The SECURE Act, a New Age for RMD’s, and What It Means for Your Retirement Planning

[et_pb_section fb_built="1" _builder_version="3.22" custom_padding="0px|||" global_colors_info="{}"][et_pb_row column_structure="2_3,1_3" module_class="postPadding" _builder_version="3.25" custom_padding="0px|0px||0px" global_colors_info="{}"][et_pb_column type="2_3" _builder_version="3.25" custom_padding="|0px||0px" global_colors_info="{}" custom_padding__hover="|||"][et_pb_text _builder_version="4.14.2" hover_enabled="0" global_colors_info="{}" sticky_enabled="0"]You may have heard about the legislation that was passed by Congress and signed into law by President Trump on December 20th, 2019, known as the SECURE Act. This law is intended to combat some of the issues facing current and future retirees.

The Secure Act

One change made was that the required minimum distribution start age moved from age 70 ½ to age 72. This presents a great opportunity!

What is an RMD?

In our planning sessions with clients, our discussions almost always include required minimum distributions (RMDs). This is when the government dictates that you must begin withdrawing funds from your pre-tax retirement accounts. Why do they force you to take withdrawals? Because they want the tax money. Withdrawals from pre-tax retirement accounts count as ordinary income on your income tax return, so by forcing the withdrawals, tax revenues increase. Keep in mind that you have most likely never paid any tax on the contributions to these accounts, assuming they were pre-tax contributions. RMD age is (unfortunately) the time to pay Uncle Sam his share!

Why does 1 ½ years make a difference?

Here is the issue: many people retire before age 72 (or the former RMD age of 70 ½). Hopefully, they have developed an income plan on how they are going to fund retirement. Some retirees will need to take withdrawals from their pre-tax retirement accounts to fund their lifestyle. Others may be living on other streams of income, like a pension benefit or social security, and have no need to withdraw their pre-tax retirement accounts. It is this second group who will run into the “RMD tax bomb.”

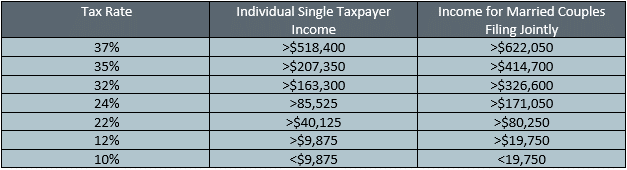

If a retiree does not need to take withdrawals from their pre-tax retirement account to sustain their desired lifestyle, the account will likely sit and continue accumulating until age 72. Then, at age 72 that retiree is forced to take their initial required distribution – even if they don’t need the money! If that pre-tax retirement account has been sitting for many years it could have become a large amount and therefore the initial RMD can force them into a higher tax bracket than normal, meaning they are forced to pay more tax on money they don’t even need to live on. The initial RMD is approximately 3.6% of the pre-tax balance for an individual. So, using a hypothetical example of a $1 million balance, the RMD would be $36,000! Imagine if you had been living in the 12% tax bracket at about $78,000 of taxable income per year (married filing joint) and now you had to add an additional $36,000 to that amount on your tax return, with the majority of that RMD being in the 22% bracket. You just got whacked with a tax bomb of almost $8,000 that you could have prevented…how? I will tell you below.

RMD calculator worksheet from IRS

RMD planning is nothing new, but it is highlighted in this article because the change in RMD age to 72 actually gives you an opportunity to control your RMDs better than before. If you are in your early 60s and have no earned income, this strategy may work particularly well for you.

A hypothetical example to explain the Secure Act and RMDs:

Dan is married and files taxes jointly. He and his wife are 62. They have taxable social security benefits of $50,000 and a pension of $15,000 per year. This total income of $65,000 is reduced by the standard deduction of $24,000 to leave a taxable income of $41,000. They are comfortable and able to live on this income. But, they also have an IRA with $500,000 in it. Luckily, they work with a savvy financial advisor who will help them with their RMD planning each year. Here is what they do:

- Determine annual taxable income: $41,000

- Find their tax bracket and see how much room they have in that bracket before reaching the next bracket

In this case, they are in the 12% bracket ($19751-$80,250)

They have $39,250 of room left (80,250 - $41,000 = 39,250) until reaching the 22% bracket

- Plan a withdrawal or Roth conversion from Dan’s IRA of about $39,250 for that tax year and withhold 12% for federal tax

Why would they do this if they don’t need the money? The answer is because it reduces the account balance in the pre-tax retirement account (the IRA in this case). The lower that pre-tax retirement account balance is come age 72, the lower their required distributions will be. By taking withdrawals, even when not needed, from age 60-72 Dan and his wife will flatten out their taxes and not have a large spike in income tax at age 72. In addition, the current tax brackets are some of the lowest rates in history, so it is a good time to remove pre-tax dollars and pay the taxes now.

