45. But if the stock prices falls during the period to $40, it would actually be $5 cheaper per share to buy through the general market. So you are no longer purchasing the stocks at a discount. ESPPs may also require a holding period in some cases, meaning you cannot sell the stock right away. If you believe the share value of your company is going to fall during this time, you could see losses.Tax Implications

If you sell your ESPP stock immediately after it is purchased with your plan, you will be taxed as a short-term capital gain (income tax). If you hold the shares for longer than one year, the gains in the shares can be taxed more favorably as long-term capital gain.

Restricted Stock Units (RSUs)

RSUs are given to employees only after the RSU remains with the company for a certain length of time or hits a required performance goal. They may not be exercised (hence the term “restricted”) for periods that sometimes last several years, and may not be sold during this timeframe. The value of RSUs is considered income once the right to exercise becomes available.Pros, Cons, Taxation

RSUs have one major upside for employees. There is no exercise price to purchase an RSU, only a vesting period. You “purchase” the shares with your time. RSUs are nearly always worth something to the employee, even when the company’s stock price drops. When the vesting period is complete, the company gives you the shares and you are taxed on the value as ordinary income. This could push you into a higher tax bracket, even if you hold the shares. Any gain after vesting will be subject to capital gains rules. You are able to sell the shares as you wish after vesting.

Phantom Stock

Although they are not technically a form of equity compensation, phantom stock options can achieve similar goals. A phantom stock plan is a contractual agreement between the company and employee. The company treats the employee as though they are a stockholder, but does not actually sell any stock (or give the option to purchase stock) to the employee. The employee receives phantom units whose value is tied to that of the overall company. Later, depending on how the agreement is written, this value is paid to the employee. Typically, the phantom stock would be paid over a 5 year period at retirement, death or disability. Think of phantom stock like an “I Owe You” from the company which is also going to be taxed as income upon receipt.Pros and Cons

The pro for employees is that they get to participate in the growth of the business if the business is growing well. The downside is they do not get actual ownership in the business, but instead a cash payout based on the value of the business in the future.Tax Implications

