2021 – New Year, New Financial Resolutions

Many people see the turn of a year as an opportunity to set fresh goals and create new habits – especially around their personal financial situation. “I want to get my finances in order, save more, spend less, increase earnings, etc…” we’ve heard it all, but unfortunately for many of us, dedication to our New Year’s resolutions disappears after the first few weeks of January fly by. As you reflect on your goals for 2021, or maybe you still need to set them, see our recent blog post: Understand S.M.A.R.T. Goals and Basic Savings Strategies. Making meaningful change starts with an awareness of where you currently stand and a clearly defined path of where you want to be. Consider committing to the following financial resolutions to improve your overall financial health in 2021.

Commitment #1 - Better Cash Flow Management

Whether you’re fresh out of college or preparing for retirement, controlling your spending is paramount to achieving your goals and having a successful financial plan. What are you saving for? Do you want to retire early? Do you have a goal of being debt free? Effective budgeting and cash flow management is all about having a clear path forward and aligning your resources with your goals and values. It starts by simply understanding the numbers. Income – Expenses = Monthly Cash Flow. If there is money left over at the end of the month, you are living in a surplus. If not, you are living in a deficit. Your budget should be strict but also adaptable enough to ensure you are reaching your goals. Every month might look a bit different. For example, spending typically increases towards the end of the year around the holidays. Or maybe you have 3 kids whose birthdays all fall during the month of June. Regardless, there are many resources available to help manage your cash flow, whether you use online budgeting application like MINT, an excel spreadsheet, or simply just pen and paper, tracking and monitoring your spending on an ongoing basis will help shed light on potential pitfalls as well as opportunities. Simply paying attention, being diligent and tracking your spending consistently will help you make more purposeful decisions.

Commitment #2 – Establish Your Emergency Fund

2020 was a stark reminder that nothing is guaranteed and that we need to be prepared for anything that life could throw our way. Having a properly established emergency fund that is liquid and available at all times to help pay for unexpected expenses is an essential step to creating financial stability. A general rule of thumb is holding somewhere between 3-6 months’ worth of monthly expenses in this account. If you are single living on one income, you should lean towards the longer end of 6 months. If you are married living on dual incomes, having 3 or 4 months’ worth of expenses should be sufficient. Whether the furnace goes out, your car breaks down, or you are in between jobs for a few months, having this cash buffer will help protect you from relying on credit or having to sell volatile investments to squeeze by.

Commitment #3 – Focus on your future

You can borrow money to purchase a vehicle, borrow money to purchase a home but there’s no borrowing money for retirement. The responsibility falls on you and you alone to save money in hopes of retiring while living a lifestyle that you desire. Saving for retirement is hard work and it doesn’t happen overnight. If you want to have options and flexibility in your “Golden Years” you need to start building your nest egg today by leveraging your current income and taking advantage of compound interest. These Basic Savings Strategies will help you ascertain how much money you should be saving and pitfalls to avoid.

Commitment #4 – Increase Your Financial IQ

Financial literacy matters and increasing your Financial IQ is one of the most important things you can do. Money, whether positive or negative, effects your life every day and your Financial IQ effects every decision that you make regarding money. Unfortunately, the lack of financial education has many of us living paycheck to paycheck and incurring loads of debt. There are many ways to increase your financial IQ: pick up a book, listen to financial podcasts, subscribe to online newsletters, or enroll in financial educational classes. The key here is taking the first step, as any step you take towards increasing your financial literacy is a step in the right direction. It may take a while for your personal finances to reach a level you’re comfortable with, but take it day by day and remember, no matter what your New Year’s resolutions are, focus on the progress, not the end results.

It may take a while for your personal finances to reach a level you’re comfortable with, but take it day by day and remember, no matter what your New Year’s resolutions are, focus on the progress, not the end results.

Three Tax Planning Strategies to End 2020 on a Better Note

This year give the gift of tax planning…to yourself! 2020 has been a unique year, and it has created some unique tax planning opportunities. The events of 2020 have led to new legislation that provides for opportunities in your charitable planning. Some folks have also had their income negatively impacted, which could provide an opportunity for a Roth conversion. If this has been a low-income year, you may have opportunity to harvest capital gains at a 0% tax rate. These strategies are discussed below. Please note that this should not be construed as tax advice and you should consult a CPA before making any tax decisions. The below insights were provided by a friend of 5280 Associates, Garry Albert, CPA.

Feeling generous? 2020 provides additional tax incentives for charitable gifting.

The CARES Act provides for some temporary options in charitable giving, whether you itemize deductions or take the standard deduction. Temporary Increase in Charitable Contribution Limit for Individuals Who Itemize Deductions. Traditionally, for those who itemize their deductions, the deduction for charitable contributions made in cash to qualifying charities has been limited to 60% (through 2025) of an individual’s adjusted gross income (AGI), and to 30% of AGI for certain “property” contributions. For the 2020 tax year only, the CARES Act allows an individual to deduct “cash” contributions to qualifying charities up to 100% of the individual’s AGI (as reduced by the amount of all other charitable contributions allowed to the individual under the traditional charitable contribution limits). Caution! A qualifying charity does not include a donor-advised fund. Conclusion: You may be able to receive a higher tax deduction for charitable contributions in 2020. Now that’s the gift of giving! Temporary “Above-The-Line” Deduction of up to $300 for Charitable Contributions for Individuals Who do Not Itemize Deductions. For the 2020 tax year only, the CARES Act allows individuals who do not elect to itemize their deductions, to take a so-called “above-the-line” deduction of up to $300 for cash contributions to a qualifying charity. Therefore, an individual may deduct this $300 amount in addition to the standard deduction for 2020. Caution! Contributions to a donor advised fund do not qualify for this special “above-the-line” deduction. Conclusion: You may be able to deduct a charitable contribution in 2020 even if you are taking the standard deduction. Do good and good will come to you!

Was your income lower in 2020? This could be the year for a Roth conversion.

Many experienced lower earned income in 2020. While this is not ideal, it can provide an opportunity in your long-term tax planning through a Roth conversion. A Roth conversion is defined as moving funds from a pre-tax account like a traditional IRA into a Roth IRA. When you do so, you must pay income taxes on the amount converted in the tax year that the conversion takes place. When considering a Roth conversion, it is best to convert in a low-income year so your Roth conversion income is taxed at the lower tax rates. If you are in a situation where, due to COVID (or for any other reason), your 2020 income is significantly lower than the income you expect in 2021 and later years, it may be a good idea to consider converting all or a portion of your traditional IRA into a Roth IRA before the end of 2020. Planning Alert! If you want a Roth conversion to be effective for 2020, you must transfer the amount from the regular IRA to the Roth IRA no later than December 31, 2020. You do not have until the due date of your 2020 tax return. Moreover, you are not allowed to later “re-characterize” that converted Roth IRA back to a traditional IRA. In other words, your conversion of an IRA to a Roth IRA cannot be undone. The IRS says that this prohibition applies to the conversion from a Traditional, SEP, or SIMPLE IRA to a Roth IRA, as well as amounts rolled over into a Roth IRA from other retirement plans such as 401(k) or 403(b) plans. Caution! Whether you should convert your traditional IRA to a Roth IRA can be an exceedingly complicated issue. Your tax rate in the year of conversion is just one of many factors that you should consider. Please call our office if you need help in deciding whether to convert to a Roth IRA.

Zero percent tax on capital gains…say what?

The current US tax code has 0% capital gains tax for some with lower income. A commonly ignored fact of the tax code is that capital gains that fall in the lowest two tax brackets (10% and 12%) are taxed at 0% capital gain tax rate. This means if you file a joint return and your taxable income is expected to be lower than $80,000 (or an individual return, lower than $40,000) you could benefit from selling shares with gains in 2020. Caution! It is always important to consider the economics of a stock sale, not just the tax consequences. If you are looking to take advantage of the 0% capital gain rate, you can sell and reinvest funds into another security in order to keep your money invested. This allows you to take advantage of the 0% rate while not giving up future investment growth. Individuals who have historically been in higher tax brackets but are now expecting a significant drop in their 2020 taxable income, may find themselves in the 0% tax bracket for long-term capital gains and qualified dividends for the first time. A significant drop in 2020 taxable income could have occurred due to COVID-19; or because you are between jobs; or you recently retired; or you are expecting to report higher-than-normal business deductions in 2020. If these pertain to your situation, please contact us prior to the end of the year to discuss the potential for this tax savings. While most of us are probably ready to put 2020 in the rear view mirror, be sure to consider how you can make your 2020 tax bill a little lighter before this extraordinary year comes to an end!

