Our Take on Inflation: Where It’s Been, Where It’s Going, and How You Can Hedge Your Portfolio Against It

Monday, Sep 13, 2021

The COVID-19 pandemic was a completely unprecedented event that left our economy at a near-standstill in 2020, causing downward pressure on pricing in many different industries. Now, the economy is beginning to heat back up creating new demands for goods and services that haven’t seen much attention for over a year. Such demand leads to one question: What does the turn of our economy mean for inflation? In this article, we will cover the potential causes for inflation, what this year has shown thus far, what we expect for inflation looking forward, and what you can do to hedge your portfolio.

What Causes Inflation?

In economics, there are two main schools of thought regarding inflation: Monetarists, followers of Milton Friedman, who believe that inflation is a monetary phenomenon where “too many dollars chase too few goods,” and Keynesians, who believe that inflation occurs when an economy overheats and production can’t keep up with demand, generally because employers can’t find any new employees, and consumers thus bid up prices. This phenomenon is referred to as “demand-pull inflation.” Really, neither of these schools of thought adequately account for inflation all on their own. We have had periods where high deficits and loose money accompany low inflation, and we have had strong economic growth and low unemployment also accompany low inflation. Inflation then, can be a product of a number of different economic factors.

The economic recession at the start of the pandemic last year certainly set the stage for 2021. Things like travel, entertainment, and transportation quickly lost demand in the wake of COVID-19, but those things are coming back. According to Helios Quantitative Research, May of last year was the last month that overall pricing was in decline. Since then, prices for goods have continued to elevate. In fact, they are coming back at a such a high rate that companies cannot handle the demand. Let’s take a look at rental car companies. In order to stay afloat during 2020 as demand decreased, many rental car companies sold off much of their fleets as they were uncertain when demand would pick back up. As you likely know now, the landscape has changed and the need for rental cars has come back faster than those companies anticipated. Have you tried renting a car recently? If not, count yourself lucky as it is a difficult and expensive process to go through. However, with 2020 in the rearview mirror, and the pandemic hopefully ending soon, we are likely to see improvements in this area soon.

In addition to increased prices for goods, Americans used to spend around 69% of their overall spending on services pre-pandemic. That number has declined down to 64% as of today, according to a study performed by Helios Quantitative Research. Services can expand with changes in demand much easier than goods. Consider a bus tour through Denver. If the tour company is doing well, they may consider adding additional tour times before adding a new bus to the fleet. By adding additional tour times, they can use the same bus with the same staff- just for longer. Understandably, the cost of doing this would be paying the employees additional compensation for more hours worked as well as added costs for gas and maintenance of the bus. However, in a perfect world, the additional income from filling seats on a new tour would likely make up for those additional costs. Let’s flip the page and consider a company that makes gym equipment now. If the demand for gym equipment rises and employees are already at full capacity, the company cannot simply add hours for their employees to make new gym equipment. They also must obtain more parts and materials and coordinate with forces up the supply chain to make more equipment. This is possible, but more difficult than the tour company adding on an additional tour- especially if the supply chain for gym equipment is facing bottlenecks.

How does such a slight decrease in demand for services over goods affect inflation? Consider how home gym equipment prices spiked dramatically over the last year. Disruptions to the gym equipment supply chain caused by COVID-19 are making it more difficult for companies to get the resources they need in time to make the amount of goods demanded. Low supply mixed with high demand is the recipe for inflated prices.

Another factor to consider is the government stimulus program we saw during the pandemic. We have never seen the government move so quickly with fiscal response to economic decline as we did last year. According to Helios Quantitative Research, the Global Financial Crisis of 2008 added $4.8 trillion to the US national debt over the course of 3 years. Since the pandemic, we have seen a rise of $4.9 trillion in just a little over a year. We have not seen this kind of fiscal response since World War II. This means there is more money in circulation than there ever has been before.