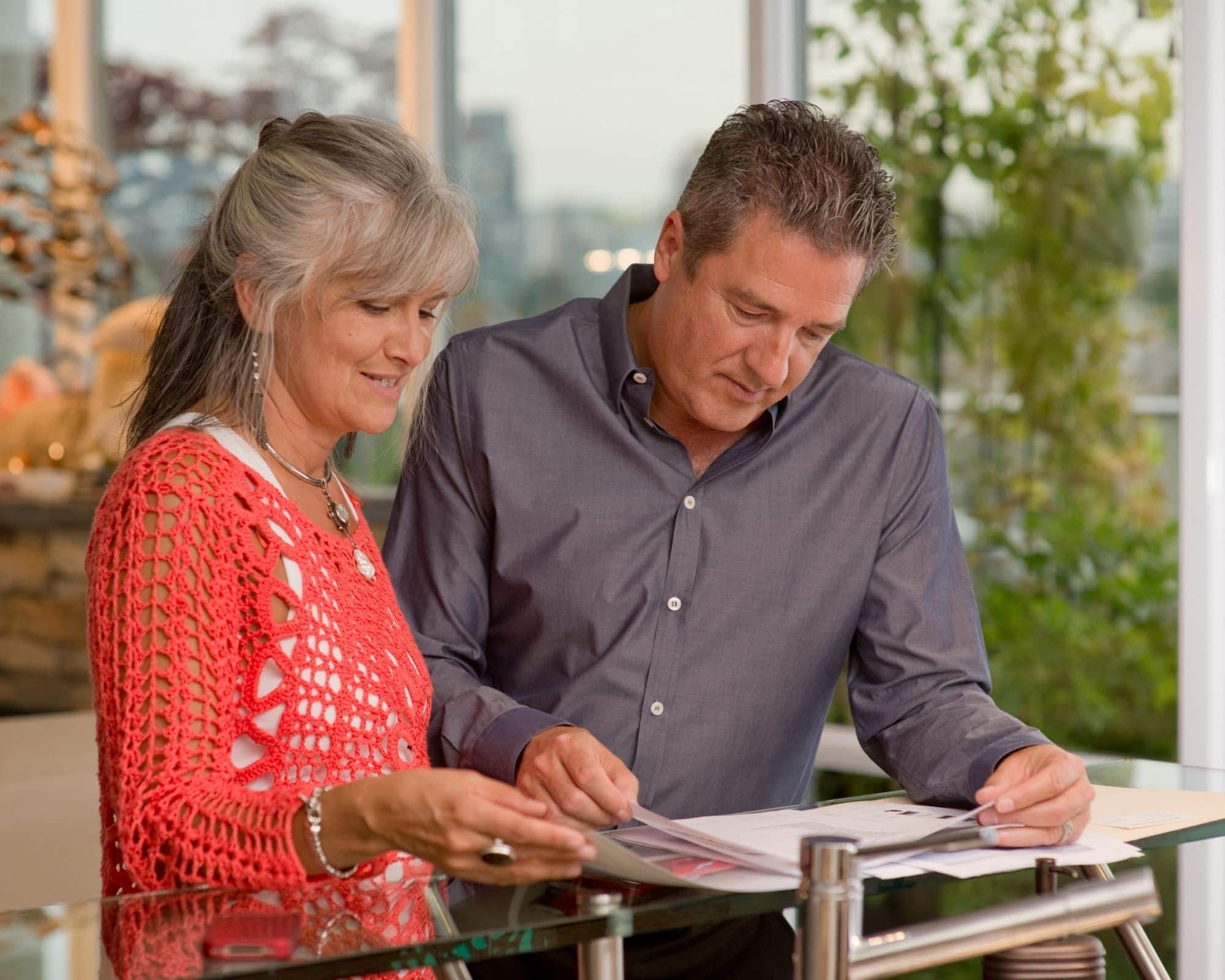

The cash paid to the employee is taxed as income. They are also subject to FICA and Medicare taxes. With all of these acronyms, pros, cons, tax implications and more- your head may be swimming. If your company offers one or multiple of these equity compensation options, it is a good idea to review your options with your wealth advisor before arriving at a decision of how to handle them.[/et_pb_text][/et_pb_column][et_pb_column type="1_3" _builder_version="4.16" custom_padding="|||" global_colors_info="{}" custom_padding__hover="|||"][et_pb_search exclude_pages="on" include_categories="16,1,15" _builder_version="4.14.8" max_width="100%" custom_css_main_element="min-height: 45px;" custom_css_input_field="min-height: 45px;" custom_css_button="border: solid 1px #da1a32;||padding: 10px;||background: #da1a32;||color: #fff;||cursor: pointer;||transition: 0.35s;||width: 90px;||font-weight: 600;||font-size: 16px;||min-height: 45px !important;" border_radii="on|0px|0px|0px|0px" input_font_size="14px" input_letter_spacing="0px" input_line_height="1em" input_text_shadow_style="none" global_module="27994" saved_tabs="all" global_colors_info="{}" button_text_size__hover_enabled="off" button_one_text_size__hover_enabled="off" button_two_text_size__hover_enabled="off" button_text_color__hover_enabled="off" button_one_text_color__hover_enabled="off" button_two_text_color__hover_enabled="off" button_border_width__hover_enabled="off" button_one_border_width__hover_enabled="off" button_two_border_width__hover_enabled="off" button_border_color__hover_enabled="off" button_one_border_color__hover_enabled="off" button_two_border_color__hover_enabled="off" button_border_radius__hover_enabled="off" button_one_border_radius__hover_enabled="off" button_two_border_radius__hover_enabled="off" button_letter_spacing__hover_enabled="off" button_one_letter_spacing__hover_enabled="off" button_two_letter_spacing__hover_enabled="off" button_bg_color__hover_enabled="off" button_one_bg_color__hover_enabled="off" button_two_bg_color__hover_enabled="off"][/et_pb_search][et_pb_blog posts_number="3" include_categories="14" show_author="off" show_date="off" show_categories="off" show_pagination="off" admin_label="Blog Sidebar" _builder_version="3.3" custom_css_content="display:none;" global_module="28007" saved_tabs="all" global_colors_info="{}"][/et_pb_blog][/et_pb_column][/et_pb_row][/et_pb_section]

With all of these acronyms, pros, cons, tax implications and more- your head may be swimming. If your company offers one or multiple of these equity compensation options, it is a good idea to review your options with your wealth advisor before arriving at a decision of how to handle them.[/et_pb_text][/et_pb_column][et_pb_column type="1_3" _builder_version="4.16" custom_padding="|||" global_colors_info="{}" custom_padding__hover="|||"][et_pb_search exclude_pages="on" include_categories="16,1,15" _builder_version="4.14.8" max_width="100%" custom_css_main_element="min-height: 45px;" custom_css_input_field="min-height: 45px;" custom_css_button="border: solid 1px #da1a32;||padding: 10px;||background: #da1a32;||color: #fff;||cursor: pointer;||transition: 0.35s;||width: 90px;||font-weight: 600;||font-size: 16px;||min-height: 45px !important;" border_radii="on|0px|0px|0px|0px" input_font_size="14px" input_letter_spacing="0px" input_line_height="1em" input_text_shadow_style="none" global_module="27994" saved_tabs="all" global_colors_info="{}" button_text_size__hover_enabled="off" button_one_text_size__hover_enabled="off" button_two_text_size__hover_enabled="off" button_text_color__hover_enabled="off" button_one_text_color__hover_enabled="off" button_two_text_color__hover_enabled="off" button_border_width__hover_enabled="off" button_one_border_width__hover_enabled="off" button_two_border_width__hover_enabled="off" button_border_color__hover_enabled="off" button_one_border_color__hover_enabled="off" button_two_border_color__hover_enabled="off" button_border_radius__hover_enabled="off" button_one_border_radius__hover_enabled="off" button_two_border_radius__hover_enabled="off" button_letter_spacing__hover_enabled="off" button_one_letter_spacing__hover_enabled="off" button_two_letter_spacing__hover_enabled="off" button_bg_color__hover_enabled="off" button_one_bg_color__hover_enabled="off" button_two_bg_color__hover_enabled="off"][/et_pb_search][et_pb_blog posts_number="3" include_categories="14" show_author="off" show_date="off" show_categories="off" show_pagination="off" admin_label="Blog Sidebar" _builder_version="3.3" custom_css_content="display:none;" global_module="28007" saved_tabs="all" global_colors_info="{}"][/et_pb_blog][/et_pb_column][/et_pb_row][/et_pb_section]

Interested in Investing in Real Estate Investment Trusts? Here is What You Need to Know.

Approximately 170 million people in the US are invested in a Real Estate Investment Trust, or a REIT. REITs typically provide high dividend yields- which make them a fine choice for investors looking for some extra income or who reinvest their dividends. So, what are REITs and how can you get started? This article will cover what you need to know, from the how-tos, to the risks and tax implications of the most popular form of Real Estate Investment Trusts.

What Are REITs?