Thrivent and its financial professionals do not provide legal, accounting, or tax advice. Consult your attorney or tax professional. Representatives have general knowledge of the Social Security tenets. For complete details on your situation, contact the Social Security Administration.

While most of us are probably ready to put 2020 in the rear view mirror, be sure to consider how you can make your 2020 tax bill a little lighter before this extraordinary year comes to an end!

Thrivent and its financial professionals do not provide legal, accounting, or tax advice. Consult your attorney or tax professional. Representatives have general knowledge of the Social Security tenets. For complete details on your situation, contact the Social Security Administration.

Understand S.M.A.R.T Goals and Basic Savings Strategies

[et_pb_section fb_built="1" _builder_version="3.22" custom_padding="0px|||" global_colors_info="{}"][et_pb_row column_structure="2_3,1_3" module_class="postPadding" _builder_version="3.25" custom_padding="0px|0px||0px" global_colors_info="{}"][et_pb_column type="2_3" _builder_version="3.25" custom_padding="|0px||0px" global_colors_info="{}" custom_padding__hover="|||"][et_pb_text _builder_version="4.14.7" global_colors_info="{}"]What should my savings strategies be? How much money should I be saving every month? If we had a nickel for every time we get asked that question here at 5280 Associates… but we love hearing it! This is where our expertise and our creativity meet to tailor a plan just for you. It comes down to setting personal goals and managing spending to meet those goals.

Set Smart Goals

Setting your financial goals may seem like a no-brainer, but setting GOOD goals takes thoughtfulness and subtlety – which is why in 1981, George Doran used the acronym S.M.A.R.T. to teach his now widely used goal setting technique. S.M.A.R.T stands for Specific, Measurable, Attainable, Relevant, and Timely, as described in detail below.

S: Specific Savings Goals

Include as much detail as possible. What is it that you are striving for? Why is it important to you? Does it involve other people? It’s easy to set a vague retirement goal, for example, “I’d like to retire in my sixties.” Instead, be detailed and focus on specifics. “I’d like to retire at age 62 with $1 million dollars in retirement assets, no debt, and a spending ability of $75,000 per year throughout retirement.” Specificity is extremely important as it will allow you to how far you’ve progressed, and most importantly, celebrate when you know you’ve hit your goal!

M: Measurable Savings Strategies

A measurable goal is an effective goal. If you can’t measure it, how will you track your progress? “I want to have more control over my finances” is not a measurable or specific goal. Instead utilize quantitative data, put numbers on the page, and apply a benchmark. For example, “I want to save $50,000 in 3 years to buy a home and reduce my monthly spending down to $2,000/month in order to afford the mortgage payment.” At one year, you can easily measure your progress. Have you saved $16,667? Have you reduced your monthly spending by $667? If so, you are on point! When you have a way to measure your goal, you can know for sure that you are on track to achieve it.

A: Attainable Goals

Shoot for the moon, but within reason. When setting attainable goals, you are walking a fine line between pushing yourself out of your comfort zone and being realistic with your resources. A great planner will help you to know the difference and find that line – then you can run on it towards your destination: financial success and stability!

R: Relevant Strategies

Now that we have laid the groundwork for setting goals by making sure they are specific, measurable and attainable, we need to determine their relevance. Where does the goal fit in the overall game plan? Where do you want to first spend your time and energy? A couple may have two major goals – retiring early at the age of 55 AND paying for their children’s college education. They may need to prioritize one of those goals over the other at first, to ensure success for both.

T: Timely Goals

The phrase “due date” might make you feel like you are back in school, but we all know a clear deadline can push us to get something done – especially if we are prone to procrastination! A timely goal has a beginning, middle, and most importantly, a solid end. When do you want to achieve your goal? What are the short- and long-term objectives you need to reach the destination – and when do you ultimately want to cross that finish line? A strategic approach in this step of the process will help provide clarity and lay the groundwork for determining your savings blueprint.

Savings Strategies

Did you know a study conducted in 2017 determined that 78% of US workers are living paycheck to paycheck? Furthermore, another study controlled by the Federal Reserve Board found that nearly 44% of respondents could not cover an unexpected $400 emergency expense. These statistics highlight the fact that many Americans struggle financially. Numerous factors come into play to create this scenario, but one overarching theme is an inability to delay gratification. When it comes to financial planning, delayed gratification can be difficult to swallow because you often won’t see the results for 10, 20, 30 years or more. It’s much easier in the short run to spend money on what brings pleasure now, instead of planning for the future. How do we combat this common money mistake? It all boils down to having a plan, a S.M.A.R.T set of goals, and the willpower to accomplish your dreams. There is no one size fits all approach to savings strategies. However, there are some basic tactics that we find useful in achieving your goals. A rule of thumb that we use at 5280 Associates is to be saving roughly 20% of your pretax income. Gulp. Did that make you spit out your morning coffee? Don’t worry if you are lagging in this area at the moment. It may take some sacrifice and diligence, but we can guide you in getting there, while still having a lot of fun with your money in the present. How can we help? By aiding you in creating a realistic budget for your monthly expenses. The word “budget” may be a four-letter word in your mind, but we promise it’s not so bad! Some experts describe budgeting as permission to spend. You are simply telling your money where to go and when to go there. You control it, instead of it controlling you! We often recommend using Mint Intuit, which provides budgeting tools as well as other useful information, but there are many other budgeting tools that can help as well. A budget helps you to cut spending on unnecessary expenses and reposition those funds into various savings accounts. Periodically you may feel the burn of denying yourself some instant gratification, but you will soon feel the pleasure of viewing your growing account balances. When it comes to driving retirement success your savings rate is by far the most influential factor. In fact, a study done by the ASPPA Journal in the summer of 2011 shows that your savings rate is 5 times more important than asset allocation, 30 times more important than actuarial assessment and intervention and 45 times more important than asset quality. Most financial advisors are accustomed to focusing on investment returns, asset quality and fees but not on the factor that truly matters, your overall savings rate. Instead of focusing on choosing the “best” investments to park your funds, spend your time and energy determining how you can increase your savings rate and improve your asset allocation – the two main drivers of retirement success. A good advisor will remind you that you will never be able to control your investment returns, but you are always in control of your rate of savings. Read more information regarding the study performed by the ASPPA Journal and below are just a few quick tips to help you save more:- Automate everything. If you give yourself the opportunity to “think” about putting $100 in your savings account, you just might “think” yourself out of it!

- Avoid “lifestyle creep”. Your quality of life matters and you should enjoy an income increase but be strategic and don’t waste your hard-earned money. Create a “livable” budget now, and as your income increases, increase your savings at the same degree.

- Don’t get caught up in the comparison game. Create your own life and work toward your own personal goals. What do you want? How do you want to live? Stay focused on the answers to those questions and create a budget that truly reflects your values and desires.