Notice that they are not spending the additional withdrawal, but simply removing it from the IRA, paying taxes, and either saving it into an investment account or completing a Roth conversion. In both cases they are saving the net amount for future use if needed.

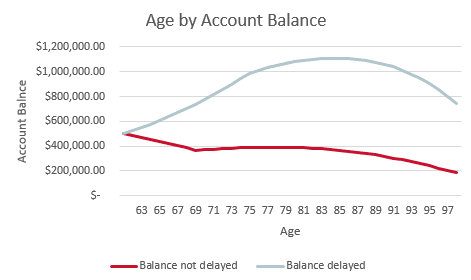

The SECURE act just gave everyone an additional couple of years to do this type of RMD tax planning! See below for a chart detailing what could have happened if Dan delayed distributions until age 70 ½ (using the old RMD chart for this example). You can see how much higher his required distributions would have been if he had waited to take the minimum withdrawals. He would have very likely been forced into a high tax bracket in his 80s. This is shown in the below chart “Age by Account Balance.” The light blue represents his account balance if he decided to delay withdrawals until RMD age. The red shows his account balance if he decided to take withdrawals early to intentionally lower his IRA balance.

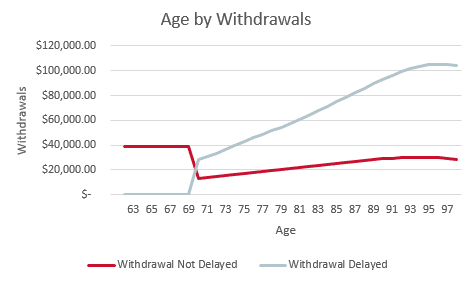

The impact is seen in the chart “Age by Withdrawals.” You can see in the light blue, the RMDs were much higher in the later years due to delaying withdrawals. In the red, distributions are flatter since there was a proactive reduction in account balance in the IRA prior to RMD age. If he had delayed RMDs, he likely would have been forced into a higher tax bracket in his 80s!

In addition, if Dan and his wife were to pass away in their 80s, they would leave a much higher pre-tax balance to their kids. Their kids would then be forced to inherit the pre-tax money and pay taxes at their income tax rate. Typical inheritance occurs from age 50-65, which are typically the highest income earning years. This means your kids could pay double or more tax on your IRA than you would while alive! Roth IRAs and investment accounts generally inherit tax free to the next generation. Bottom line, doing this RMD planning now with your wealth advisor not only helps level out your taxes while you are alive, but will keep more of your hard-earned money in the family at your passing. It’s a win-win!

Ready to take advantage of the new law? Contact your wealth advisor today for further guidance and planning.

[/et_pb_text][/et_pb_column][et_pb_column type="1_3" _builder_version="3.25" custom_padding="|||" global_colors_info="{}" custom_padding__hover="|||"][et_pb_search exclude_pages="on" include_categories="15" _builder_version="3.23" max_width="100%" custom_css_main_element="min-height: 45px;" custom_css_input_field="min-height: 45px;" custom_css_button="border: solid 1px #da1a32;||padding: 10px;||background: #da1a32;||color: #fff;||cursor: pointer;||transition: 0.35s;||width: 90px;||font-weight: 600;||font-size: 16px;||min-height: 45px !important;" border_radii="on|0px|0px|0px|0px" input_font_size="14px" input_letter_spacing="0px" input_line_height="1em" input_text_shadow_style="none" global_module="27994" saved_tabs="all" global_colors_info="{}" button_text_size__hover_enabled="off" button_one_text_size__hover_enabled="off" button_two_text_size__hover_enabled="off" button_text_color__hover_enabled="off" button_one_text_color__hover_enabled="off" button_two_text_color__hover_enabled="off" button_border_width__hover_enabled="off" button_one_border_width__hover_enabled="off" button_two_border_width__hover_enabled="off" button_border_color__hover_enabled="off" button_one_border_color__hover_enabled="off" button_two_border_color__hover_enabled="off" button_border_radius__hover_enabled="off" button_one_border_radius__hover_enabled="off" button_two_border_radius__hover_enabled="off" button_letter_spacing__hover_enabled="off" button_one_letter_spacing__hover_enabled="off" button_two_letter_spacing__hover_enabled="off" button_bg_color__hover_enabled="off" button_one_bg_color__hover_enabled="off" button_two_bg_color__hover_enabled="off"][/et_pb_search][et_pb_blog posts_number="3" include_categories="14" show_author="off" show_date="off" show_categories="off" show_pagination="off" admin_label="Blog Sidebar" _builder_version="3.3" custom_css_content="display:none;" global_module="28007" saved_tabs="all" global_colors_info="{}"][/et_pb_blog][/et_pb_column][/et_pb_row][/et_pb_section]

