Should I Refinance My Mortgage? 6 Questions to Ask Yourself

Tuesday, Mar 09, 2021

One of the only great things to come out of 2020 is the opportunity to refinance debt, particularly your mortgage, for a lower interest rate. There are many considerations in refinancing a mortgage but the most discussed is the interest rate. If you are able to exchange a higher interest loan for a lower interest loan, you may save tens of thousands of dollars in the long run. Below are some questions you should consider before picking up the phone and calling your lender. Some of the insights in this article were provided by a friend of 5280 Associates, Heather Hoadley, Senior Mortgage Loan Officer.

What is my interest rate?

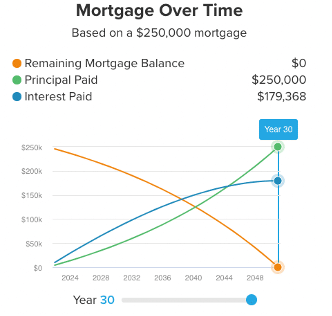

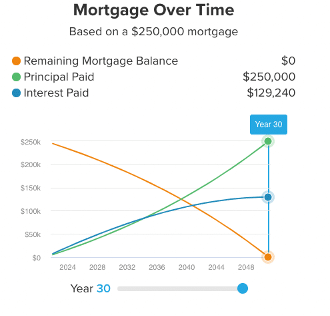

We are in a very low interest rate market, historically speaking. One of the fall outs of the Coronavirus pandemic was the federal reserve taking swift action to decrease the federal funds rate to 0% in order to provide easy access to capital for a struggling economy. This can mean that mortgage rates decrease as well. If your interest rate is in the 4% or even high 3% range (as of the writing of this article), you may be able to refinance and save a lot of interest in the next 30 years. See the charts below. The borrower in the 4% mortgage (left chart) would pay $179,368 in interest vs. the borrower in the 3% mortgage (right chart) would pay only $129,240 in interest, a $50,128 difference in interest!

What is my term?

The term of a mortgage is the length of time it takes to pay the mortgage off if you pay the minimum payment. Most mortgages allow you to make additional payments to the principal of the loan, which would shorten the term and pay the loan of faster. If you have a 30 year mortgage and you are still in the early years of the loan, it may make sense to refinance for another 30 year term if the savings on the interest rate is considerable. You can also refinance to a shorter term loan, like 20 or 15 years. Since the time period is shorter, you will likely have an increase in payment, but the loan will be completed sooner. Shorter term loans generally have a lower interest rate than a longer term loan.

What does it cost to refinance?

It typically costs around $2,500-$3,200 to close a mortgage. These costs can be more or less depending on the amount of the loan. This would include a few things you must pay for, like an appraisal of your home. If you are refinancing for a lower interest rate, it may make sense to ask the lender to roll these costs into the new loan so you are not having to pay out of pocket.

What is the immediate benefit of refinancing?

In today’s market it is common to refinance for a lower interest rate. This typically will lower your monthly payment, sometimes significantly. For example, if you have a $250,000 mortgage at 4% for 30 years, your principal and interest payment would be about $1,194/mo. If you were able to refinance your mortgage for $250,000 at 3% for 30 years your principal and interest payment would decrease to $1,054. This monthly savings of $140 could be applied to another part of the financial plan like additional savings, debt reduction, or spending. If the mortgage costs and fees were $2,500 total, the monthly savings of $140 would recoup your costs in 18 months.

What are other considerations?

If you plan to move from the house prior to breaking even on the cost of the mortgage, it may not be a good idea to refinance unless you plan to keep and rent the property.

Refinancing can be difficult if your financial situation is complex. It requires gathering many financial documents for the lender to get the loan approved.

The Colorado current “Jumbo Loan” amount is $548,250 in most counties. Loans above these amounts can be more difficult to qualify for and have different interest rates.

If you currently have to pay for mortgage insurance a refinance may allow you to remove this cost if your home has appreciated in value since you bought it.

What are other refinance strategies?

Cash out– you can refinance and take a loan amount higher than your current loan in order to get cash out of your home for use in other areas. For example, you may have credit card debt at 15% that you can use cash out of your new mortgage to pay off. If your mortgage rate was 4% you would then begin savings a considerable amount of interest as you pay off the 15% debt with 4% debt. In this example you may have a $250,000 mortgage and $25,000 credit card debt. You would take out a new $275,000 mortgage to pay off the old $250,000 mortgage and use the remaining $25,000 to pay off the credit card. Of course, your home must be worth at least $344,000 in order to do this as the maximum loan to value ratio is usually 80% if you want to avoid paying mortgage insurance. Other factors also apply.

Shortened term– If you can afford a higher payment and want to decrease your interest rate, you may consider shortening the loan term. Many retirees or pre-retirees want to get their home paid off quickly and are willing to pay a higher monthly amount to do so. By shortening the term, you will also see a lower interest rate. Note, however, that most mortgages will allow you to pay more toward principal which effectively shortens the term. So, you may be able to pay down the loan quickly without having to refinance to a shorter term.

Reviewing your current mortgage for a refinance opportunity is a good idea in today’s interest rate environment. With a little work gathering your financial documents you may save tens of thousands of dollars over the life of your refinanced loan.