Set Smart Goals with your Savings Strategies

In closing, saving can be intimidating and at times you may feel like you are sacrificing a great deal, but it will get easier. Once you set your goals, determine your savings amounts, and start contributing, you will begin to form a habit. After a month or two of committing to the plan, the peace of mind will set in and you will feel at ease and more accustomed to your new spending habits. Start small and increase incrementally over time. Even if you determine you can only save 5% of your income, start there, and increase when possible. The key here is to start as soon as possible and never stop. Be patient, be S.M.A.R.T. and plan for the future you want most.[/et_pb_text][/et_pb_column][et_pb_column type="1_3" _builder_version="3.25" custom_padding="|||" global_colors_info="{}" custom_padding__hover="|||"][et_pb_search exclude_pages="on" include_categories="15" _builder_version="3.23" max_width="100%" custom_css_main_element="min-height: 45px;" custom_css_input_field="min-height: 45px;" custom_css_button="border: solid 1px #da1a32;||padding: 10px;||background: #da1a32;||color: #fff;||cursor: pointer;||transition: 0.35s;||width: 90px;||font-weight: 600;||font-size: 16px;||min-height: 45px !important;" border_radii="on|0px|0px|0px|0px" input_font_size="14px" input_letter_spacing="0px" input_line_height="1em" input_text_shadow_style="none" global_module="27994" saved_tabs="all" global_colors_info="{}" button_text_size__hover_enabled="off" button_one_text_size__hover_enabled="off" button_two_text_size__hover_enabled="off" button_text_color__hover_enabled="off" button_one_text_color__hover_enabled="off" button_two_text_color__hover_enabled="off" button_border_width__hover_enabled="off" button_one_border_width__hover_enabled="off" button_two_border_width__hover_enabled="off" button_border_color__hover_enabled="off" button_one_border_color__hover_enabled="off" button_two_border_color__hover_enabled="off" button_border_radius__hover_enabled="off" button_one_border_radius__hover_enabled="off" button_two_border_radius__hover_enabled="off" button_letter_spacing__hover_enabled="off" button_one_letter_spacing__hover_enabled="off" button_two_letter_spacing__hover_enabled="off" button_bg_color__hover_enabled="off" button_one_bg_color__hover_enabled="off" button_two_bg_color__hover_enabled="off"][/et_pb_search][et_pb_blog posts_number="3" include_categories="14" show_author="off" show_date="off" show_categories="off" show_pagination="off" admin_label="Blog Sidebar" _builder_version="3.3" custom_css_content="display:none;" global_module="28007" saved_tabs="all" global_colors_info="{}"][/et_pb_blog][/et_pb_column][/et_pb_row][/et_pb_section]

4 Keys to Investing During a Volatile Stock Market

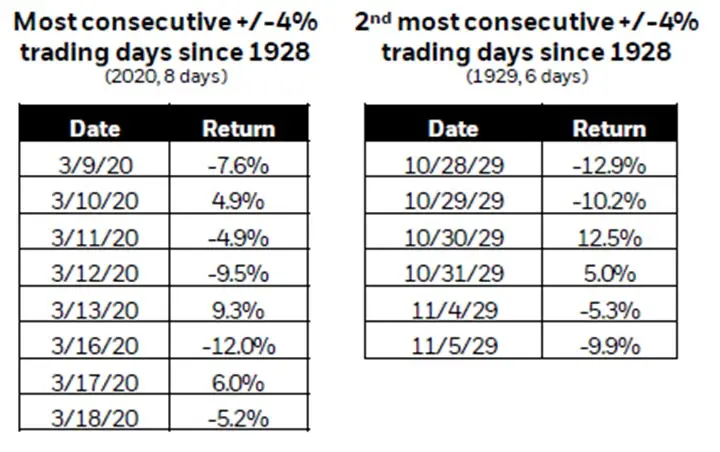

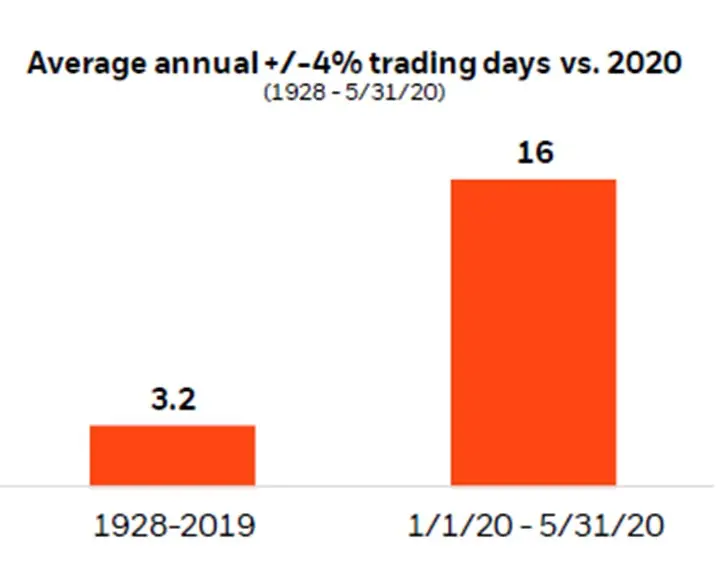

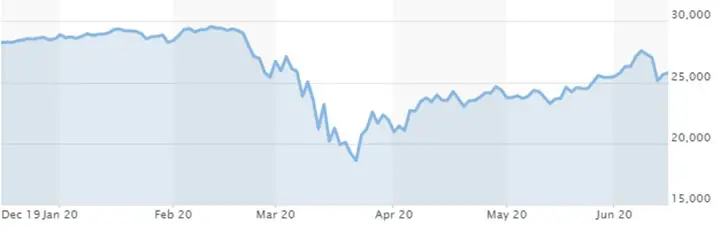

[et_pb_section fb_built="1" _builder_version="3.22" custom_padding="0px|||" global_colors_info="{}"][et_pb_row column_structure="2_3,1_3" module_class="postPadding" _builder_version="3.25" custom_padding="0px|0px||0px" global_colors_info="{}"][et_pb_column type="2_3" _builder_version="3.25" custom_padding="|0px||0px" global_colors_info="{}" custom_padding__hover="|||"][et_pb_text _builder_version="4.14.7" hover_enabled="0" global_colors_info="{}" sticky_enabled="0"]Investing can be intimidating, even in “normal” times, but throw in one of the most volatile stock markets in US history, and investing can become almost unapproachable for some. As you may know, 2020 has certainly been a roller coaster for the stock market. We have already seen historic market volatility this year and it’s not even halftime yet.

- From March 9, 2020 – March 18, 2020 we had 8 consecutive trading days where the S&P 500 traded positive or negative at least 4%. You’d have to look back to the start of the Great Depression in 1929 to find the year in 2nd place for the most consecutive +/ – 4 % trading days. They had 6 that year. Since 1928, on average, the S&P 500 has about 3.2 trading days annually where the index is +/ – 4%. Up to May 31st of this year, we have already had 16.

Source: BlackRock Student of the Market June 2020

Source: BlackRock Student of the Market June 2020

- On top of that, we have seen the biggest single day point drop AND the biggest single day point gain for the DOW in market history. As you can see in the chart below, DOW gained 2117.72 points on March 24, 2020 and lost 2997 points on March 16, 2020.

Source: MarketWatch

While it’s not ideal to be living through a volatile stock market like this, it’s important to remember that volatility is a part of the investing environment and that long-term investors should not react to day-to-day market fluctuations and attempt to time the market.

Source: MarketWatch

While it’s not ideal to be living through a volatile stock market like this, it’s important to remember that volatility is a part of the investing environment and that long-term investors should not react to day-to-day market fluctuations and attempt to time the market.

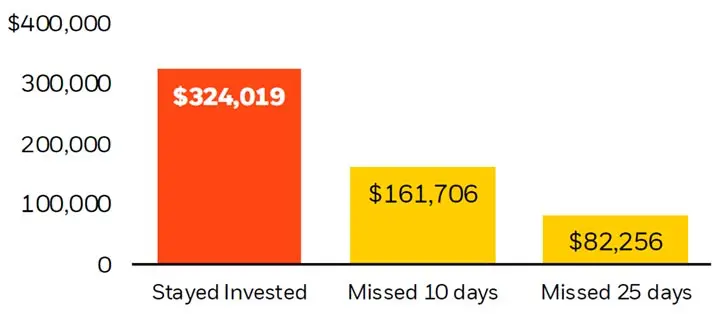

Key #1 – Keep your money invested during a Volatile Stock Market

It’s a lot easier said than done for most. Take a look at the hypothetical example below provided from Blackrock to explain the importance of not attempting to time the market. From January 1, 2000 to December 31, 2019, if you invested $100,000.00 in the S&P 500 Index, your account balance would have grown to $324,019.00. However, if during those 20 years you attempted to buy/sell when the market was up/down and your money was not invested or “missed” the top 10 positive market days, your account only would have grown to $161,706.00. To further illustrate the point, if you missed the top 25 days, your account balance would have declined to $82,256.00. Keep in mind you can’t invest directly in an index.

