April 2022 Market Commentary

In this brief video, Ted covers April's market overview, bond performance, fixed income drawdowns, credit risk, trends across asset classes, Fed Policy and inflation expectations, and our ecosystem of elements.

Elevate Webinar 1: Market Commentary with Ted Kouba

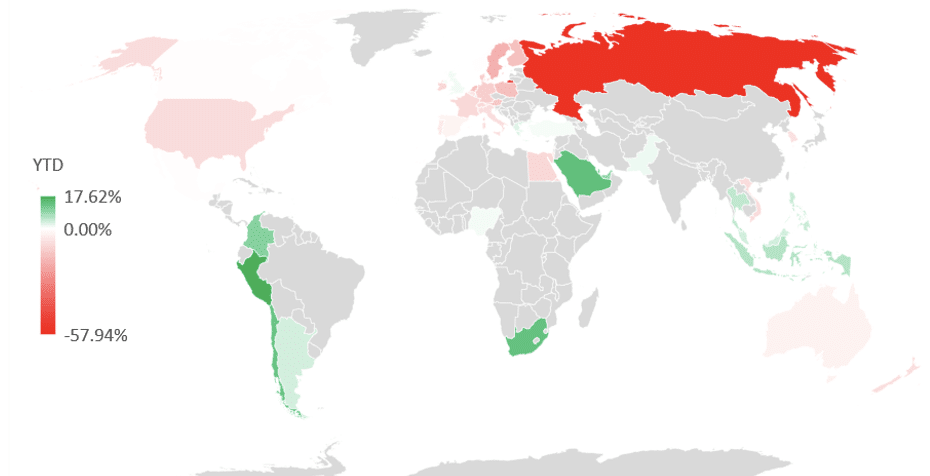

"Elevate" your knowledge of the markets and economy with our first 30-minute zoom webinar featuring our Director of Investment Management, Ted Kouba! This is the first webinar of a quarterly series. In Q1's call, Ted touches on January's volatility, market overview, and expectations on Federal Policy. Moving onto February, we look at the February market, Russia's weight in the global markets, and more Fed expectations. Ending with March, we visit the markets, the yield curve, mortgage rates and inflation expectations. We encourage you to keep an eye out quarterly for webinar registration and recordings! There is time for questions during the live events. You may also bring questions to info@5280associates.com.

Elevate Webinar Series: Market Commentary with Ted Kouba

5280 Associates invites you to join us next week for our first quarterly market updates webinar with our Director of Investment Management, Ted Kouba. This series will be called “Elevate” as we hope you use these calls to elevate your knowledge of the markets and your own portfolio. The event will take place April 21st at 12:00pm Mountain Time. Can’t make the call? We will be sure to post a recording to our Insights page after the event. Click here to register. A registration link is also at the end of Ted’s video.

Quarterly Market Update Webinar

We hope to see you there!

Missed the event? Click here to access the recording.

March 2022 Market Commentary

In this month's market recap, Ted discusses the recent inversion of the yield curve, Fed expectations, mortgage rates, inflation expectations, and the four model elements. Keep an eye out for registration for our first quarterly webinar with Ted on April 21st. A recording of that webinar will be posted to our Insights page after the event.