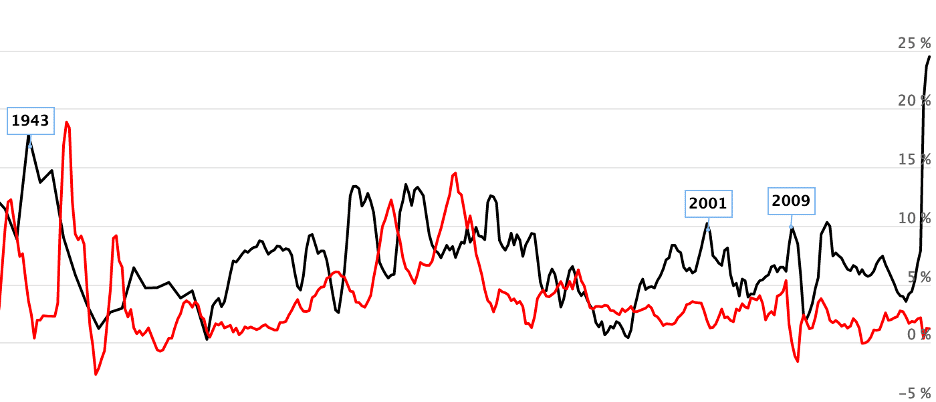

What does that mean for inflation? It may be surprising, but the relationship between money supply and inflation is not quite as correlated as one might think. Check out the chart below from Longtermtrends.net. The black line represents the amount of money in circulation, while the red line represents inflation.

While inflation does follow money supply to a degree, you can see that the correlation is not exact, especially in 1943, 2001, and 2009. Why could this be? The simple answer is that printing money only causes inflation if it is done too quickly and supply is limited. If money is spent on extra goods and services that are readily available, the price of those good and services theoretically should not rise. However, if money is printed with not enough supply of goods to spend it on, prices on those goods will likely rise- causing inflation. Printing money creates inflation when the money printed causes demand for goods and services which do not have the supply to meet a change in demand.

2021 So Far

Following the US Inflation Calculator, inflation was fairly moderate early in the year, with January and February following the same trends as the second half of 2020 with rates at about 1.4-1.7% over the previous year. Rates spiked to 2.6% in March, then really started gaining momentum in April as inflation rates surged over 4%.

In both June and July of this year, inflation rates were nearly 5.4% higher over last year. In June, inflation was accelerating at a rapid rate – faster than we have seen in 13 years. Prices went up the most for travel items, such as auto (as mentioned with rental cars above) and airline tickets.

Right now in our economy, we are not at full employment and a number of bottlenecks have popped up in our supply chain due to Covid. Along with this, the Federal Reserve has had a fairly loose money supply, along with generous fiscal policy, and the impact has been an increase in our overall inflation rate. While the increase in prices is apparent to everyone, what is not so apparent, is how long the current inflation will last. Some believe that price level increases will moderate as we come out of Covid and production increases, some believe that inflation will take longer to wring out of the economy, due to our monetary and fiscal policy.

When Does the Fed Step In?

How long this inflationary period lasts is largely up to the Federal Reserve. They can tighten the Money Supply, increase interest rates, and reign in prices. This, however, comes at the cost of economic growth. Thus far, while there has been mounting pressure to scale back or reverse stimulus, they have seemed reluctant to do so.

How does this work? The Federal Reserve can influence the availability as well as the cost of credit. They can also change the federal funds rate, or the rate that banks pay to borrow money from the federal funds market. By raising this rate, banks in turn raise their own interest rates on borrowed money, raising the interest rates for loans on houses, businesses, and other items. When interest rates go down, it is less costly to borrow money. Therefore, households are more willing buy goods and services and businesses are more willing to expand. When interest rates go up, the opposite takes effect, and the demand for goods and services decreases.

On July 28th, Federal Reserve officials did give an update on how they are keeping US inflation in check. Chairman Jerome Powell claimed at that time that the economy is not quite close enough to the “substantial further progress” that they hope to see towards stable prices and employment.

Looking Forward

It is uncertain exactly what will happen with inflation as the economy continues its recovery, however we do anticipate higher levels of inflation for the foreseeable future due to bottlenecks in supply chains, pent-up demand for goods and services, and the fed delaying action to step in. Of course, there are plenty of scenarios that could change this. The truth of the matter is that it is very difficult to create an outlook on inflation given the uncertainty in our world. For now, it is safe to say that inflation will continue into 2022.