If you are attempting to time your investments, you are leaving yourself vulnerable to emotions. Market timing is mostly driven by fear of loss. Don’t be your own worst enemy and instead of attempting to time the market, try these steps:

From January 1, 2000 to December 31, 2019, if you invested $100,000.00 in the S&P 500 Index, your account balance would have grown to $324,019.00. However, if during those 20 years you attempted to buy/sell when the market was up/down and your money was not invested or “missed” the top 10 positive market days, your account only would have grown to $161,706.00. To further illustrate the point, if you missed the top 25 days, your account balance would have declined to $82,256.00. Keep in mind you can’t invest directly in an index.

If you are attempting to time your investments, you are leaving yourself vulnerable to emotions. Market timing is mostly driven by fear of loss. Don’t be your own worst enemy and instead of attempting to time the market, try these steps:

- Designate a purpose for each investment account you hold (Why do I have each account?)

- Evaluate your time horizon (When are you going to use the funds in each account?)

- Assess your diversification strategy (How much risk should you be taking?)

- Look for opportunities to rebalance (Have positions drifted from your target allocation?)

- Be confident in your plan.

Key #2- Control your emotions during a Volatile Stock Market

There are many risks associated with investing, to give you a few examples: market risk, interest rate risk, liquidity risk, credit risk, inflation risk, concentration risk, and, lastly, because it’s an election year, political risk. The key here is having a basic understanding of the risks associated with your investments and setting clear expectations to help mitigate the danger of emotional investing. That means doing your due diligence and understanding the fundamentals of the company/fund before purchasing. It means being realistic in forecasting returns and projected volatility. It also means being knowledgeable about common emotions and pitfalls that investors experience such as chasing past performance, following the crowd, not having patience, failing to diversify, or waiting to get even. Developing and committing to a long-term investment plan may be the best way to combat these emotions. For long-term investors, reacting emotionally to volatility may be more detrimental to your portfolio than simply letting the market run its course. Taking the time up front to understand your investment and level set expectations can pay off when times of uncertainty kick in.

Key #3 Look for opportunity during volatility

Volatility creates opportunity for many investors. Take a look at some of the concepts in my partner’s recent blog: The Silver Lining of the Coronavirus Impact on Financial Planning. While largely unrelated to this post, some of the concepts in that article are savvy planning techniques to utilize during volatile times. Specifically, Roth conversions and tax loss harvesting are two prime examples of opportunities created by volatility. In both circumstances, you would benefit from selling stocks/funds at a lower share price and realizing less in taxes. Rebalancing your portfolio during times of volatility can also have a meaningful impact long - term. However, in order to initiate a rebalancing strategy, you need to have a plan up front. What’s the purpose of the account and when you set it up, what percentage did you allocate to equities and/or to Bonds? Current market conditions should not dictate your target asset allocation strategy but rather provide guidance on how to perform the rebalance. Rebalancing simply means adjusting your portfolio back to its original allocation structure. As a hypothetical example, let’s say your portfolio you set up a year ago has a current allocation of 50% equities and 50% bonds, but you initially set the target allocation for the portfolio of 60% equities and 40% bonds. If you were to rebalance your portfolio now, you would be selling bonds and buying more equities to get back to your target allocation of 60% equities and 40% bonds. Assuming the equity market has declined and the bond market has increased in this example, you benefit from the rebalance due to the fact that you are selling the bond portion of your portfolio at higher prices and purchasing into the equity portion of your portfolio at lower prices.

Key #4 Stick to the Investment Plan

Remember, volatility is a natural part of market cycles, it is unavoidable, yet it presents investors with opportunity. Creating and adhering to a plan helps you avoid making costly mistakes – like trying to time the market or letting your emotions drive actions. Instead, ignore the noise, focus on your goals, and let your game plan create a sense of reassurance while others go into panic mode. No matter the year, the environment, or the worldwide events, investing can be daunting. By keeping your money in the market, prohibiting emotions from taking the lead, finding opportunities, and sticking to a strict plan, investing can go from unnerving to rewarding during a volatile stock market.

[/et_pb_text][/et_pb_column][et_pb_column type="1_3" _builder_version="3.25" custom_padding="|||" global_colors_info="{}" custom_padding__hover="|||"][et_pb_search exclude_pages="on" include_categories="15" _builder_version="3.23" max_width="100%" custom_css_main_element="min-height: 45px;" custom_css_input_field="min-height: 45px;" custom_css_button="border: solid 1px #da1a32;||padding: 10px;||background: #da1a32;||color: #fff;||cursor: pointer;||transition: 0.35s;||width: 90px;||font-weight: 600;||font-size: 16px;||min-height: 45px !important;" border_radii="on|0px|0px|0px|0px" input_font_size="14px" input_letter_spacing="0px" input_line_height="1em" input_text_shadow_style="none" global_module="27994" saved_tabs="all" global_colors_info="{}" button_text_size__hover_enabled="off" button_one_text_size__hover_enabled="off" button_two_text_size__hover_enabled="off" button_text_color__hover_enabled="off" button_one_text_color__hover_enabled="off" button_two_text_color__hover_enabled="off" button_border_width__hover_enabled="off" button_one_border_width__hover_enabled="off" button_two_border_width__hover_enabled="off" button_border_color__hover_enabled="off" button_one_border_color__hover_enabled="off" button_two_border_color__hover_enabled="off" button_border_radius__hover_enabled="off" button_one_border_radius__hover_enabled="off" button_two_border_radius__hover_enabled="off" button_letter_spacing__hover_enabled="off" button_one_letter_spacing__hover_enabled="off" button_two_letter_spacing__hover_enabled="off" button_bg_color__hover_enabled="off" button_one_bg_color__hover_enabled="off" button_two_bg_color__hover_enabled="off"][/et_pb_search][et_pb_blog posts_number="3" include_categories="14" show_author="off" show_date="off" show_categories="off" show_pagination="off" admin_label="Blog Sidebar" _builder_version="3.3" custom_css_content="display:none;" global_module="28007" saved_tabs="all" global_colors_info="{}"][/et_pb_blog][/et_pb_column][/et_pb_row][/et_pb_section]

No matter the year, the environment, or the worldwide events, investing can be daunting. By keeping your money in the market, prohibiting emotions from taking the lead, finding opportunities, and sticking to a strict plan, investing can go from unnerving to rewarding during a volatile stock market.

[/et_pb_text][/et_pb_column][et_pb_column type="1_3" _builder_version="3.25" custom_padding="|||" global_colors_info="{}" custom_padding__hover="|||"][et_pb_search exclude_pages="on" include_categories="15" _builder_version="3.23" max_width="100%" custom_css_main_element="min-height: 45px;" custom_css_input_field="min-height: 45px;" custom_css_button="border: solid 1px #da1a32;||padding: 10px;||background: #da1a32;||color: #fff;||cursor: pointer;||transition: 0.35s;||width: 90px;||font-weight: 600;||font-size: 16px;||min-height: 45px !important;" border_radii="on|0px|0px|0px|0px" input_font_size="14px" input_letter_spacing="0px" input_line_height="1em" input_text_shadow_style="none" global_module="27994" saved_tabs="all" global_colors_info="{}" button_text_size__hover_enabled="off" button_one_text_size__hover_enabled="off" button_two_text_size__hover_enabled="off" button_text_color__hover_enabled="off" button_one_text_color__hover_enabled="off" button_two_text_color__hover_enabled="off" button_border_width__hover_enabled="off" button_one_border_width__hover_enabled="off" button_two_border_width__hover_enabled="off" button_border_color__hover_enabled="off" button_one_border_color__hover_enabled="off" button_two_border_color__hover_enabled="off" button_border_radius__hover_enabled="off" button_one_border_radius__hover_enabled="off" button_two_border_radius__hover_enabled="off" button_letter_spacing__hover_enabled="off" button_one_letter_spacing__hover_enabled="off" button_two_letter_spacing__hover_enabled="off" button_bg_color__hover_enabled="off" button_one_bg_color__hover_enabled="off" button_two_bg_color__hover_enabled="off"][/et_pb_search][et_pb_blog posts_number="3" include_categories="14" show_author="off" show_date="off" show_categories="off" show_pagination="off" admin_label="Blog Sidebar" _builder_version="3.3" custom_css_content="display:none;" global_module="28007" saved_tabs="all" global_colors_info="{}"][/et_pb_blog][/et_pb_column][/et_pb_row][/et_pb_section]