Research Supplement: The Fed and Interest Rate Expectations

Summary

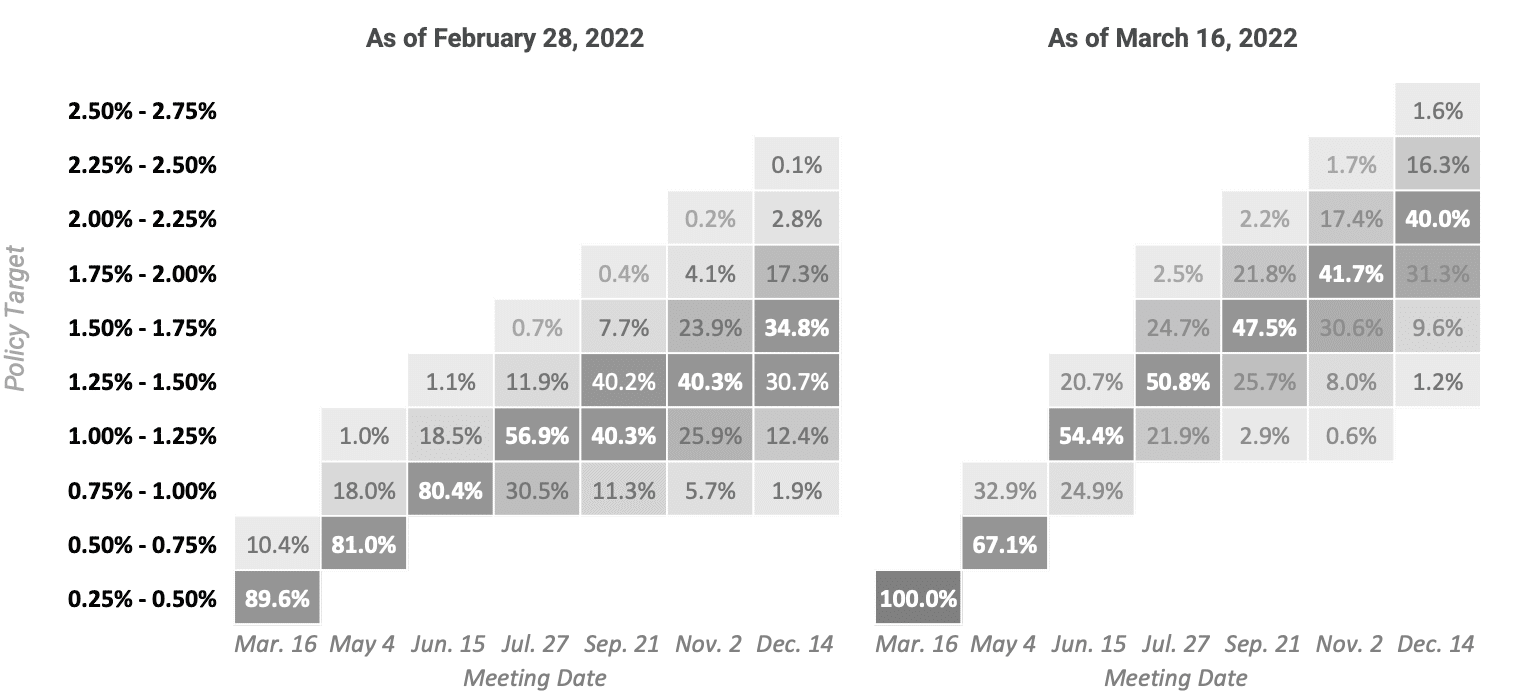

On March 15th, in a highly telegraphed move, the Fed took its first step in attempting to combat inflation. Recently, expectations of the Fed’s meeting have shifted around quite a bit, which can drive short-term equity volatility. With inflation and the Fed being key items for the market right now, it is worth keeping an eye on the market’s expectations through the remainder of the year.

•The Fed increased the target rate by a quarter percentage point, moving the upper bound from 0.25% to 0.50%.

