Financial Planning

Effective financial planning is the process of creating a roadmap to help you reach your financial objectives through proper management of your resources. Our team of experienced wealth managers works with you to understand your unique financial situation, assess your current assets and liabilities, and develop a customized plan to help you achieve your financial goals. We provide ongoing personalized financial advice and guidance, tailored to your specific needs, to help you navigate the complex world of investing and money management and keep your financial management plans on track.

5280 ASSOCIATES FINANCIAL PLANNING

After agreeing on the scope of the financial planning, 5280 Associates team members work with you to collect all relevant information and documents. Modeling software is used to analyze the many possible paths forward. Findings are presented to you, complete with recommendations and action steps. The implementation of these action steps is also assisted by the team. After the initial assessment, 5280 Associates wealth advisors provide ongoing advice, ensuring that your financial management plan keeps pace with your life as it unfolds.

Topics Covered in Financial Planning

General Financial Planning

- Update and prioritize goals

- Update account values

- Establish fundamental goals

- Account consolidation

- Family updates and changes

- 3rd party referrals (CPA, mortgage, etc.)

- Business ownership changes

- Credit report analysis

- Large purchase decision making

- Real estate review

- Debt refinance check

- College Planning

Investment Planning

- Semi-annual review and rebalance

- Performance review

- Fee check

- External account analysis

- Employer retirement plan allocation review

- Stock Option Review

Cash Flow Planning

- Debt management (payoff analysis and tracking)

- Budget and expense review

- Cash flow analysis

- Tax and liquidity planning

- Net worth review

Retirement Tracking and Planning

- Future projections

- Savings amount

- Money Guide Pro

- Monte Carlo analysis

- Retirement income creative strategy

- Social security planning

- Rental property income review

- Required distribution withdrawals

- Required distribution planning

Insurance Analysis

- Basic risk analysis

- Life insurance review

- Disability insurance review

- Long-term care insurance review

- Employer benefits review

- Property and casualty insurance review

- Umbrella insurance review

- Health insurance review

- Real estate rental insurance

- Medicare/Medicaid advice

Charitable Planning

- Charitable giving tax strategies

- Donor-advised funds

- Charitable remainder trusts

- Charitable lead trusts

- Qualified charitable distributions

- Charitable giving strategies

- Donating appreciated assets

- Foundation formation

Tax Analysis

- General change in tax situation

- Health savings account option

- Employer plan contribution changes

- Roth conversions

- Roth contribution limit check

- Qualified charitable donations

- Planned giving (charitable) analysis

- Tax loss harvesting

- Appreciated asset charitable donations

Estate Analysis

- Beneficiary review of all accounts

- Ownership review of all accounts

- Tax efficient wealth transfer review

- Estate law change discussion

- Trust review

- Health directive review

- Power of attorney review

Process

The 5280 Associates financial planning process begins with an initial analysis. Then, we keep your financial plan on track with regular, ongoing meetings.

Initial Analysis

Introduction

Meet and Greet

Proposal And Agreement

Agree on services and fees

Gather Data

Statement and info collection

Strategy Call

Specific questions after document review

Analysis

Expert examination of your plan

Presentation

Your initial findings and recommendations

Initial Implementation

Put initial recommendations in place with our assistance*

Ongoing Advice

We meet every six months to keep you on track

Understanding Your Initial Financial Analysis

At 5280 Associates, we aim to be transparent, and we want you to be well-informed and involved in your financial journey. That’s why we provide a comprehensive analysis and present it to you in a detailed, personalized report. We design the report to give you a thorough understanding of your financial standing and a clear path toward achieving your financial goals. With this valuable tool, you’ll gain the knowledge and insight needed to confidently plan for tomorrow.

What's Included in Your Write-up?

- Current State: This section provides a snapshot of your current financial situation, including your assets, liabilities, income, and expenses.

- Desired State: This section outlines your financial goals and objectives.

- Observations: This section provides our analysis of your financial situation and identifies any potential areas of concern.

- Recommendations: This section provides specific recommendations for how you can improve your financial situation and achieve your financial goals.

Benefit From Ongoing Financial Planning Advice

Financial planning isn’t a one-time event—it’s an ongoing process. The world changes, priorities shift, and life events happen. It’s important for your wealth management strategy to keep up. At 5280 Associates, we ensure that your financial planning stays on track by offering ongoing advice, biannual meetings, and clear documentation.