Financial Spring Cleaning: 4 Key Areas and What to Do in Light of Coronavirus

[et_pb_section fb_built="1" _builder_version="3.22" custom_padding="0px|||" global_colors_info="{}"][et_pb_row column_structure="2_3,1_3" module_class="postPadding" _builder_version="3.25" custom_padding="0px|0px||0px" global_colors_info="{}"][et_pb_column type="2_3" _builder_version="3.25" custom_padding="|0px||0px" global_colors_info="{}" custom_padding__hover="|||"][et_pb_text _builder_version="4.14.5" global_colors_info="{}"]The Coronavirus has left many of us wondering, “What should I do?” Here is a guide outlining four key financial spring cleaning areas you should be thinking about given the events of 2020 so far: investments, insurance, real estate, and estate planning.

Financial Spring Cleaning Area 1: Investments

If you are like many Americans, you may have money invested in the stock market, mutual funds, exchange traded funds, or something similar. These can be done through your retirement plan at work or through privately established accounts. What you do now should depend more on your age and timeline, rather than current events. Below is different advice depending on age, the first being a dual income family near age 40 and the second a “pre-retiree” age 60.Dual income family, age 40

You should be thinking that you will stay the course. When the market is volatile, it is tempting to remove your money from that volatility. This can be a big mistake because just as negative volatility is very bad, positive volatility is very good. In fact, in the stock market’s most volatile times we can experience some of the strongest single performance days. It is important that, as a younger investor with a long time to retirement, you catch those very positive days that often tend to occur right after very negative days in volatile times. This is why it is so important to resist selling during volatility. Many studies have been done where if you miss the five best days over a 10-year investment period (3,650 days), your return can be cut in half or more over the entire period! See one study HERE. In addition, when the market is down it is a great time to add funds to your accounts. Can you bump up your 401k contribution? Can you afford to add a chunk of funds to your investment account? If so, a down market can be your friend as a great price entry point. You can take advantage of the 20 years you have left to go before stopping work. It is usually advisable to make consistent monthly contributions, but don’t resist buying in a little more when prices are very attractive.Pre-retiree, age 60

If you are within a few years of retiring, you should begin to think where your income will be coming from after you are done with work. Most people will have some form of income from social security at some point in their retirement. Others will have additional income through a pension or military benefit. But, will this income cover all of your desired expenses? If the answer is no, you should be thinking about what the annual gap between your income and your desired expenses is. When you determine that number, consider putting about 5 years’ worth of that gap number into something that is more conservative like cash and cash equivalents. By doing this, you are effectively “locking in” your income for the first five years of retirement since all of the needed funds in the first five years will come from these cash and cash equivalent funds and your income sources. The assets that are left over can be invested more for growth since you have established your short-term needs. This allows you to feel secure in your income plan while also protecting against inflation and keeping some of your funds invested for growth. Here is a hypothetical example: John and Jane have $1,000,000 in a 401k and project to have $60,000 per year in income from social security. They would like to spend $80,000 per year total in retirement. Since they have $60,000 from social security, they still need $20,000 per year to fill the gap. Typically, 401k plan distributions are taxable (unless Roth) so they will need a little more than $20,000 each year from the 401k to cover the taxes. Let’s assume they expect to pay 20% tax on the distribution. They will need $24,000 each year to get their $20,000 and pay the $4,000 in taxes. In order to “lock in” their next 5 years, they would need to put $120,000 ($24,000 x 5 years) into cash and cash equivalent investments. They could then invest the remaining $880,000 in a series of investments with more growth potential, in order to keep up with inflation, and rest easy knowing that the next five years are taken care of. As the years pass, there will likely be positive gains during some years in the invested $880,000. When these gains occur, they can move some money from the “in the market” account into the cash or cash equivalents accounts to always secure the next 5 years of income secure. Now that the market has recovered somewhat from the March 23rd low point, it may be a good time to consider moving some money out of the market in a strategy similar to the above, if it’s right for your specific situation. The goal is to have this in place the next time the market declines, and you will sleep much better when that time comes around. Depending on your age, timeline for when you will be using your funds, and how much you will need – you should be making decisions accordingly.

Financial Spring Cleaning Area 2: Insurance

Insurance protection is always something that is difficult to pay for as you are covering for a risk that has not happened yet and may never happen. Protecting your financial plan from unexpected disasters is important and further secure one’s financial future. There are many different types of insurance for you to consider protecting your plan. As the world becomes more digital, many old insurance policies may be advantageous to consider replacing with newer, sometimes cheaper policies with similar coverage. This is due to the insurance company’s cost of doing business reducing over the past years by working primarily online with less overhead cost. In addition, certain insurances like auto insurance could see a dramatic reduction in claims as the result of many people not driving as much in the year 2020. Many auto insurance providers also offer other insurance like home and umbrella coverage. It is likely they could consider lowering rates in competition with each other in the coming months. It wouldn’t hurt to give your insurance agent a call to see if rates have decreased. Be sure to use a broker who can access insurance coverage of many insurers so they can compete the quotes against each other. You just might see a slight reduction in your out of pocket costs when it is needed most.

Financial Spring Cleaning Area 3: Real Estate

There are two opportunities to consider in real estate currently, selling and refinancing.Selling

The real estate market has become a seller’s market overnight again. When Coronavirus stopped showings for real estate in many states due to social distancing concerns, many people decided to not list their house. This reduces inventory available for buyers and creates serious competition for the houses that are available. If you are thinking about selling your house and want to do it fast, it may be a great time to consider selling. Don’t be surprised if you get multiple competing offers on day one of your listing. You may even find you can sell your property for more than you thought you could.Refinancing

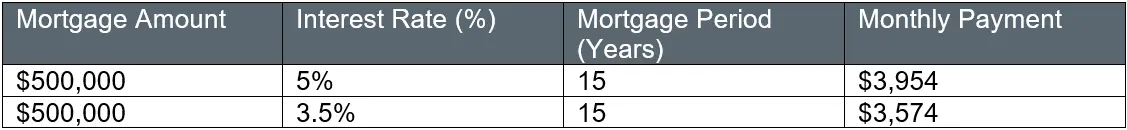

When crisis has occurred in the past 20 years, Americans have become used to interest rates declining. Controlling the federal funds rate is one lever that the Federal Reserve has available to help prop up the economy in difficult times. The Fed lowers rates, making accessing funds for individuals and businesses less expensive in hopes of stimulating the economy. What does this mean for you? Take a look at the interest rate on your mortgage. You may be able to exchange debt at a high interest rates, like 5%+, for a lower interest rate, like 3.5% (see below). You will have to pay closing costs on the loan. Often times you will break even quickly due to your monthly payment being lower. This simple move could end up saving you many thousands of dollars over the life of the loan, see below. Again, make sure you work with a lender that has access to many bank’s loan programs so that they can shop and compete many loans for you. Click here for a free mortgage calculator.

Click here for a free mortgage calculator.