Real estate investments trusts are companies which own or finance, and sometimes manage and/or operate, real estate which produces income. Generally, REIT’s specialize in one or more categories of property. This can include office space, apartment buildings, warehouses, shopping centers, medical centers, cell towers, data centers, and other commercial properties. Most REITs trade within major stock exchanges and can offer certain benefits to investors. REIT’s somewhat model mutual funds in the sense that they pool capital together from various investors to purchase real estate (either for ongoing income or resale.) REITs were created by congress in 1960 to make it possible for everyday people such as you or me to benefit from income-producing real estate. They also have opportunities for dividends and returns. Anyone can invest in an REIT the same way they would for other stocks. You can purchase shares individually, through a mutual fund, or through an exchange traded fund (ETF). So… how do REITs make their income? By owning properties which can be leased out, the REITs collect rent as income which is then paid out to the REIT’s shareholders as dividends. As a rule, REITs must pay 90% of their taxable income to their shareholders. Many pay out 100%! There are 4 major different types of REITs- Equity REITs, mortgage REITs, Public Non-Listed REITs, and Private REITs. Equity REITs represent the majority. These are the REITs that are publicly traded and what folks are typically referring to when they simply say “REIT”. Mortgage REITs, or mREITs, purchase mortgages and/or mortgage-backed securities. Their income comes from the interest on their investments. Public Non-Listed REITS, or PNLRs, are registered with the Securities and Exchange Commission, but are not traded on the national stock exchanges. Lastly, Private REITs are not registered with the SEC, and their shares are not traded publicly. For the sake of this article, I will focus on Equity REITs, and refer to them simply as REITs. Historically, REITs have delivered competitive returns- which makes them a good diversifier to add to your portfolio! So, how do you do it?

How to Invest in REITs

You can invest in REITs as you would for any other public stock. REIT mutual funds and exchange-traded funds are also available as options. At 5280 Associates, your advisor can assist you in analyzing your options and choosing investments that are right for your portfolio. It is best to assess the risks and tax implications before diving in.

How Can a Company Qualify as a REIT?

There are a few rules that companies must follow in order to be considered a Real Estate Investment Trust. These rules include, but are not limited to:- Invest a minimum of 75% of their total assets into real estate.

- Own real estate as a long term investment.

- Gain a minimum of 75% of their gross income from rent, interest of mortgages (mREITs), or the sale of real estate.

- Have at least 100 shareholders.

- Not allow 50% or more of their shares to be held by 5 or fewer individual shareholders.

- Pay out a minimum of 90% of taxable income to their shareholders every year in the form of dividends.

- See that 95% of the REIT’s income is passive.

- Be a taxable business entity.

- Have a board of directors or trustees.

Pros and Cons of REITs

Pros

One of the pros of investing in Real Estate Investment Trusts is they can add diversity to your portfolio. The performance of REITs is not always correlated to the performance of the stock market, and therefore, they can be a good diversifier. REITs also offer dividends, as they must pay out a minimum of 90% of their income in this fashion. They may pay out more than 90%, but may never opt for less. Investors looking for a consistent flow of dividends may find REITs attractive for this reason. Because REITs don’t have to pay corporate tax, their dividend payout is higher than other investment options. Lastly, REITs are relatively liquid compared to other real estate investment options. Buying and selling REITs takes less time than buying and selling properties. You also don’t have to deal with the struggle of managing a rental property.Cons

Real Estate Investment Trusts face their fair share of negatives, as all investment options do. While REITs don’t owe corporate taxes, they do still require the investor to pay taxes on dividends- and these dividends are taxed at income rates instead of the more favorable capital gains rate. REITs are hypersensitive to changes in interest rates. Rising interest rates can sometimes mean falling prices for REITs. The value of REITs is also heavily influenced by trends. For example, if a REIT is invested in smoothie shops at outdoor malls while smoothies fall out of trend, the value of the REIT will fall. It is safer to invest in REITs with a diverse portfolio of properties that do not fall victim to fads. REIT’s are also subject to tenant risk. Meaning, any REIT’s cash flows are only as reliable as it’s tenants. This risk can be mitigated by doing due diligence ensuring that the tenants of the potential REIT are of high credit quality with a diverse tenant base. REITs, similar to other equity type investments, are meant to be held long term- at least 5-7 years. If you are looking for a short-term investment, REITs probably are not for you.

Tax Implications

As mentioned above, dividends from REITs are typically taxed as income for the investor. This is because the REIT owes no corporate tax, and therefore the income is passed from the company to you, the investor. A portion of these dividends may qualify for 20% deduction under the Tax Cuts and Jobs Act, passed by President Trump in 2017 as an amendment to the Internal Revenue Code. However, these potential deductions are set to expire after 2025. While ordinary income usually makes up the bulk of REIT distributions and taxation, REITS can also make capital gain/loss distributions. This occurs when the REIT sells a property they have held for over a year and in turn, this gain or loss is also passed from the company to you. The REIT will let you know when they sell a property whether they faced a gain or a loss. In addition to both of the above scenarios, a portion of the dividends can also be classified as a nontaxable return of capital. This occurs when the distributions to the REIT’s investors exceeds the REIT’s earnings. This part of the dividend is not taxable the year it is paid out. It is instead taxed when you sell that share of the REIT. However, if the cost basis falls below zero, any further payouts from the REIT are taxed to you as capital gains. Real Estate Investment Trusts can be a good option if you are looking to add some diversity to your portfolio. Talk to your advisor about whether REITs are a good fit for your situation and how you can get started.

Real Estate Investment Trusts can be a good option if you are looking to add some diversity to your portfolio. Talk to your advisor about whether REITs are a good fit for your situation and how you can get started.

A Few Things to Consider Before Investing in Bitcoin

Bitcoin and other forms of cryptocurrency used to be regarded as an investment for day traders only. Today, it is gaining interest, creating many questions for investors. Some investors look to Bitcoin as a way to protect their portfolio from inflation and currency debasement. The uniqueness of the investment provides an opportunity for growth and maintains a low correlation to other forms of investments.