How Much Do I Need to Save to Retire?

[et_pb_section fb_built="1" _builder_version="3.22" custom_padding="0px|||" global_colors_info="{}"][et_pb_row column_structure="2_3,1_3" module_class="postPadding" _builder_version="3.25" custom_padding="0px|0px||0px" global_colors_info="{}"][et_pb_column type="2_3" _builder_version="3.25" custom_padding="|0px||0px" global_colors_info="{}" custom_padding__hover="|||"][et_pb_text _builder_version="4.14.2" global_colors_info="{}"]Retirement is a large part of “the American Dream” for most people. We look forward to a time when we can stop working and live out our golden years in comfort and with dignity. If this dream exists for you, at some point you will probably stop and ask, “How much do I need to save to retire?” This is an essential question and the answer can vary quite a lot from person to person. The amount you need to save depends on how much you intend to spend in retirement, how much you currently have saved, how long you have left to work, and what income streams will be available to you in retirement. Everyone has a retirement income plan, whether they know it or not. Some choose to prepare in advance and plan for what they want their lifestyle to look like after their working years, while others choose to avoid planning and are often surprised or even fearful as they approach retirement age.

We will review a few general aspects of retirement planning and their definitions in order to understand how a typical retirement plan works. Then we will discuss a real-world example, bringing all these concepts together.

Step 1: Determine Retirement Spending Goals

Everyone has a current lifestyle cost. This is the amount of money spent on an annual or monthly basis in order to fund your life. When considering retirement spending, you will have basic expenses (bills, groceries, gas, etc.) and discretionary expenses (dining out, travel, etc.). Some of these expenses happen every month while others may happen once a year. To begin to understand how much you need to retire comfortably, first calculate your lifestyle costs today, regardless of your age, and adjust that number for what is likely at retirement time. Using a cash flow worksheet like this will be very helpful.

Here are a few common changes at retirement time to one’s lifestyle cost. For example:

- Many people pay off their real estate mortgage prior to retirement. So, while that is a cost today, you may be able to remove it from your future needs.

- Inflation is another large factor in determining how much you will need in retirement. An expense of $10,000 today will be equivalent to $12,189 in 10 years with a 2% inflation rate.

- There are nondiscretionary expenses that could be greater in retirement. For example, medical insurance will now be an out-of-pocket expense rather than employer paid.

- Lastly, there are often several discretionary expenses that are added to the plan like additional travel or other purchases related to retirement lifestyle.

Step 2: Compile Current Savings

The amount you have saved will contribute to the amount of retirement income you will be able to generate. It is important to sum up all your current savings. The definition of savings can vary widely. One can save money into retirement accounts, real estate, business ownership, cash, and many other types of assets.

Typical savings accounts for retirement purposes are 401(k)s, IRAs, Roth IRAs, Investment Accounts, etc. These types of assets are liquid and can be used to create income in retirement. These accounts will vary in how they are taxed. It is important to understand what the value of your liquid assets are today, how they will be taxed, and what they are projected to be at retirement.

Real estate is an example of an asset that is not liquid. You may have a large amount of equity in your home, but that does little to help generate income in retirement. Many people’s largest asset is the equity in their home, so their net worth may seem large while their ability to create income is limited. Similarly, business ownership equity is also only valuable if someone is willing to buy out the equity in the business so that the owner can then use the proceeds to produce income.