Financial Spring Cleaning Area 4: Estate Planning

Estate planning can be defined as preparing one’s assets to transfer to someone else at death. Many people don’t realize that their assets will be taxable to the recipient even if the person who dies is below the estate tax exemption limit, currently $11,580,000. If a person has less than $11,580,000 in their estate at death, they will avoid paying additional estate taxes. However, they may still owe income tax on their assets if held in pre-tax qualified accounts or non-qualified variable annuity accounts. When markets decline, it can be an opportunity to prepare your estate for transfer in the future, even if that transfer is many years down the road. One should always consult an estate tax attorney to ensure other state death taxes do not apply in addition to the federal death tax.Pre-tax accounts

Accounts like IRAs that have pre-tax funds in them generate income that is taxable when a retiree takes money out of the accounts. When that retiree dies, and passes the IRA to their heirs, that tax liability does not go away and can even increase. This is for two reasons: First, the typical heir is around age 60 as their parents pass away in their 80s. A person in their 60s tends to be in their highest income earning years of their career. This creates a tax issue when, say, the heir is earning $200,000 per year and then inherits a $500,000 IRA. The heir is likely going to be in a higher income tax bracket than their parents were prior to their death. This means that the heir will pay more tax on the $500,000 than the parents would have. Second, a recent law change on December 20, 2019 called the SECURE Act requires that the person inheriting an IRA take the full amount of that IRA out within a 10-year period instead of over the heir’s lifetime. This requires that a larger amount of an inheritance be claimed as income per year by the heir than before. It should be noted that in rare cases some beneficiaries can still use their life expectancy and spread the tax over their lifetime. Of course, more money (even when taxed) is more money than you had before – so the issue is not that it is bad to inherit money. But, if you think about it from the parent’s perspective, they had an opportunity while alive (assuming they were in a lower tax bracket) to move that money out of the IRA, pay the taxes, and position that asset in an account that their heir would inherit tax free. Many don’t realize that non-qualified assets (money outside of retirement accounts) generally receive a step up in cost basis on the date of death, essentially making the inheritance tax free to the heir.Non-qualified variable annuities

A variable annuity is a financial product that can be held in an IRA or in a non-qualified account.Usually assets held in a non-qualified account will receive a step up in cost basis at the owner’s death, meaning that the heir would not owe any tax on the gain accrued in the previous owner’s lifetime. However, variable annuities do not qualify for this great tax benefit. In fact, the gains in a non-qualified variable annuity are taxed as income to the recipient, not even as capital gains which would be more attractive. So, for similar reasons mentioned above regarding pre-tax accounts, non-qualified variable annuity owners may want to remove the gains at their tax bracket while alive if they will be giving those funds to an heir. If the gains are removed from the contract, the cost basis of the annuity will pass tax free to the heir. The removed gains could be invested into a regular non-qualified account and subsequently get the preferred step up in cost basis. (Note: Holding an annuity inside a tax-qualified plan does not provide any additional tax benefits.) How does all of this relate to recent events? When the market is down, you can remove more shares from your IRA than when prices are higher and pay the same amount of tax. So if you are in retirement and have funds in an IRA or non-qualified variable annuity that you will likely be passing to the next generation, the time is now to consider doing some estate planning from a tax perspective with those assets. As the world changes, so should your approach to your financial plan. These financial spring cleaning ideas could help make your plan a little more efficient given the recent events of 2020.[/et_pb_text][/et_pb_column][et_pb_column type="1_3" _builder_version="3.25" custom_padding="|||" global_colors_info="{}" custom_padding__hover="|||"][et_pb_search exclude_pages="on" include_categories="15" _builder_version="3.23" max_width="100%" custom_css_main_element="min-height: 45px;" custom_css_input_field="min-height: 45px;" custom_css_button="border: solid 1px #da1a32;||padding: 10px;||background: #da1a32;||color: #fff;||cursor: pointer;||transition: 0.35s;||width: 90px;||font-weight: 600;||font-size: 16px;||min-height: 45px !important;" border_radii="on|0px|0px|0px|0px" input_font_size="14px" input_letter_spacing="0px" input_line_height="1em" input_text_shadow_style="none" global_module="27994" saved_tabs="all" global_colors_info="{}" button_text_size__hover_enabled="off" button_one_text_size__hover_enabled="off" button_two_text_size__hover_enabled="off" button_text_color__hover_enabled="off" button_one_text_color__hover_enabled="off" button_two_text_color__hover_enabled="off" button_border_width__hover_enabled="off" button_one_border_width__hover_enabled="off" button_two_border_width__hover_enabled="off" button_border_color__hover_enabled="off" button_one_border_color__hover_enabled="off" button_two_border_color__hover_enabled="off" button_border_radius__hover_enabled="off" button_one_border_radius__hover_enabled="off" button_two_border_radius__hover_enabled="off" button_letter_spacing__hover_enabled="off" button_one_letter_spacing__hover_enabled="off" button_two_letter_spacing__hover_enabled="off" button_bg_color__hover_enabled="off" button_one_bg_color__hover_enabled="off" button_two_bg_color__hover_enabled="off"][/et_pb_search][et_pb_blog posts_number="3" include_categories="14" show_author="off" show_date="off" show_categories="off" show_pagination="off" admin_label="Blog Sidebar" _builder_version="3.3" custom_css_content="display:none;" global_module="28007" saved_tabs="all" global_colors_info="{}"][/et_pb_blog][/et_pb_column][/et_pb_row][/et_pb_section]

As the world changes, so should your approach to your financial plan. These financial spring cleaning ideas could help make your plan a little more efficient given the recent events of 2020.[/et_pb_text][/et_pb_column][et_pb_column type="1_3" _builder_version="3.25" custom_padding="|||" global_colors_info="{}" custom_padding__hover="|||"][et_pb_search exclude_pages="on" include_categories="15" _builder_version="3.23" max_width="100%" custom_css_main_element="min-height: 45px;" custom_css_input_field="min-height: 45px;" custom_css_button="border: solid 1px #da1a32;||padding: 10px;||background: #da1a32;||color: #fff;||cursor: pointer;||transition: 0.35s;||width: 90px;||font-weight: 600;||font-size: 16px;||min-height: 45px !important;" border_radii="on|0px|0px|0px|0px" input_font_size="14px" input_letter_spacing="0px" input_line_height="1em" input_text_shadow_style="none" global_module="27994" saved_tabs="all" global_colors_info="{}" button_text_size__hover_enabled="off" button_one_text_size__hover_enabled="off" button_two_text_size__hover_enabled="off" button_text_color__hover_enabled="off" button_one_text_color__hover_enabled="off" button_two_text_color__hover_enabled="off" button_border_width__hover_enabled="off" button_one_border_width__hover_enabled="off" button_two_border_width__hover_enabled="off" button_border_color__hover_enabled="off" button_one_border_color__hover_enabled="off" button_two_border_color__hover_enabled="off" button_border_radius__hover_enabled="off" button_one_border_radius__hover_enabled="off" button_two_border_radius__hover_enabled="off" button_letter_spacing__hover_enabled="off" button_one_letter_spacing__hover_enabled="off" button_two_letter_spacing__hover_enabled="off" button_bg_color__hover_enabled="off" button_one_bg_color__hover_enabled="off" button_two_bg_color__hover_enabled="off"][/et_pb_search][et_pb_blog posts_number="3" include_categories="14" show_author="off" show_date="off" show_categories="off" show_pagination="off" admin_label="Blog Sidebar" _builder_version="3.3" custom_css_content="display:none;" global_module="28007" saved_tabs="all" global_colors_info="{}"][/et_pb_blog][/et_pb_column][/et_pb_row][/et_pb_section]

The Silver Lining of the Coronavirus Impact on Financial Planning

[et_pb_section fb_built="1" _builder_version="4.16" custom_padding="0px|||" global_colors_info="{}"][et_pb_row column_structure="2_3,1_3" module_class="postPadding" _builder_version="4.16" custom_padding="0px|0px||0px" global_colors_info="{}"][et_pb_column type="2_3" _builder_version="4.16" custom_padding="|0px||0px" global_colors_info="{}" custom_padding__hover="|||"][et_pb_text _builder_version="4.16" global_colors_info="{}"]We know this is a time of uncertainty given the Coronavirus (COVID-19) pandemic in the U.S. and around the globe. As always, but especially now, we are committed to serving our members, customers and their families.