How Bitcoin Works

Bitcoin isn’t the shiny photos of coins that represent it on the internet or in the image above. Bitcoin is a software, with a set of processes. It is a form of cryptography, or the science of making and breaking code. Bitcoin runs on a cryptography protocol known as blockchain. Blockchain is literally a chain of blocks of information, arranged in chronological order. This information can include contracts, emails, titles to property, bonds, marriage certificates, and more. Any type of written agreement can be established on a blockchain. When this happens, a third party no longer needs to be involved in the agreement. In the case of Bitcoin, the information stored in their blockchain is mainly from transactions. It is best to think of Bitcoin as a list:- John sent a Bitcoin to Jane

- Jane sent two Bitcoins to Susan

- Susan sent ½ Bitcoin to Robert

Bitcoin Value

To some investors, Bitcoin is seen as a hedge against inflation. That is because there is a finite amount of tokens. The government cannot create more as it can with currency. Bitcoin is not the only investment to provide some relief from rising inflation. Real estate and other physical assets may have the same effect, along with private equity and technology stocks. Gold also retains its worth as inflation rises, hence why Bitcoin has been granted the nickname “digital gold” as both assets can be divided, are not government regulated, are portable and transferable, and are able to be verified. There is also a finite amount of gold, just as there are Bitcoin tokens. The recent crash in Bitcoin prices was not the first of its kind. The upward slope followed by a crash pattern has happened before. The Economic Times show that Bitcoin nearly reached $20,000 in 2017 before crashing to $3,300 just a year later. This time around, however, more solutions exist. Now, firms such as Fidelity offer cryptocurrency custody solutions, or independent security and storage systems meant to hold a large quantity of Bitcoin tokens. The interest of major investment companies such as this helps hold the value of Bitcoin steady, making it an appealing investment for even more companies. In July of 2020, the Office of the Comptroller of the Currency permitted national banks to process bitcoin transactions and provide cryptocurrency custody solutions.

Tax Implications

Currently, the IRS recognizes forms of cryptocurrency as property. This means that Bitcoin is taxed with typical capital gains. Crypto futures contracts are treated as futures and are taxed as ordinary income. The IRS has deemed it mandatory to report all Bitcoin transactions, even if only a small value. When investing in Bitcoin, it is required that the investor record all buying, selling, investing, and other usage of their Bitcoin assets. As with other tax reporting, incorrect reporting of Bitcoin usage can result in penalties and even prosecution. Investors considering Bitcoin should consult with a licensed tax professional before investing in Bitcoin. The following types of Bitcoin transactions are taxable:- Personally mined Bitcoins sold to a third party

- Previously purchased Bitcoins sold to a third party

- Purchasing goods or services with personally mined Bitcoins

- Purchasing goods or services with previously purchased Bitcoins

A Bitcoin Bull Market

Bitcoin continues to follow a boom-and-bust cycle. Each cycle has reached a different peak. According to The Ascent, before this year, Bitcoin hit peaks in 2010, 2013, and 2017. During each of these peaks, the value of Bitcoin would rise dramatically, then fall by almost 66% in the next year. This pattern follows the Bitcoin halving events, in which the value of mining Bitcoin is cut in half. Starting at 50, the value of Bitcoin has halved in 2012, 2016, and again in 2020, where the value was left at 6.25 according to Investopedia. With typical investments, this would pose a concern, but Bitcoin investors look to the predictability of the halving events as a positive rather than a negative. The predicted supply growth results in more transparency for Bitcoin investors, which with the number of Bitcoin investors, means the demand for Bitcoin will continue to drive up the value. The reason more people are buying into Bitcoin is mostly based on how useful Bitcoin has become as a payment method. Due to the global nature of Bitcoin, it can be seen as a more efficient method of payment for foreign purchases as the currency does not have to be converted. The belief is that the more widely Bitcoin is accepted as a payment method, the more participation in Bitcoin will grow. While Bitcoin is growing as a network of payment, it is also growing as an investment. Its returns have been promising compared to other investments, making it a good portfolio diversifier for the long term. Bitcoin is typically not highly correlated with other forms of investments. As the network of Bitcoin investors continues to grow, so will the security around Bitcoin.

A Bitcoin Bear Market

The biggest risk that Bitcoin brings as an investment is its incredibly high volatility patterns. It is five times as volatile as gold, four times that of the S&P 500, and nearly 9 times that of the S&P Real Assets index over six years, according to Bloomberg. To say whether or not Bitcoin is a good investment depends on the situation of the investor. While the widespread adoption of Bitcoin could reduce volatility to some degree, there is a possibility that end-of-period rebalancing could force investors to sell and actually increase Bitcoin’s volatility. Another issue Bitcoin is facing is its leadership as a cryptocurrency. While it is the most popular of the cryptocurrency options, its market share has dropped from 70% of the cryptocurrency pie to 46% according to Bloomberg. Other forms of crypto have surpassed Bitcoin in the area of growth including Ethereum, Dogecoin, and Ripple. These other forms of cryptocurrency have a higher usage rate compared to Bitcoin, and not as many limitations. Bitcoin may no longer see itself as the leader of the cryptocurrency options if this continues. Bitcoin faces another form of competitive risk with the new promise of Central Bank Digital Currencies (CBDCs). While cryptocurrency is rising as a challenger against traditional forms of currency, regulatory risks are still a threat. CBDCs have a similar technology to Bitcoin and other forms of cryptocurrency, however, they are backed by governments and other forms of regulatory agencies, which is forcing adoption. The fact that Bitcoin is not government regulated does offer it a leg up, as well as the fact that it is a global currency while the CBDCs are currently only spread across individual nations. As Bitcoin becomes more widely accepted, this risk will decrease. There are other risks for Bitcoin as well. Some countries have threatened to ban cryptocurrencies completely. There is also the risk of hacking, although this is generally targeted at individuals or service providers with weakened security. Hacking the entire Bitcoin network would mean taking control of over half of the Bitcoin mining power. Bitcoin’s network is fairly decentralized, although it is estimated that over half of their mining takes place in China. This does create risk as it is highly concentrated in one area. Bitcoin has also been criticized for wrongful use. All of Bitcoin’s transactions are recorded and held permanently, meaning that all Bitcoin transactions can be tracked. The FBI has tracked Bitcoin users making illicit purchases. There is no assurance that Bitcoin will not be used for illicit and illegal reasons. Lastly, Bitcoin mining requires a significant amount of energy. In fact, it is estimated that the amount of energy used to mine Bitcoin thus far is more than the total consumption of energy in all of Argentina! As the value of Bitcoin goes up, more miners are incentivized to enter the Bitcoin network. As more miners enter, the complexity of mining grows as well, due to Bitcoin’s algorithm. Every time the complexity increases, so does the energy it takes to mine. This could have a massive environmental impact. That being said, it is difficult to say whether the majority of Bitcoin mining is using clean, renewable energy or not. Bitcoin has certainly held the attention of investors in the past few years. Its high returns and low correlation with other investments make it a good portfolio diversifier. However, it does also present a series of risks, which means buying into Bitcoin needs to be an educated decision.