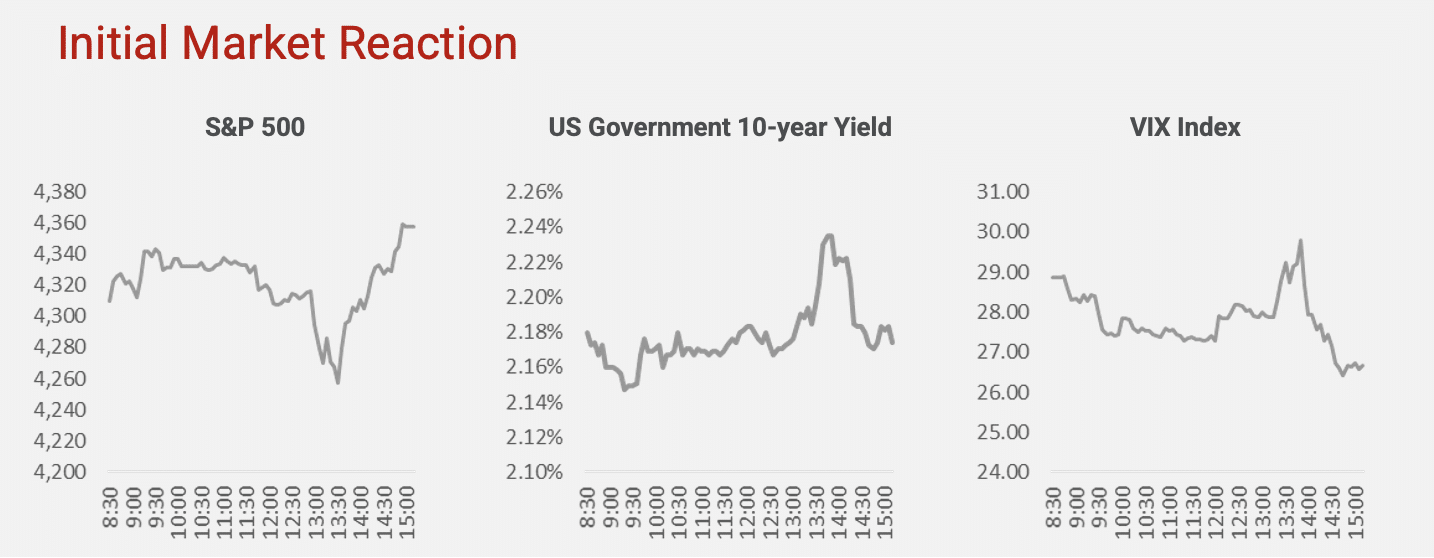

•The initial market reaction was notable, with the S&P 500 gaining 2.24% over the day, after losing nearly 2% intraday, and the US government 10-year yield increasing to 2.18%.

•We can look at what is being priced into the market through Fed futures. The more the heatmaps at the bottom of the page change over time, the more volatility we can expect to seep into the broader market.