The Coronavirus has had a significant impact on the global health systems, economy and livelihood. While it seems impossible for this situation to have a silver lining, it may provide an opportunity for you to spend some time reflecting on your financial plan. With the extra time you may have at home, we’ve provided you with some topics and options to consider, with resources at your fingertips. Here are a few: 1. Consider making a 2020 Roth conversion while markets are lower relative to where they were to potentially reduce tax liability 2. Consider investing uninvested cash that is not needed in the next two years 3. Harvest tax losses in non-qualified accounts and reposition assets for success 4. If you own an older Non-qualified Variable Annuity, consider shifting into a lower cost brokerage account while the markets are lower relative to where they were to reduce taxes on the shift 5. Refinance high interest debt 6. For small business owners, investigate the various relief programs provided by the recently signed CARES Act

2020 Roth Conversions

For those of you that are nearing or in retirement age you may want to explore the option of Roth conversions. By converting dollars to a ROTH IRA from your Traditional IRA, or employer retirement plan now, those account values will be less when calculating your required minimum distributions. You pay the tax now so you may reduce your future tax liabilities. Roth conversions are especially attractive currently since the Tax Cut and Jobs Act of 2017 was passed, which lowered the percentages in our tax bracket system. See my previous blog about the new SECURE Act for more details on using this strategy. Converting assets to a ROTH IRA is a taxable event, but when markets are down, there are other benefits: 1. If you were planning to convert, say, 100 shares of Apple stock 6 weeks ago, you would have been converting a dollar amount of about $32,500 (assuming AAPL’s price was $325/share). If we assume you would pay 25% tax on that conversion you would be paying $8,125 in tax in 2020 in order to convert. As of the writing of this blog, AAPL’s price is $254/share. So, you can convert the same number of shares (total value $25,400) and pay only $6,350 in tax. The best part is that when the 100 shares gets into the Roth the growth from that point on is tax deferred, and could be tax free in the future with a “qualified distribution.” You saved $1,775 in taxes and your shares can grow tax free moving forward when the recovery hopefully happens in the coming months and years. 2. You could also take advantage of the current low market if you were planning to convert a specific dollar amount rather than a specific number of shares. If you were planning to convert $50,000 of an index fund with a price six weeks ago of $50, you would have been preparing to convert 1,000 shares. If the price dropped by 25%, as many funds did during the past 6 weeks, the price would now be $37.50. Now with the lower price you could convert 1,333.33 shares if you stuck with the $50,000 amount. This doesn’t save on taxes, but it does get many more shares into your Roth IRA which can grow tax free in most cases.

Cash on the Sideline?

If you are one of the fortunate people who has a large amount of cash savings, this could be an excellent opportunity for you. If you look at a historical chart of the S&P500 index (which represent the 500 largest companies in the United States), you will see what the typical response to a dramatic drop in market prices is over the long term. Usually, you see a recovery and increasing stock prices after a large decline over the following years. See the below chart from Charles Schwab:

Key: X-axis: Year | Y-axis: PriceOne way or another, and in different amounts of time, the market tends to recover. Obviously, this is not guaranteed, but it depends on your belief in the American financial system. It is important to remember that the stock market is not gambling. A stock’s value depends on the profit that the company is projected to make in the future. The market then guesses whether those projections are correct, and the price rises and falls based on those guesses. Another consideration is that the company has employees who need to make money for their families to survive. The employees are dedicated to the success of their company because their financial livelihoods depend on it. The question becomes: Do I think that things will get so bad that people will stop going to work? If you believe the general public will continue to get up daily, go to work, and produce a great product or service for their customers then you might consider taking on the risk of investing in markets after a dramatic downturn, such as the one created now by COVID-19. Perhaps you pick a couple of your favorite companies that are large and strong and invest in them. Perhaps you just keep it simple and choose a diversified, low cost index fund. Either way, the opportunity for growth tends to be highest after a recent decline in stock prices. Just be sure to not invest money you may need in the next couple of years, as we never know what is around the corner in the stock market.

Harvest Tax Losses and Reposition for Success

Sometimes you have an old crummy stock position that is one that you want to get rid of, but you just can’t pull the trigger because you don’t want to sell at a deep loss. You know the adage, “Buy low and sell high,” NOT, “Sell low and buy high!” But what about, “Sell low and buy low?” Let’s face it, times are tough in market prices. But do you think one stock is going to perform better from this point on than another in your portfolio? Do you think a company that provides work from home capabilities might be a better stock to own right now than an oil company? Do you think a restaurant chain is going to perform well in the coming months compared to a home gym equipment company? Hmm, dramatic change in the world may require dramatic change in your portfolio of stocks. This is a great time to consider selling stocks low and buying into some pretty darn good ones at low prices, too! It’s important to focus on where the market is going, not where it came from. So, if you want to take advantage of this dip to purchase some companies you think will fare better in the next couple of years, it is definitely a time to consider selling low and buying low. Oh, by the way, if you do this you can harvest those tax losses on the sale of your old crummy stock that you can use to offset future gains and/or income down the road when you file your next tax return. It could be a win-win from a financial planning standpoint.

Non-qualified Variable Annuity Swap

You may be an owner of a non-qualified variable annuity (NQVA). This is a variable annuity that is not held in a qualified account, like an IRA account. These products have some great qualities:- They are tax-deferred (you don’t get a 1099 for them each year)

- They can have some valuable riders that you added at an additional expense

- Income riders

- Death benefit riders

- Market protection riders

- There is no limit in how much you can contribute.

- They have some liquidity restrictions similar to IRAs that you must pay a penalty in most cases to access the funds prior to age 59 ½.

- Most annuities will have a surrender period where penalties apply for transferring the funds with a certain number of years after starting the contract, usually 5-20 years.

- Variable annuities may have higher internal fees than comparable investments that are not variable annuities.

- Gains are taxed as income, not capital gains.

Refinance?

This is the easiest of the bunch! If you have any debt, especially a mortgage, with an interest rate over 4% you should give a mortgage broker a call and see about refinancing. Refinancing means that you take out a new loan at a lower interest rate than your previous loan and use the proceeds to pay off the old loan. Even a small reduction in interest rate can result in several thousands of dollars in savings over the life of the loan. There are some costs involved with refinancing, but with very low rates the long-term benefit often outweighs the cost of setting up the new loan. If the interest rate can be lowered, you will likely see a reduction in your monthly payment as well, so there is an immediate benefit to help with lost income during COVID-19. Here is a nifty refinance calculator to see if there may be a benefit to you.

CARES Act Opportunities and Government Assistance

On March 27, 2020 President Trump signed the CARES Act into law. It is the largest aid package ever signed into law by a government in the history of the world at $2.2 trillion. The act is designed to help Americans remain afloat during what is hopefully this temporary economic suspension to flatten the curve of instances of COVID-19. There are many applications for individuals and small businesses. A summary, provided from this article from Forbes, is below:- Direct payments: Americans who pay taxes and were not claimed as dependent in 2019 will receive a one-time direct deposit of up to $1,200, and married couples will receive $2,400, plus an additional $500 per child. The payments will be available for incomes up to $75,000 for single filers and $150,000 for joint filers. Reduced payments are available for single filers with income up to $99,000 and joint filers with income up to $198,000.

- Unemployment: The program provides $250 billion for an extended unemployment insurance program, expands eligibility, and offers workers an additional $600 per week and will fund up to 13 additional weeks, on top of what state programs pay. It also extends UI benefits through December 31, 2020 for eligible workers. The deal applies to the self-employed, independent contractors, and gig economy workers.

- Payroll taxes: The measure allows employers to delay the payment of their portion of 2020 payroll taxes until 2021 and 2022.

- Use of retirement funds: The bill waives the 10% early withdrawal penalty for distributions up to $100,000 for coronavirus-related purposes, retroactive to January 1, 2021. Withdrawals are still taxed, but taxes are spread over three years, or the taxpayer has the three-year period to roll it back over.

- 401(k) Loans: The loan limit is increased from 50% of your vested benefit up to $50,000 to 100% up to $100,000.

- RMDs suspended: Required Minimum Distributions for all retirement accounts are suspended for 2020.

- Charity. There is a new provision that provides an above-the-line deduction for charitable contributions, plus, the limits on charitable contributions are changed.