Bitcoin has certainly held the attention of investors in the past few years. Its high returns and low correlation with other investments make it a good portfolio diversifier. However, it does also present a series of risks, which means buying into Bitcoin needs to be an educated decision.

Is a Roth Conversion Right for You?

Many diligent retirement savers have spent decades putting away money into Traditional IRA’s or Traditional 401k’s/403b’s. The main benefit of these vehicles is tax deferral and the potential to receive a deduction on your taxes for the year in which the contributions are made. With a Traditional IRA/401k, taxes are not due until funds are pulled out of the account, typically in retirement. However, because the funds in these types of accounts have never been taxed, the IRS forces investors to start “RMD’s” or required minimum distributions at age 72. With a Roth IRA/401k, funds also grow tax deferred, but are not subject to required minimum distributions at age 72. With no RMD’s on a Roth IRA, it’s easy to understand why investors would want to perform a Roth conversion, but is it right for you? Let’s take a deeper look at all the pros and cons before you decide.

Traditional Retirement Accounts vs Roth Retirement Accounts

First, it’s important to understand the basics behind Traditional and Roth IRA’s. With a Traditional IRA, contributions may be tax deductible in the year in which they are contributed. There are two factors that determine the deductible nature of your contributions. Those factors are your income and whether or not the individual or individual’s spouse participates in an employer sponsored retirement plan, like a 401k. Funds in traditional IRA’s grow tax deferred until they are taken out and are subject to “RMD’s” or Required Minimum Distributions every year starting at age 72. With a Roth IRA, investors contribute after tax dollars and do not receive a deduction of any kind in the year they contribute. Allowable contributions to a Roth are income based, and funds inside the Roth grow tax deferred similar to a Traditional IRA. However, Roth IRA’s are not subject to “RMD’s” and will benefit from additional tax free growth. Qualified distributions come out of Roth IRA’s tax fee. The most common ways for distributions to become qualified is if you’re at least 59 ½ years old and your first Roth IRA was opened and funded at least 5 years ago.

What is a Roth Conversion?

Simply put, a Roth conversion is when you take money in a traditional tax deferred retirement account and convert it to a Roth account. In the process of converting, you pay income tax on the amount converted in the year the conversion takes place. However, once the funds are in the Roth, you will never have to pay taxes on those funds again. Up until January 1st 2010, there were income restrictions on who was eligible to take advantage of Roth conversions. Those limitations were lifted due to the Tax Increase Prevention and Reconciliation Act (TIPRA) and since then, Roth conversions have gained a ton of traction, allowing more investors the opportunity for further tax efficiency. In general, most financial advisors and tax professionals would not typically recommend that you accelerate the recognition of taxes. However, given the low tax rate environment that we are currently in, Roth conversions may provide significant benefits for many investors.

How to Know If a Roth Conversion is Right for You

Anyone can do a Roth conversion but not everyone should. Unlike the limitations placed on Traditional and Roth IRA contributions, there are no restrictions for conversions. However, there are still several factors involved that should be kept top of mind in determining if a Roth conversion is right for you:- Where will you live in retirement?

- Generally speaking, if you plan to move to a state in retirement that has a higher income tax than the state you currently reside in, it might make sense to convert at least some of your assets before you move.

- IRMAA

- Watch out for IRMAA! IRMAA, the Medicare Income-Related Monthly Adjustment Amount may create a surcharge in your Medicare part B or D premiums and comes into play for married couples filing jointly with a Modified Adjusted Gross Income (MAGI) of $176k ($88k for single filers.) The tricky part here is that IRMAA is based on your income from 2 years prior. This means that if you are married filing jointly and your MAGI was higher than $176k in 2019, you may have to pay the additional Medicare surcharge for your 2021 premiums.

- Medicare Surtax

- Similar to IRMAA, married couples filing jointly with MAGI of $250k or more ($200k for single filers) may be subject to an additional 3.8% Medicare surtax. Just like all distributions from a Traditional IRA, the amount you convert from a Traditional IRA to a Roth IRA is treated as income for tax purposes. Therefore, the conversion is part of your MAGI and may cause you to incur additional taxes/surcharges.

- How would you pay for the conversion?

- In general, it typically makes sense to utilize taxable assets to pay for the cost of the conversion versus proceeds from the converted account. This is especially true if you are under age 59 1/2 because the IRS imposes a 10% early withdrawal penalty for proceeds being used from a qualified account to specifically pay for the cost (taxes) of the conversion. Further consideration should be made if there are not enough taxable assets to pay the taxes on the conversion.

When is the Best Time to Do a Roth Conversion?