How to Hedge Your Portfolio

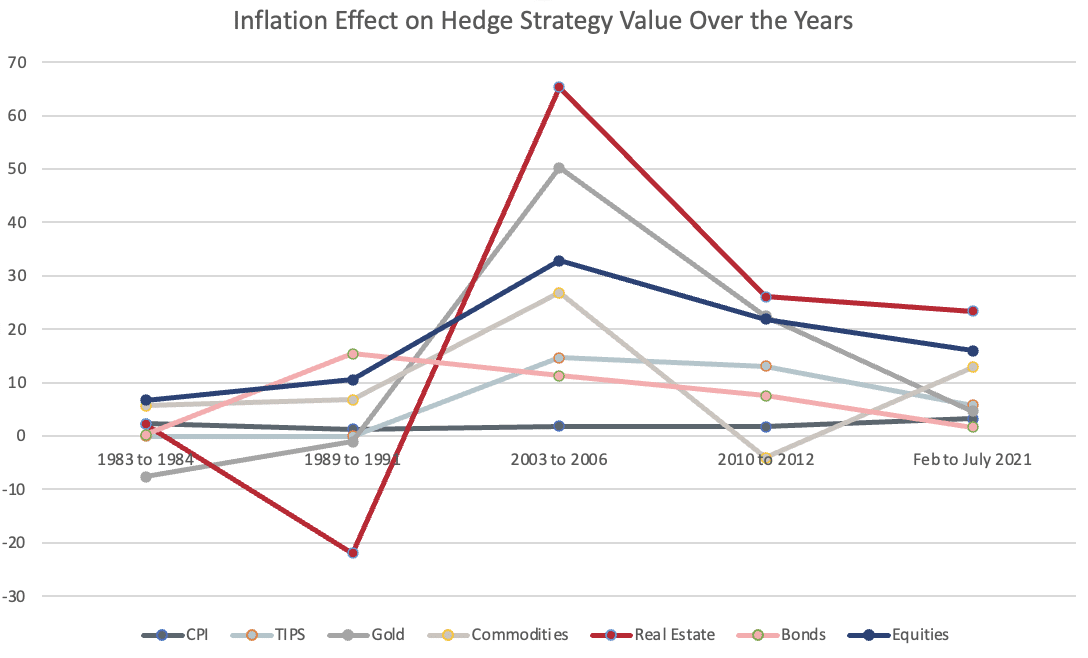

Truly hedging a portfolio against inflation in a matter that works and is both consistent and reliable is difficult to do. There are many potential strategies to combat inflation in your portfolio but the reality is they come with a high opportunity cost. You may consider adding investments such as commodities, gold, real estate, and Treasury Inflation Protected Securities into your portfolio, but make sure to keep diversification top of mind as completely redirecting your portfolio to such investments may not be wise. Timing is also important, if you do not time the change perfectly, you may not see the returns you are hoping for.

Take a look at the case study below performed by Helios Quantitative Research in regards to adding these types of investments into your portfolio as a hedge against inflation. As you can see, the value of each of these assets does not follow inflation, and there is no real pattern to any of them. In fact, even though inflation was up in each of the years shown, some of the assets even lost their value. This goes to show that predictions around these strategies are difficult! The best way to hedge inflation without worrying about timing is to stay invested and keep your portfolio diversified.

At 5280 Associates, we take a measured view of this matter. We have recently updated our investment models in response to growing inflation concerns. Our advisors will continue to monitor the situation and make adjustments to our clients’ portfolios as the situation warrants.

Additional ways to combat inflation include paying off variable debt. As inflation goes up, so do interest rates. As interest rates go up, the more you owe! Now is a wonderful time to consider refinancing any adjustable-rate loans into loans with a fixed-rate. Other considerations are to prepay for an item, buy items in bulk, or seek cheaper alternatives. If you expect your washer to kick the bucket soon, now may be the time to shop around for a replacement. Build inflation into your overall financial plan as well. Prices will most certainly look different once your children begin college or you reach retirement age!

In conclusion, we are facing high inflation rates in the US currently and it is likely to remain that way into 2022. Bottlenecks in supply chains from COVID-19 and an increase in spending on goods over services is likely to drive prices for goods higher. Take inflation into consideration when reviewing your financial plan and portfolio. Not sure where to start? Our advisors are happy to help!