Step 3: Factor in Length of Time Before Retirement

Perhaps the greatest asset in financial planning is time. Having time allows you to take advantage of the growth potential of an investment and compound over time, perhaps requiring less contribution. The older you are, the more you will need to save out of pocket to accomplish your goals. As an example, if one saves $10,000 at age 30 and earns an annual rate of return of 7.2%, that investment will be worth $80,000 at age 60. But, if one saved the same $10,000 at age 40 and earned the same rate, the investment would only be worth $40,000 at age 60. The additional 10 years of time, with compounded interest, doubles the ending value! Therefore, the amount the one needs to save in order to retire is very dependent on the length of time they have until retirement. If you can predict how long you have left to work, you can figure out how much is needed in savings on a monthly basis to accomplish your goals.

Step 4: Determine Income Streams Available to You

Some people may also have income from sources like a pension or rental real estate property. Most people who have worked in the United States will have social security income that will supplement any other income generated from saved assets. The Social Security Website has a great estimator tool that will give you an idea of expected benefits.

See: 4 Key Factors to a Solid Social Security Strategy

Step 5: Put Together Your Plan

A complete retirement plan incorporates all 4 of the factors above to determine how much you should save for retirement. At 5280 Associates, we take it further by making tailored recommendations on the most efficient ways to save in order to reach your goals.

Conclusion: A hypothetical example of a Typical Couple

Meet Bob and Jan. They are married, the same age, and have worked for 30 years, earning a household income of $80,000. Their retirement income effective tax rate is 20%. In order to live the lifestyle, they desire, Bob and Jan have calculated they will need $100,000 per year at retirement,

At age 67 they will have a household social security income of approximately $50,000 after tax, per year. They will need to generate an additional $50,000 of income per year in order to accomplish their goal of $100,000 total. In order to generate $50,000 after tax they would need to have saved approximately $1,200,000 in retirement assets. In order to save 1.2 million in assets they would need to save about $785/mo. and earn a 6% rate of return from age 30 until age 67. If they started to save at age 40, they would need to save about $1,570/month in order to accomplish the same goal.

With professional guidance and expert planning, Bob and Jan will be able to reach their retirement goals. Have you started thinking about retirement savings? Does it overwhelm you or make you feel excited? Either way, 5280 Associates is here to help you develop and put your plan into action.

[/et_pb_text][/et_pb_column][et_pb_column type="1_3" _builder_version="3.25" custom_padding="|||" global_colors_info="{}" custom_padding__hover="|||"][et_pb_search exclude_pages="on" include_categories="15" _builder_version="3.23" max_width="100%" custom_css_main_element="min-height: 45px;" custom_css_input_field="min-height: 45px;" custom_css_button="border: solid 1px #da1a32;||padding: 10px;||background: #da1a32;||color: #fff;||cursor: pointer;||transition: 0.35s;||width: 90px;||font-weight: 600;||font-size: 16px;||min-height: 45px !important;" border_radii="on|0px|0px|0px|0px" input_font_size="14px" input_letter_spacing="0px" input_line_height="1em" input_text_shadow_style="none" global_module="27994" saved_tabs="all" global_colors_info="{}" button_text_size__hover_enabled="off" button_one_text_size__hover_enabled="off" button_two_text_size__hover_enabled="off" button_text_color__hover_enabled="off" button_one_text_color__hover_enabled="off" button_two_text_color__hover_enabled="off" button_border_width__hover_enabled="off" button_one_border_width__hover_enabled="off" button_two_border_width__hover_enabled="off" button_border_color__hover_enabled="off" button_one_border_color__hover_enabled="off" button_two_border_color__hover_enabled="off" button_border_radius__hover_enabled="off" button_one_border_radius__hover_enabled="off" button_two_border_radius__hover_enabled="off" button_letter_spacing__hover_enabled="off" button_one_letter_spacing__hover_enabled="off" button_two_letter_spacing__hover_enabled="off" button_bg_color__hover_enabled="off" button_one_bg_color__hover_enabled="off" button_two_bg_color__hover_enabled="off"][/et_pb_search][et_pb_blog posts_number="3" include_categories="14" show_author="off" show_date="off" show_categories="off" show_pagination="off" admin_label="Blog Sidebar" _builder_version="3.3" custom_css_content="display:none;" global_module="28007" saved_tabs="all" global_colors_info="{}"][/et_pb_blog][/et_pb_column][/et_pb_row][/et_pb_section]