While there is no blanket answer here, we will typically recommend you look at completing conversions after you stop working, but before you begin taking withdrawals from a tax deferred account, or start receiving social security, pensions, or annuity disbursements. This time period has often been called the “Tax Planning Window” and varies for every individual. For some, this period may span 5-10 years, while for others it may only last 1-3 years. While the “tax planning window” is an ideal time to implement a conversion strategy, it isn’t the only time. Any time period of low taxable income could be a good opportunity to do a Roth conversion. For example, if you’re in between jobs or out on disability due to a sickness or injury. When it comes to Roth conversions, timing is everything as the lower your taxable income is, the less taxes you will need to pay.

Further Considerations

While no one can predict what tax laws will be in the future, it is almost certain they will be higher than they are today. This is partially due to the predetermined finite period of the Tax Cuts and Jobs Act and the fact that taxes are set to revert to their higher levels in 2026 as they were before the TCJA was enacted in 2018. Knowing that taxes are most likely lower now than they will be in the future provides significant incentive for investors to analyze Roth conversions sooner rather than later. Furthermore, given the last 18 months and the amount of resources the Federal Government has deployed to lessen the impact of the Covid-19 pandemic, it’s safe to assume taxes will go up even further to help offset the cost of stimulus programs that were enacted. Lastly, two very important points to remember: <ulclass="news">- Conversions cannot be undone. If you are unsure about the amount you should convert, check with qualified financial or tax advisor before completing the conversion.

- There is a 5-year window that applies for each separate conversion before you can take a qualified withdrawal. Withdrawals prior to this time frame are subject to a 10% early withdrawal penalty.

With the proper analysis, Roth conversions can be an integral part of your retirement plan. We are here to help! Please contact us if you have any questions on whether a Roth conversion is right for you.

With the proper analysis, Roth conversions can be an integral part of your retirement plan. We are here to help! Please contact us if you have any questions on whether a Roth conversion is right for you.

How Much Should I Contribute to My 401(k)?

[et_pb_section fb_built="1" _builder_version="4.16" global_colors_info="{}"][et_pb_row _builder_version="4.16" background_size="initial" background_position="top_left" background_repeat="repeat" global_colors_info="{}"][et_pb_column type="4_4" _builder_version="4.16" custom_padding="|||" global_colors_info="{}" custom_padding__hover="|||"][et_pb_text _builder_version="4.27.4" background_size="initial" background_position="top_left" background_repeat="repeat" hover_enabled="0" global_colors_info="{}" sticky_enabled="0"]Many employers offer retirement savings accounts, and 401(k) contribution planning is a popular topic among our clients. Have you ever asked yourself any of the following questions?

- How much should I contribute?

- How much does the match matter?

- How much do I need to put in each pay period to ensure the retirement of my dreams?!?

A 401(k) can be a great option for retirement savings, but it is not the only option. There are several ways to build a long-term financial plan for success and achieve those important retirement goals. Read on for an exploration of saving options and how they work together for your best benefit.

How much can I contribute?

A 401(k) is an employer sponsored retirement plan where an employee can make contributions up to certain limitations, and the employer can also make contributions up to certain limitations. Under current law, the employee can put $19,500 per year into a 401(k) plan. Some 401(k) plans allow only pretax contributions where others also allow Roth contributions. Regardless of whether you contribute to the pre-tax or Roth portions of your plan, the employee can only contribute $19,500 per year. If the employee is 50 years old or older, they can contribute an additional $6,500 as a “catch-up” contribution. The employer can elect to match your contributions, or they can share profits occasionally directly into the plan.

How much should I contribute?

Great question! And the answer lies in knowing your specific retirement goals. As a baseline, it often makes sense to maximize the employer match by putting enough into the 401(k) so that you will get the full amount that the employer is offering as a match into the plan. For example, your employer says they will match up to 3%. It’s a great practice to contribute at least 3% so you can get that full match, commonly referred to as “free money”. Who doesn’t want some free money?

Once you have maximized your employer match, you may want to contribute more to the 401(k) plan, but first, consider the following in light of your own circumstances.

If you have a high income, you may want to put more into the pretax portion of your 401(k), because you get a dollar-for-dollar deduction on your tax return for contributions to pretax 401(k) plans. There is no income limitation on this deduction, making it an important one for high income folks to consider in reducing their overall annual tax liability.

You may be surprised to find out that you are unable to contribute to a Roth IRA. Roth IRAs have contribution limitations based on income. A single taxpayer cannot contribute to a Roth if their adjusted gross income was above $161,000 in 2024. . A married couple filing jointly cannot contribute to a Roth if their income was above $240,000 in 2024. If you fit into this category, you may want to see if your 401(k) allows for Roth contributions. This is a way that you can still contribute to a Roth retirement plan if you are over the income limits to contribute to a Roth IRA. The income limitations do not apply to 401(k) plans, even the Roth portion of the 401(k). This could be another reason you contribute more to your 401(k) plan than what is needed to maximize the company match.

Where else can I save?

Although commonly thought so, 401(k) plans are not the only way to save for retirement! There are several types of accounts for you to utilize. These accounts can have beneficial liquidity options as well as better tax rates. Diversity can be a key component of your overall portfolio – more on that in a minute!

The most popular alternative options to a 401(k) plan are non-qualified brokerage accounts, a Roth or traditional IRA, life insurance, and real estate investments. Let’s examine the advantages and disadvantages of each option.

Non-qualified Brokerage Account

A non-qualified brokerage account is a fancy name for a regular old investment account that is not a retirement account of some sort. Think of this account just like your savings account at your bank although you can purchase securities inside of it like mutual funds, stocks, bonds, or exchange traded funds. These accounts are unique from a tax perspective because they are subject to capital gains tax as opposed to income tax. Generally speaking, gains in a non-qualified brokerage account are taxed at long-term capital gains rates if you’ve held the security for more than one year before realizing the gain. Currently, for most people, capital gains rates are 15% when long-term. This rate is often lower than one's income tax rate providing an advantage from a tax perspective. In addition, non-qualified brokerage accounts are liquid, meaning that you can put money into them and remove money without any age restrictions. This differs from most retirement plans which have penalties for accessing funds prior to age 59 1/2. So having a non-qualified brokerage account as part of your long-term plan makes sense from a tax and liquidity perspective.

