PROACTIVE TAX PLANNING

Tax planning isn’t just about looking backward. Proactive strategies help you stay ahead of evolving regulations, minimize tax liabilities, and maximize financial opportunities. Whether you’re a CPA, an estate planning attorney, or a client looking to improve your tax situation, proactive tax planning is a valuable tool. At 5280 Associates, we understand that proactive tax planning is key to long-term financial success. We offer specialized strategies that go beyond traditional tax preparation to help you achieve your goals.

5280 ASSOCIATES PROACTIVE TAX PLANNING SERVICES

Tax planning is more than numbers—it’s about strategy, foresight, and understanding how financial decisions today can shape tomorrow. At 5280 Associates, we specialize in proactive tax planning to equip our clients with the tools and strategies they need to achieve their financial goals and maximize their opportunities.

We dig deeper to develop strategies that harmonize with your broader financial goals. Whether it’s optimizing retirement income, reducing taxable investment gains, or planning for healthcare costs, our personalized services are designed to deliver measurable value and long-term peace of mind.

Proactive Tax Planning Strategies

Roth IRA Conversions

Transition traditional IRAs to Roth IRAs strategically to better manage tax liabilities and create tax-free retirement income.

Investment Income Optimization

Incorporate tax-efficient investment strategies to reduce exposure to the Net Investment Income Tax (NIIT) and maximize after-tax returns.

Medicare Premium Planning

Proactively manage your Modified Adjusted Gross Income (MAGI) to avoid Medicare surcharges and control Part B and D premiums.

Social Security Taxation Strategies

Reduce the taxable portion of Social Security benefits with smart income and withdrawal strategies to retain more of your retirement income.

Colorado-Specific Tax Opportunities

Take advantage of unique state benefits, such as retirement income exclusions, property tax exemptions, and charitable contribution subtractions.

Capital Gains Planning

Strategically manage short- and long-term capital gains to align with your financial goals while minimizing tax obligations.

Charitable Giving Strategies

Incorporate charitable planning strategies like Qualified Charitable Distributions (QCDs) and donor-advised funds to make a meaningful impact while optimizing tax benefits.

MAGI Phase-Out Management

Navigate income thresholds and phase-outs for key deductions, credits, and eligibility to maintain financial flexibility and maximize savings.

Unlocking the Benefits of Proactive Tax Planning

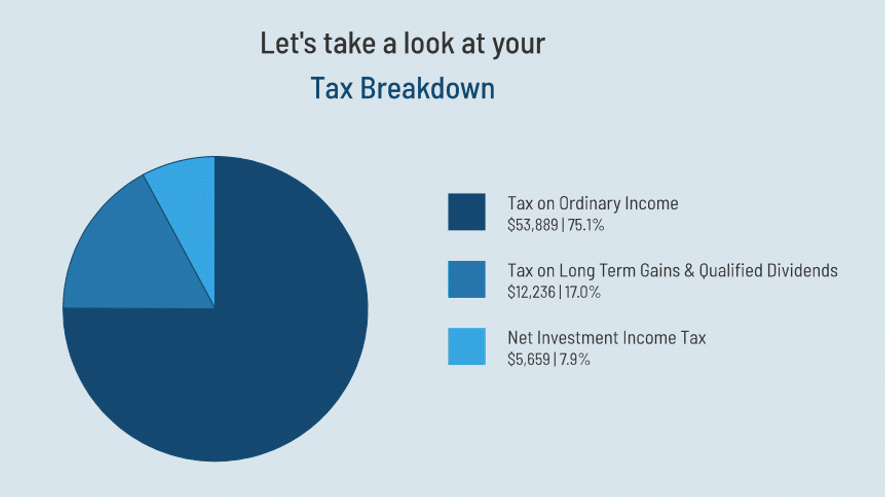

For many retirees in Colorado, proactive tax planning is a crucial part of their financial strategy. With so many moving parts—ranging from income to deductions and tax brackets—it can be challenging to ensure your strategy is as tax-efficient as possible. Take Brad and Jessica, a couple with an income of $398,918 and the goal of minimizing their tax burden while making the most of their retirement savings.

Financial Snapshot

- Total Income: $398,918

- Deductions: $33,200

- Taxable Income: $365,718

- Total Tax Due: $71,784

- Marginal Tax Bracket: 24%

- Average Tax Rate: 18%

Observations and Recommendations

Observations

- Brad and Jessica are just within the 24% federal marginal tax bracket and the fourth IRMAA surcharge bracket.

- Brad will become eligible to make Qualified Charitable Distributions (QCDs) in 2025.

- Colorado tax laws provide opportunities for maximizing retirement income exclusions and charitable deductions.

