5280 Associates Financial Blog

Welcome to our financial blog! This is where our licensed financial advisors share their advice, knowledge, and expertise for your reference. Posts are sorted with the most recent appearing at the top. Not seeing what you are looking for? Try using our search bar or pagination at the bottom.

The Pros and Cons of Donor-Advised Funds

DAFs offer distinct advantages that go beyond what is possible with traditional checkbook giving, but when making a decision, financial or otherwise, one should not focus solely on the positives.

The Future of Donor-Advised Fund Rules

The future of donor-advised funds is currently being shaped by regulatory shifts. Discover how potential rule changes could shape your giving strategy and long-term philanthropic goals.

Leveraged Charitable Deductions for High-Net-Worth Individuals

Learn how high-income earners can unlock leveraged charitable deductions using appreciated assets, DAFs, and QCDs.

Utilizing Charitable Giving Tax Deductions

Discover how you can move toward maximizing your charitable giving tax deductions with intentional donation strategies, examples, and upcoming tax law insights.

Understanding Charitable Gift Annuities in Denver, CO

Unlock your philanthropic potential by exploring how charitable gift annuities provide fixed income, tax benefits, and lasting support for nonprofits in Denver and beyond.

Combining Estate Tax Planning and Charitable Giving to Leave a Lasting Legacy

Estate planning often begins with numbers, assets, exemptions, and taxes, but it rarely ends there.

Spark Purpose-Driven Planning with Charitable Investment Management

Explore how charitable investment management in Denver can help high-net-worth families give back to their communities.

How Donating Real Estate to Charity Can Amplify Impact

Learn how making a charitable donation of real estate can help reduce taxes and support causes you care about. Explore the benefits of donating real estate to charity.

How Donor-Advised Funds Can Support Strategic Philanthropy

Donor-advised funds give strategic philanthropists the flexibility to maximize impact and tax benefits. Learn how DAFs support strategic philanthropy.

Charitable Planning Services: Guiding Your Giving Through Major Wealth Events

Learn how charitable planning services can guide your giving during business exits, inheritances, or major liquidity events.

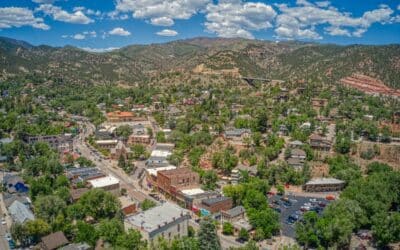

Charitable Wealth Planning: Why Giving Matters for Your Denver Legacy

This guide covers purpose, tax benefits, family engagement, and legacy to explain why Denver donors pursue charitable wealth planning.

Strategic Uses of Charitable Remainder Trusts in Retirement

Using charitable remainder trusts in retirement can help you generate income, enjoy tax benefits, and leave a lasting legacy.

Incorporating High-Income Tax Planning into Wealth Management

For high-income earners, tax planning isn’t just about complying with the law—it’s a critical strategy for preserving wealth and minimizing unnecessary liabilities.

How Bunching Charitable Donations Can Maximize Impact

If you’re looking to unlock the full potential of your charitable giving, our whitepaper will help you understand to advantages of donating appreciated assets.

Leveraging Charitable Distributions from IRA for Tax Savings

Retirement offers the chance to give back in ways that weren’t possible before, and charitable contributions from your IRA provides a smart, efficient way to do so.