Market Expectations

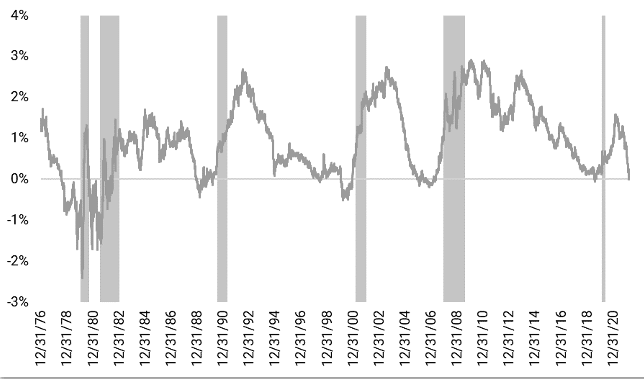

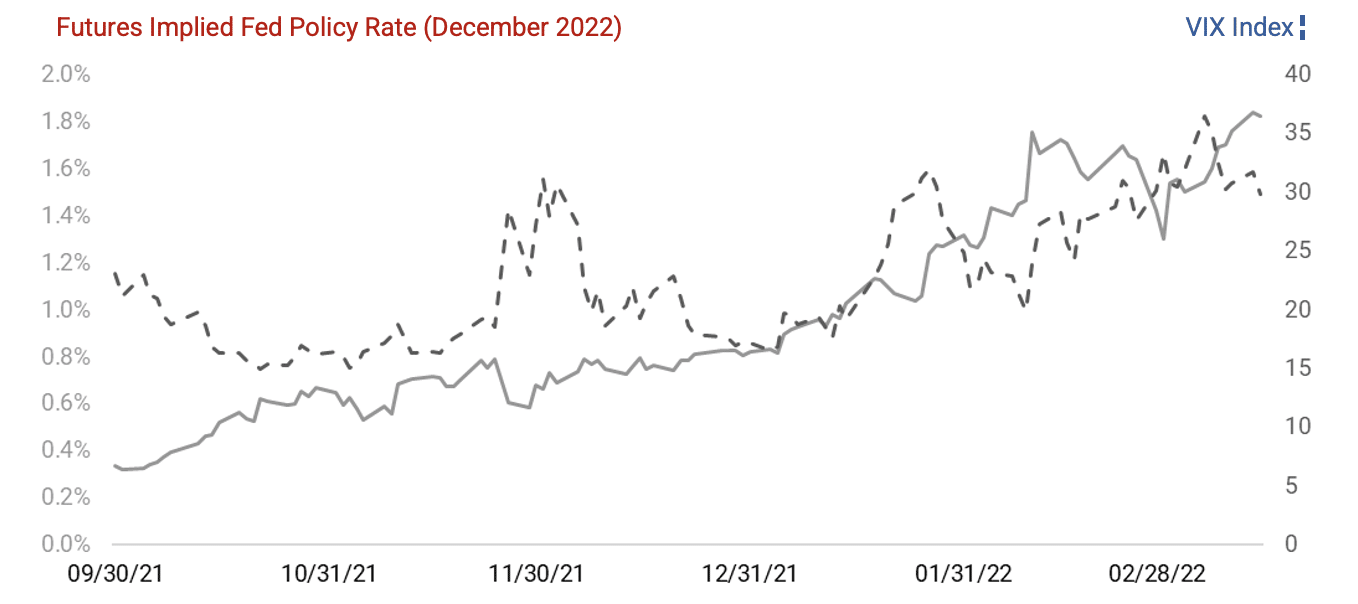

Markets Tend to React to Changing Expectations

Since markets look towards the future, it’s not surprising to see equity market volatility rise with changing expectations for interest rate policy. The above graph shows the changing expectations for Fed policy at the end of 2022 compared to implied volatility of the S&P 500, measured by the VIX Index.

Since markets look towards the future, it’s not surprising to see equity market volatility rise with changing expectations for interest rate policy. The above graph shows the changing expectations for Fed policy at the end of 2022 compared to implied volatility of the S&P 500, measured by the VIX Index.

Images source: Helios Quantitative Research, Bloomberg

Important Disclosures:

The material presented includes information and opinions provided by a party not related to Thrivent Advisor Network. It has been obtained from sources deemed reliable; but no independent verification has been made, nor is its accuracy or completeness guaranteed. The opinions expressed may not necessarily represent those of Thrivent Advisor Network or its affiliates. They are provided solely for information purposes and are not to be construed as solicitations or offers to buy or sell any products, securities, or services. They also do not include all fees or expenses that may be incurred by investing in specific products. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. You cannot invest directly in an index. The opinions expressed are subject to change as subsequent conditions vary. Thrivent Advisor Network and its affiliates accept no liability for loss or damage of any kind arising from the use of this information.

This communication may include forward looking statements. Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,” “projects,” “targets,” “forecasts,” “seeks,” “could’” or the negative of such terms or other variations on such terms or comparable terminology. These statements are not guarantees of future performance and involve risks, uncertainties, assumptions and other factors that are difficult to predict and that could cause actual results to differ materially

Index Benchmarks presented within this report may not reflect factors relevant for your portfolio or your unique risks, goals or investment objectives. Past performance of an index is not an indication or guarantee of future results. It is not possible to invest directly in an index.

The S&P 500® Index, or the Standard & Poor's 500® Index, is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies.

The CBOE Volatility Index®, or VIX, is a real-time market index representing the market's expectations for volatility over the coming 30 days.

Images source: Helios Quantitative Research, Bloomberg

Important Disclosures:

The material presented includes information and opinions provided by a party not related to Thrivent Advisor Network. It has been obtained from sources deemed reliable; but no independent verification has been made, nor is its accuracy or completeness guaranteed. The opinions expressed may not necessarily represent those of Thrivent Advisor Network or its affiliates. They are provided solely for information purposes and are not to be construed as solicitations or offers to buy or sell any products, securities, or services. They also do not include all fees or expenses that may be incurred by investing in specific products. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. You cannot invest directly in an index. The opinions expressed are subject to change as subsequent conditions vary. Thrivent Advisor Network and its affiliates accept no liability for loss or damage of any kind arising from the use of this information.

This communication may include forward looking statements. Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,” “projects,” “targets,” “forecasts,” “seeks,” “could’” or the negative of such terms or other variations on such terms or comparable terminology. These statements are not guarantees of future performance and involve risks, uncertainties, assumptions and other factors that are difficult to predict and that could cause actual results to differ materially

Index Benchmarks presented within this report may not reflect factors relevant for your portfolio or your unique risks, goals or investment objectives. Past performance of an index is not an indication or guarantee of future results. It is not possible to invest directly in an index.

The S&P 500® Index, or the Standard & Poor's 500® Index, is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies.

The CBOE Volatility Index®, or VIX, is a real-time market index representing the market's expectations for volatility over the coming 30 days.