Recommendations

- Perform a $64,000 Roth conversion to maintain their current tax brackets while utilizing $24,000 from Jessica’s IRA to maximize the Colorado retirement income exclusion.

- Utilize QCDs starting in 2025 for all future charitable contributions to minimize taxable income.

- Optimize tax planning to fully leverage Colorado-specific deductions, including charitable contribution subtractions and retirement income exclusions.

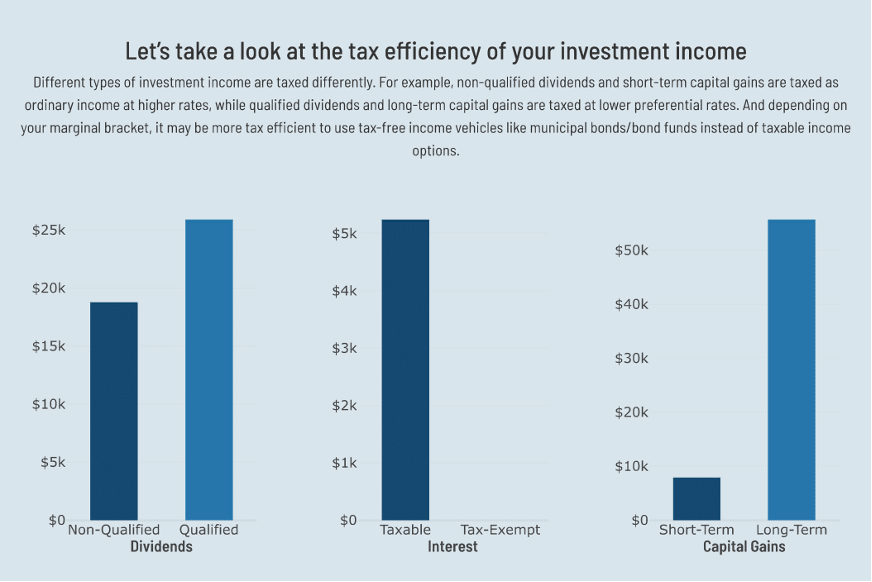

Tax Efficiency of Investment Income

Different types of investment income have varying tax implications. Understanding these differences is key to optimizing after-tax returns. By choosing tax-efficient income streams, Brad and Jessica reduced their taxable investment income and maximized their after-tax returns.

Proactive Planning for Better Outcomes

For Brad and Jessica, looking ahead made all the difference. By crafting a forward-looking tax plan, they minimized their tax burden, optimized retirement income, and took control of their financial future. Proactive planning isn’t just about avoiding surprises—it’s about creating opportunities. Let’s work together to uncover strategies that put you ahead of the curve.

Pricing

Integrating tax planning into your comprehensive financial strategy is essential, rather than treating it as a standalone service. Our financial planning service, detailed on our financial planning page, is tailored to the complexity of your needs and the ongoing advice you require as your circumstances and goals evolve.

Our fee structure is straightforward and transparent: you pay an annual flat fee for a 12-month agreement. This fee covers your initial analysis, automated meetings to keep you on track, access to our diverse team with various backgrounds, skill sets, and specialties, ongoing plan maintenance, and any required advice. The minimum annual flat fee for new clients starts at $5,000.

Proactive Tax Planning FAQs

What is proactive tax planning?

Proactive tax planning involves anticipating future tax liabilities and implementing strategies to minimize them, rather than merely reacting to past tax events.

What are the benefits of proactive tax planning?

Proactive tax planning can reduce taxable income, lower overall tax liabilities, and enhance financial outcomes by aligning tax strategy with long-term financial goals.

How will 5280 Associates work with my CPA?

We collaborate closely with your CPA, aligning our proactive tax strategies with their expertise to create a unified plan. This ensures your tax strategy is forward-thinking and seamlessly coordinated with your existing financial approach.

How does proactive tax planning differ from traditional tax planning?

Traditional tax planning often focuses on compliance and historical data. Proactive tax planning emphasizes forward-thinking strategies to optimize future tax outcomes.

How does this benefit my practice as a CPA or estate attorney?

Tax planning based solely on a client’s past decisions limits potential savings. With proactive tax planning, you’ll gain access to specialized strategies that help write your clients’ long-term financial narratives.

What types of clients benefit most from proactive tax planning?

Proactive tax planning benefits anyone with complex financial situations, including high earners, retirees, business owners, and individuals with significant investments or charitable goals.

When should I start implementing a proactive tax strategy?

The earlier, the better. By starting at the beginning of the tax year, you have the maximum time to adjust income and investments to align with your financial goals.