4 Key Factors to a Solid Social Security Strategy

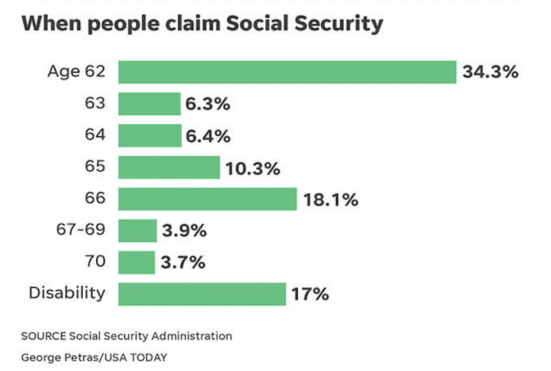

[et_pb_section fb_built="1" _builder_version="3.22" custom_padding="0px|||" global_colors_info="{}"][et_pb_row column_structure="2_3,1_3" module_class="postPadding" _builder_version="3.25" custom_padding="0px|0px||0px" global_colors_info="{}"][et_pb_column type="2_3" _builder_version="3.25" custom_padding="|0px||0px" global_colors_info="{}" custom_padding__hover="|||"][et_pb_text _builder_version="4.14.2" background_size="initial" background_position="top_left" background_repeat="repeat" global_colors_info="{}"]Social security strategy is certainly a “frequently asked question” here at 5280 Associates. It’s no wonder, as this topic affects nearly everyone, particularly those who are nearing retirement age. The most common age for people to claim social security is, by far, age 62 (34.3%) followed by age 66 (18.1%) and age 65 (10.3%). But just because 62 is the earliest you can take social security, doesn’t make it the best strategy for everyone. Caplinger, Dan. “What’s the most popular way to take Social Security?” The Motley Fool, USA Today content partner. June 19, 2018.

You might think the only decision to make is what age you will start taking your benefits. Not so fast! There are many other factors involved in making smart decisions regarding your social security benefits, and your Financial Planner should be involved to guide you through each one. Read on for some thought starters, and don’t hesitate to give your wealth advisement team a call to discuss how each factor relates to you personally.

Caplinger, Dan. “What’s the most popular way to take Social Security?” The Motley Fool, USA Today content partner. June 19, 2018.

You might think the only decision to make is what age you will start taking your benefits. Not so fast! There are many other factors involved in making smart decisions regarding your social security benefits, and your Financial Planner should be involved to guide you through each one. Read on for some thought starters, and don’t hesitate to give your wealth advisement team a call to discuss how each factor relates to you personally.

Social Security Strategy

Asset Level

Assets are the part of your portfolio that refer to the accounts you have. They may be IRAs, Investment Accounts, Roth IRAs, etc. The unique aspect of assets is that they are typically market based and they can run low or even down to zero! If you have a large sum of assets it may make sense to delay the start of social security because the assets you own can provide income through withdrawals in the early years of retirement. If you do not have sufficient assets you may need to begin social security a little earlier in order to make ends meet. Determining where you fall on the asset scale is relative to the amount of money you plan on spending annually. A detailed, ongoing financial plan is essential to determining your asset level and need for social security benefits.

Other Income Available

Although less common, retirees may have access to a pension. A pension can be defined as a stream of income that usually lasts for your lifetime. A stream of income is very helpful in retirement as an automatic paycheck is deposited into your bank account each month. If you have a significant pension payment, you may be able to delay taking social security as your income need is satisfied. If you do not have additional income available, social security may need to begin earlier to supplement income needs.

Life Expectancy

Social security can be taken anytime between age 62 and 70. The “full retirement age benefit” (FRA) is the full social security benefit as defined by the administration. Most people’s FRA is between ages 66 and 67 depending on the year of birth. If you take social security before FRA, the value is reduced. If you take the benefit after FRA, the value is increased. For example, a person with a $2,500/month FRA at age 67 who takes social security at age 62 would only get $1,760. Similarly, if the same person took the benefit at age 70, they would get $3,100. So, why wouldn’t everyone take it at age 70? Life expectancy. If you take social security early, and then live a long time, you are forever penalized with the lower amount. However, if you take social security at 62 and die at age 75, you would have gotten more out of the system than if you waited until age 70. For most people there is a breakeven point around age 82 where if you delay until 70 you must live past 82 to get more income from the system than if you decided to take the benefit prior to 70 and died before 82.