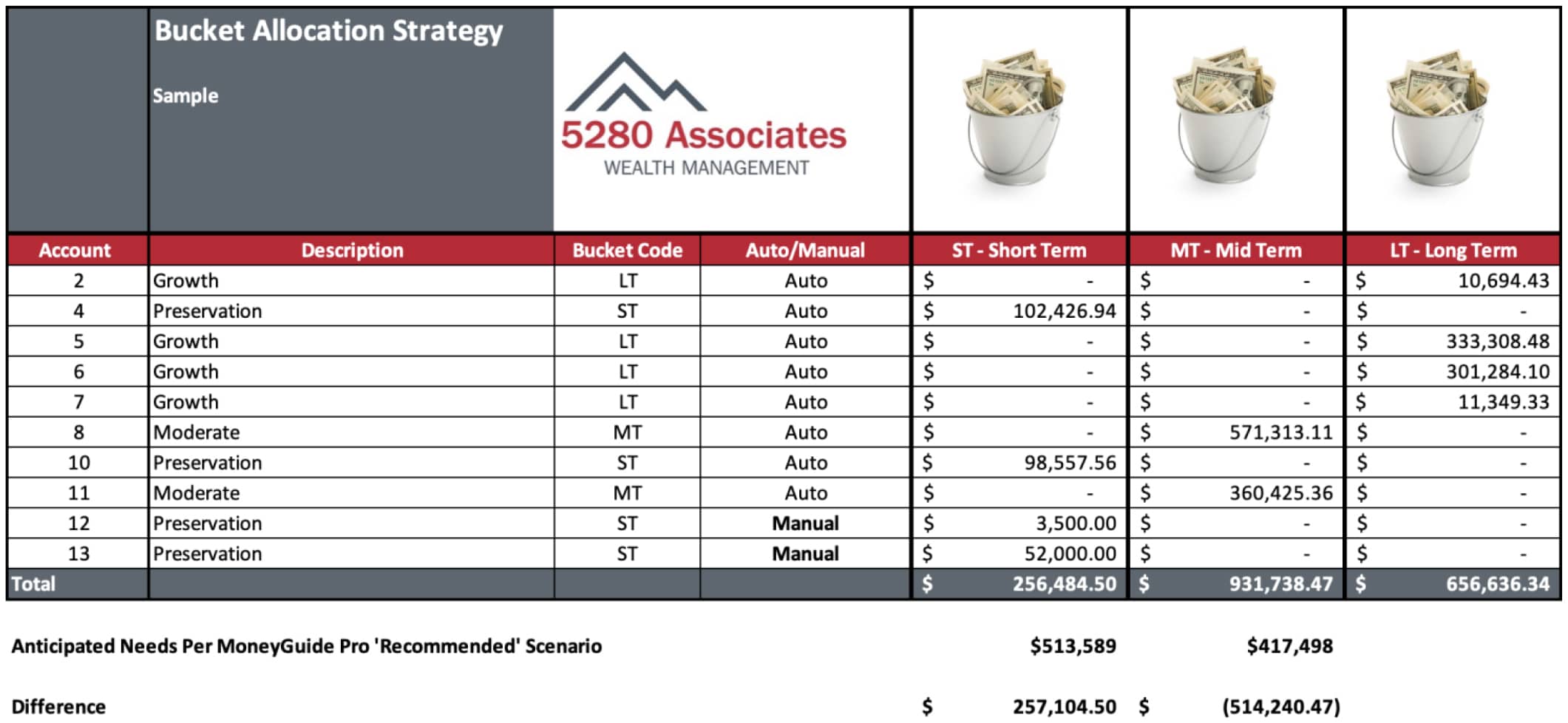

Biannual Meetings

Each year, we meet with clients twice—once in the Spring and again in the Fall—to review their financial plan, discuss market changes, and adjust strategies as needed. After each meeting, we provide:

- Bucket Allocation Summary: A detailed breakdown of how your assets are structured for short-, mid-, and long-term goals.

- Meeting Summary: A comprehensive document covering key discussion points, portfolio strategy, and next steps.

Your Bucket Allocation Summary

We use a Bucket Allocation Summary to help you visualize your financial strategy. This structured approach categorizes your assets into three time-based buckets:

- Short-Term (ST): Funds needed in the near future for expenses and liquidity.

- Mid-Term (MT): Investments designated for medium-range goals.

- Long-Term (LT): Assets allocated for long-term growth and retirement planning.

Below is an example of a Bucket Allocation Summary, which provides a clear snapshot of how your wealth is allocated:

Your Meeting Summary

To keep you informed and involved in your financial journey, we provide a comprehensive Meeting Summary after each biannual meeting. This document serves as a valuable reference point, capturing key insights and action items. Here’s what you can expect:

A Clear Overview of Your Portfolio Strategy

We detail your current portfolio allocation, including the rationale behind our recommendations and how they align with your risk tolerance and financial goals.

Transparency in Investment Advisory Services

We outline the services we provide, our investment philosophy, and any relevant disclosures to ensure you have a complete understanding of our approach.

Key Takeaways and Actionable Steps

We summarize the main discussion points from our meeting, highlight any agreed-upon changes to your strategy, and outline the next steps for both you and our team.

A Record of Your Financial Journey

This document becomes a valuable part of your financial history, allowing you to track progress, review past decisions, and see the evolution of your financial plan over time.

Pricing

The cost to create and maintain your financial plan depends on the level of complexity you need and the scope of ongoing advice as your circumstances and goals evolve. In every case, however, the fee is flat, transparent, and agreed upon at the onset. You’ll pay an annual flat fee for a 12-month agreement that you are able to renew yearly or cancel. This includes your initial analysis, automated meetings to keep you on track, access to our entire team and their diverse backgrounds, skill sets and specialties, maintaining your plan, and any advice you need. The minimum annual fee for Financial Planning starts at $5,000 for new clients.