IRAs

Both Roth and traditional IRAs can be useful as well. Depending on your income and whether you have a retirement plan through work that you are participating in, you might find some tax benefit in using a Roth or traditional IRA. Check with your tax pro to make sure you are under the deduction limits specific to your filing status. If you are, your traditional IRA contributions are deductible on your tax return. Hooray for instant tax savings!

You can also contribute to a Roth IRA, if you are beneath the income limitations discussed earlier. While there is no deduction for a contribution to a Roth IRA, the gains in a Roth IRA become 100% tax free after age 59 1/2 if the IRA has been in existence for more than five years.

Life Insurance

You can use cash value life insurance as a portion of your long-term plan. Cash value life insurance involves an insurance component and a cash value account component. Cash value life insurance can be complex, and a thorough analysis of whether implementing it makes sense should be done for each individual situation. However, broadly, life insurance can provide for a tax-free bucket of money prior to age 59 1/2 if done correctly. Life insurance distributions are principle first, making it very unique in the investment world. Most investments require gains to come out in some form or fashion when you take a withdrawal. This is not the case in life insurance. Your contribution amount can come back to you first and tax free. This can make using cash value life insurance an attractive option for college planning or any other large expense that you plan to have in ages 40 to 60. This type of planning generally works best when you establish the cash value insurance at a younger age, around 30 to age 40, and build the life insurance cash value over 15 to 20 years. It takes time to realize the strategy, but it can be a good one for young families planning for funding college expenses after they have had a couple of kids.

Cash value life insurance can also be a useful tool for high net worth individuals who may be subject to estate tax at the end of their lives. While this is difficult to plan for because estate tax law changes frequently, life insurance death benefits are generally tax free. This means that an irrevocable life insurance trust could be established and the life insurance of a high net worth individuals placed inside the trust. As placing the life insurance inside of your irrevocable trust removes that life insurance policy from the estate, these proceeds will not generate additional estate tax but can be used instead to cover the estate tax of other parts of a high net worth individual’s portfolio.

Real Estate

Real estate can be a useful place to put savings if one is comfortable with the concept. You can access real estate investments through exchange traded securities or you can buy actual real estate on your own. Either way, exposure to the real estate market in the United States is generally a good idea for long-term investors. Perhaps the most popular way of doing this is through purchasing a rental property. A rental property can be an amazing wealth creator because you can purchase a property using a loan, and you pay off the loan with the rental income. Essentially you can purchase a property with a 20% down payment and have that loan paid off for you by somebody else. The kicker is that you get to keep all of the equity proceeds as the loan is getting paid off. So, not only do you get the appreciation of the real estate over time, but you also get the equity increase as the principle of the mortgage is paid off by someone else. Here is an example of how this might work.

Let’s say you purchase a rental property for $400,000 in July of 2021. You put 20% down, and get a 3% interest rate on your 30-year loan. With property taxes, insurance, and HOA, your total payment is about $1,850 a month. For the location of this property and the amenities offered, you determine you can charge $2,500 per month for rent. This allows you to cover your monthly payment with $650 left over! Now let’s say that by 2035, the value of this property has doubled. In 14 years, you would have around $626,600 in equity without ever covering your mortgage on your own, assuming you never took the equity out or refinanced your loan.

How do I decide how much to put in all these areas?

This is a complex question and one that is dependent on your financial circumstances and retirement goals. Every financial plan is different – and that is why financial planning exists! If it were easy, everyone would do it.

Do you want to retire at age 50? If so, you may want to have a large amount of your savings going towards nonqualified brokerage accounts for liquidity purposes.

Do you want to have a retirement based on stable income? If so, you might want to consider investing in real estate and focus on paying down the mortgages of the rental properties you purchase. This way, once the mortgages are paid off, the rental income that comes to you is generally usable as a passive living income.

Are you worried the taxes will be higher in the future? If so, you probably want to overweight your contributions to Roth IRA’s or Roth 401(k)s. Even though this forces you to not take tax deductions in the year that you make those contributions to a Roth, you will have a large amount of tax-free money in the future, and if taxes are higher, you will not be impacted.

Are these questions giving you a headache? Don't worry. We are here for you. 5280 Associates engages with you to answer all these questions and so many more – all for one flat fee. Perhaps you want to continue managing your money on your own, but need guidance in doing so? We specialize in providing our clients high-quality, custom, long-term financial plans, regardless of whether we are managing the money.

So... how much do you need to save for retirement and where should those savings be?

We can’t tell you until we know you. Come on in!

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]

Should I Refinance My Mortgage? 6 Questions to Ask Yourself

One of the only great things to come out of 2020 is the opportunity to refinance debt, particularly your mortgage, for a lower interest rate. There are many considerations in refinancing a mortgage but the most discussed is the interest rate. If you are able to exchange a higher interest loan for a lower interest loan, you may save tens of thousands of dollars in the long run. Below are some questions you should consider before picking up the phone and calling your lender. Some of the insights in this article were provided by a friend of 5280 Associates, Heather Hoadley, Senior Mortgage Loan Officer.