- Small business relief: $350 billion is being dedicated to preventing layoffs and business closures while workers have to stay home during the outbreak. Companies with 500 employees or fewer that maintain their payroll during Coronavirus can receive 2.5 times average monthly payroll costs up to $10 million. If employers maintain payroll, the portion of the loans used for covered payroll costs, interest on mortgage obligations, rent, and utilities , along with specific future staffing requirements- loans could be forgiven.

- Net Operating Losses: The Tax Cuts and Jobs Act (TCJA) net operating loss rules are modified. The 80% rule is lifted, and losses can now be carried back five years.

- Excess Loss Limitations: The excess loss limitation (ELL) rules for pass-through entities are suspended.

- Interest Expense Limitation: The interest expense limitations are increased to 50% from 30% for tax years beginning in 2019 or 2020. Taxpayers can also elect to calculate the interest limitation for 2020 using their 2019 adjusted taxable income as the relevant base, which often will be significantly higher.

- Large corporations: $500 billion will be allotted to provide loans, loan guarantees, and other investments. These will be overseen by a Treasury Department inspector general. These loans will not exceed five years and cannot be forgiven. Airlines will receive $50 billion (of the $500 billion) for passenger air carriers, and $8 billion for cargo air carriers.

- Hospitals and health care: The deal provides over $140 billion in appropriations to support the U.S. health system, $100 billion of which will be injected directly into hospitals. The rest will be dedicated to providing personal protective equipment (PPE) for health care workers, testing supplies, increased workforce and training, accelerated Medicare payments, and supporting the CDC, among other health investments.

- Coronavirus testing: All testing and potential vaccines for COVID-19 will be covered at no cost to patients.

- States and local governments: State, local, and tribal governments will receive $150 billion. $30 billion is set aside for states, and educational institutions. $45 billion is for disaster relief, and $25 billion for transit programs.

- Agriculture: The deal would increase the amount the Agriculture Department can spend on its bailout program from $30 billion to $50 billion.

Tax Deadlines and Payment Extensions

The Treasury Department, IRS, Colorado and other states issued guidance on both tax filing and payment relief. Here are the summaries.Federal and State Relief Provisions

Federal

- Families First Coronavirus Response Act – This link includes information about common issues employers and employees face when responding to COVID-19, and its effects on wages and hours worked under the Fair Labor Standards Act (FLSA), job-protected leave under the Family and Medical Leave Act (FMLA), and paid sick leave and expanded family and medical leave under the Families First Coronavirus Response Act (FFCRA). Additionally, it provides the Employee Rights Posters (and Poster FAQs) employers are required to display/provide to employees.

- For Employers: Employer Paid Leave Requirements

- FAQs regarding FFCRA

- For Employees: Employee Paid Leave Rights

- Coronavirus Aid, Relief, and Economic Security (CARES) Act – Signed into law on 03/27/2020, CARES provides loan forgiveness, small business support, unemployment insurance enhancements, and federal loans to industries severely impacted by the pandemic. In addition, it provides tax relief and tax incentives for individuals and businesses alike. The majority of the tax relief is designed to increase liquidity in the economy, largely through the relaxation of limitations on business deductions and the deferral of taxes, but also with the introduction of recovery rebates for individuals.

State of Colorado

Colorado Department of Labor & Employment (CDLE) – The State has adopted temporary emergency rules for unemployment requirements. This site provides a variety of resources for workers and employers who are impacted by the Coronavirus. Here is some helpful information for those seeking unemployment or employers with questions from employees:- For Employers

- The Colorado Health Emergency Leave with Pay (“Colorado HELP”) Rules provides paid sick-leave information, including which employees and employers are covered under the Rules and additional requirements per the State (versus Federal).

- Additional resources for employers from CDLE can be accessed HERE.

- For Employees

- Employees whose employers are closed or working fewer hours click HERE for information on unemployment benefits and how to file an unemployment claim.

- HERE are some common FAQs on qualifying for unemployment

- STATE OF COLORADO BUSINESS RESOURCE CENTER – This site provides state and federal COVID-19 announcements, programs, and information relevant to Colorado businesses.

- COVID-19 RECORDED SEMINAR FOR BUSINESSES AND EMPLOYERS – You may want to check out this COVID-19 seminar hosted by Autopaychecks and Employment Law Attorney Michael Santo. The seminar provided good information and clarification for employers on employee and HR directives. Watch the recorded seminar HERE and download the accompanying handout HERE.

Disaster Loan Assistance

Check with your banking relationship first. Many banks are ready and able to help businesses and individuals with short and long-term lending needs. Your bank may provide the quickest and most efficient way to attain a loan as others, such as the Small Business Administration, may be inundated with applications at this time, thus the process may take longer. Small Business Administration (SBA) Funding for Small and Medium-Sized Businesses. The SBA has expanded its funding programs for economic injury disaster loans. There are two programs available for disaster relief. Both programs can be used, however they are not intended for the same purpose. Below is a brief summary of the programs. Additional conditions and amendments may apply. We expect SBA to update their website information with the full details. HERE is their programs and resources page. Note – Lenders are still receiving final guidance on the PPP. We recommend you contact your local bank to ensure they are a 7(a) lender and let your bank know you are interested in the PPP to start on any initial paperwork or needed documentation. Paycheck Protection Program (PPP). PPP is a new loan program created by the CARES Act and offered by the SBA to expand the availability of capital to small businesses and provide liquidity during the COVID-19 event. It is intended to allow for some loan forgiveness for retention of staff and payroll.- The program is available for businesses and qualifying nonprofit organizations with 500 or fewer employees. There are some additional rules for entities under collective ownership.

- Business/borrower must have been in operation on 02/15/2020.

- These loans are attained through authorized SBA 7(a) lending banks and other commercial lenders (versus direct through SBA). The application period ends 6/30/2020.

- The maximum PPP loan to any business is $10 million – or – 2.5 times the average monthly payroll costs of the business over the year prior to the making of the loan and excluding the prorated portion of any annual compensation above $100,000 for any person (whichever is less).

- The loan can be used for:

- Group healthcare benefit costs and insurance premiums

- Mortgage interest, rent payments, utilities

- Interest on debt owed prior to 02/15/2020

- Payroll costs, including vacation and retirement benefits, salaries and tips, and severance payments (excludes independent contractors and employees who are paid more than $100,000 per year)

- PPP loan terms include:

- Maximum rate of 4%

- Maximum of 10 years

- No collateral required

- Cannot acquire this loan if you are taking advantage of the new Employee Retention Tax Credit established under the CARES Act.

- Interest and principal payments are deferred for 6 months to 1 year (interest will still accrue from the time of loan)

- No prepayment penalties

- The program is available for small businesses, small agricultural cooperatives, small aquaculture businesses, and most private non-profit organizations. Ineligible entities include religious organizations, charitable organizations, gambling concerns, casinos, racetracks, and agricultural enterprises as defined in Section 18(b)(1) of the Small Business Act (neither business nor its affiliates are eligible).

- Eligible entities may qualify for loans up to $2 million.

- The interest rate is 3.75% for small businesses. The interest rate for non-profits is 2.75%.

- Terms are determined on a case-by-case basis, based upon each borrower’s ability to repay and to keep payments affordable.

- Generally, loans over $25,000 require collateral. SBA takes real estate as collateral when it is available. However, the SBA will not decline a loan for lack of collateral, but requires borrowers to pledge what is available.

- These loans may be used to pay fixed debts, payroll, accounts payable and other bills that can’t be paid because of the disaster’s impact. The loans are not intended to replace lost sales or profits or for expansion.

- You must apply through the SBA. Paper applications are acceptable, however the SBA encourages filing electronically for quicker response and accuracy.

- What will I need to apply for an EIDL?

- Completed SBA loan application (SBA Form 5)

- Completed Tax Information Authorization(IRS Form 4506T) for the applicant, principals, and affiliates

- Complete copies of the most recent Federal Income Tax Return

- Schedule of Liabilities (SBA Form 2202)

- Personal Financial Statement (SBA Form 413)

- Other information may also be requested some examples include:

- Complete copy, including all schedules, of the most recent Federal income tax return for principals, general partners or managing member, and affiliates

- Current year-to-date profit-and-loss

- Additional Filing Requirements (SBA Form 1368) providing monthly sales figures