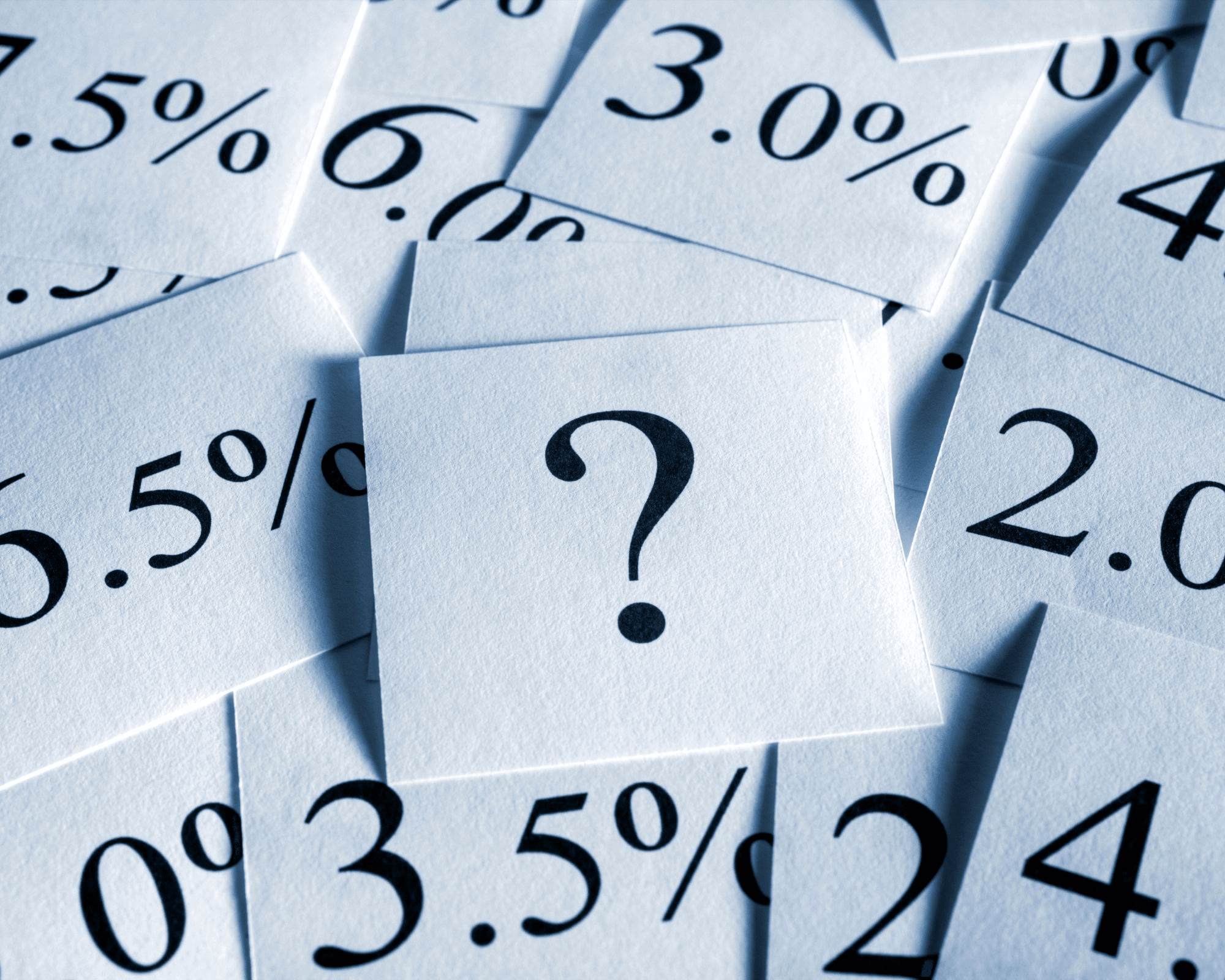

What is my interest rate?

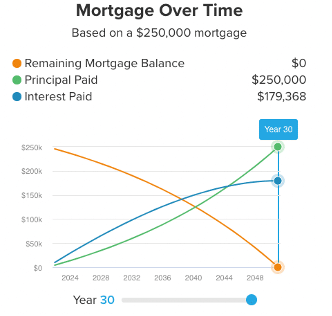

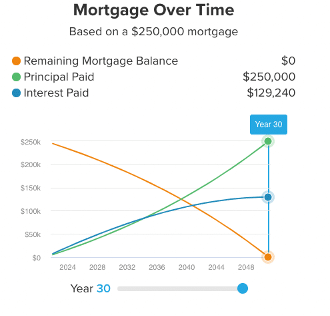

We are in a very low interest rate market, historically speaking. One of the fall outs of the Coronavirus pandemic was the federal reserve taking swift action to decrease the federal funds rate to 0% in order to provide easy access to capital for a struggling economy. This can mean that mortgage rates decrease as well. If your interest rate is in the 4% or even high 3% range (as of the writing of this article), you may be able to refinance and save a lot of interest in the next 30 years. See the charts below. The borrower in the 4% mortgage (left chart) would pay $179,368 in interest vs. the borrower in the 3% mortgage (right chart) would pay only $129,240 in interest, a $50,128 difference in interest!

What is my term?

The term of a mortgage is the length of time it takes to pay the mortgage off if you pay the minimum payment. Most mortgages allow you to make additional payments to the principal of the loan, which would shorten the term and pay the loan of faster. If you have a 30 year mortgage and you are still in the early years of the loan, it may make sense to refinance for another 30 year term if the savings on the interest rate is considerable. You can also refinance to a shorter term loan, like 20 or 15 years. Since the time period is shorter, you will likely have an increase in payment, but the loan will be completed sooner. Shorter term loans generally have a lower interest rate than a longer term loan.What does it cost to refinance?

It typically costs around $2,500-$3,200 to close a mortgage. These costs can be more or less depending on the amount of the loan. This would include a few things you must pay for, like an appraisal of your home. If you are refinancing for a lower interest rate, it may make sense to ask the lender to roll these costs into the new loan so you are not having to pay out of pocket.